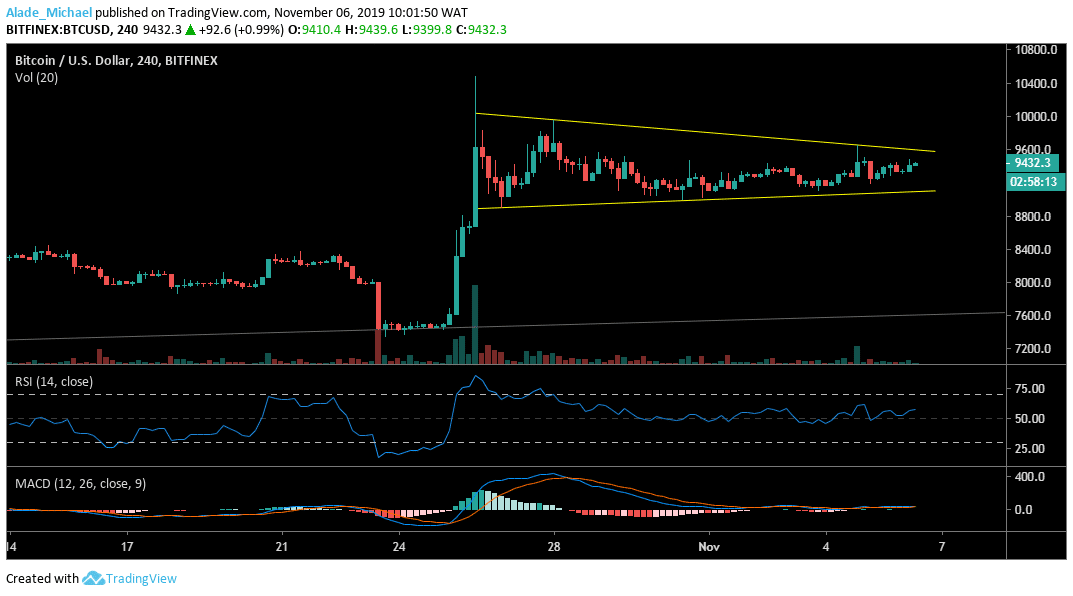

Bitcoin (BTC) Price Analysis: 4H Chart – Neutral

Key resistance levels: $9600, $9800, $10000

Key support levels: $9200, $9000, $8820

The symmetrical triangle pattern has continued to make Bitcoin look indecisive for the past few days now. Meanwhile, a potential big move is around the corner as the price approaches a tight angle. The sideways movement is much playing out on the MACD but the RSI is now gearing for an upward move after finding support at the 50 levels. If the RSI continues to show strength, Bitcoin may go bullish soon.

The immediate resistance to watch out for is $9600, $9800 and $10000. But the ongoing indecisiveness may not give us a clear picture of where Bitcoin is heading next. In case of a down surge, the price could drop to $9200, $9000 and $8800 within the shortest period. At the moment, the next actual direction for BTC is yet to be ascertained on the 4-hour chart.

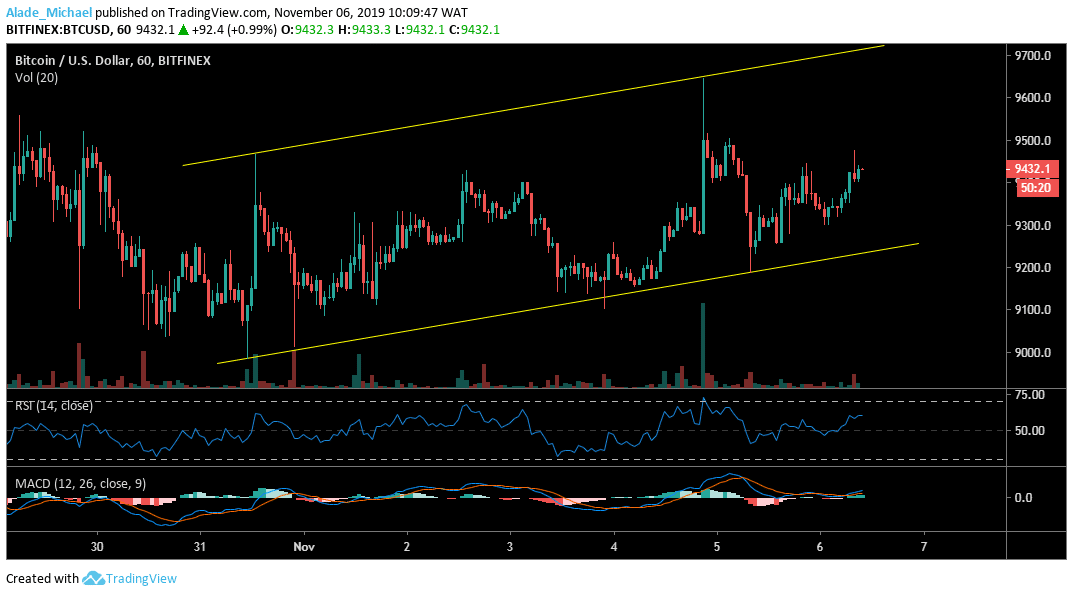

Bitcoin (BTC) Price Analysis: Hourly Chart – Bullish

But looking at the hourly chart, Bitcoin is stylishly making a bullish swing. While creating a rising channel pattern, BTC has been finding it difficult to continue the upward move above the $9500 since yesterday. Today, Bitcoin is still looking for a strong buy to shoot price towards the channel’s resistance at $9700. Meanwhile, $9500 and $9600 resistances are important for the next major move.

The RSI is currently shooting high following the $9200 rebound during yesterday’s trading. Also, the MACD is preparing for a new bullish rally. Considering the last two hourly evening star, Bitcoin could reverse a bit to $9300 support if it plays out. A further drive may cause BTC to move out of the channel to $9150 and $9000 on the downside.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.