Key Demand Zones: $7, 000, $6, 000, $5,000

BTC/USD Long-term Trend: Ranging

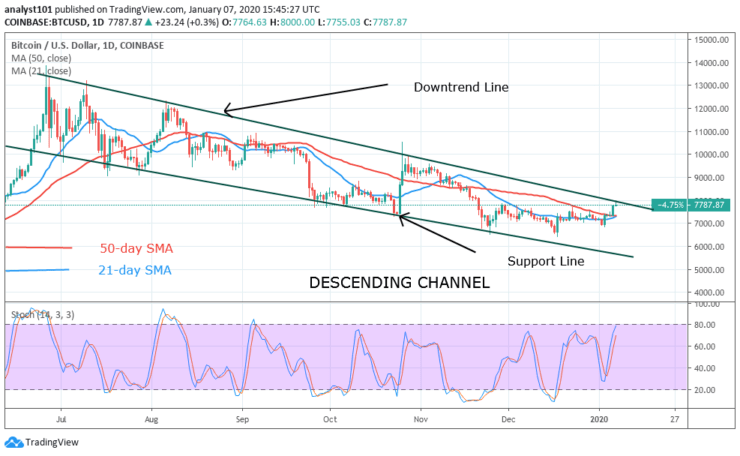

Expectantly, the bulls have broken the $7,600 and $7,800 resistance level. This impressive run has been on for the past three days. The bulls have had the upper hand as price breaks the major key levels. Nonetheless, the bulls are not yet done but are facing resistance at the $8,000 price level.

The coin is currently retracing after the resistance. Bitcoin will resume if it retraces but finds support in one of the broken levels. Assuming, the market found support and resume the bullish move, Bitcoin will rise and test the $9,200 and $10,300 price levels.

Daily Chart Indicators Reading:

Bitcoin is now trading above 75% range of the stochastic indicator. The market is in a bullish momentum and it is approaching the overbought region of the market. However, the price is also approaching the downtrend line. A break above the downtrend line and the price closes above it; indicates that the downtrend has been terminated.

BTC/USD Medium-term bias:

On the 4 Hour Chart, Bitcoin fell to its low at $6,400 and began an upward move. Firstly the market went up and reached a high of $7,400. It pulled back but was resisted at $7,600 price level. Yesterday the bulls had a bullish run but were stopped at $8000. The market is retracing to the support at $7,800.

4-hour Chart Indicators Reading

The exponential moving averages have a bullish crossover. The 12-day SMA crosses above the 26-day SMA signaling the uptrend. The Relative Strength Index period 14 level 70 indicates that Bitcoin is in the bullish trend zone.

General Outlook for Bitcoin (BTC)

Bitcoin has reached the critical supply zone for a probable upward move. The fact remains that a break above the $7,800 will propel the price to reach a high of $9,200. In the same vein, if the uptrend is sustained, the price will rally again at the $10,300 price level. Traders should lookout to buy a setup where the price might likely find support to initiate long trade.

BTC Trade Signal

Instrument: BTC/USD

Order: Buy Limit

Entry price: $7,600

Stop: $7,100

Target: $9,200

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.