In a significant development in the ongoing legal battle, the US Securities and Exchange Commission (SEC) has encountered a roadblock in its lawsuit against Binance.US, the American arm of the global cryptocurrency exchange Binance. A federal judge has denied the SEC’s request to inspect Binance.US’s software, citing the need for greater specificity and additional witness testimony.

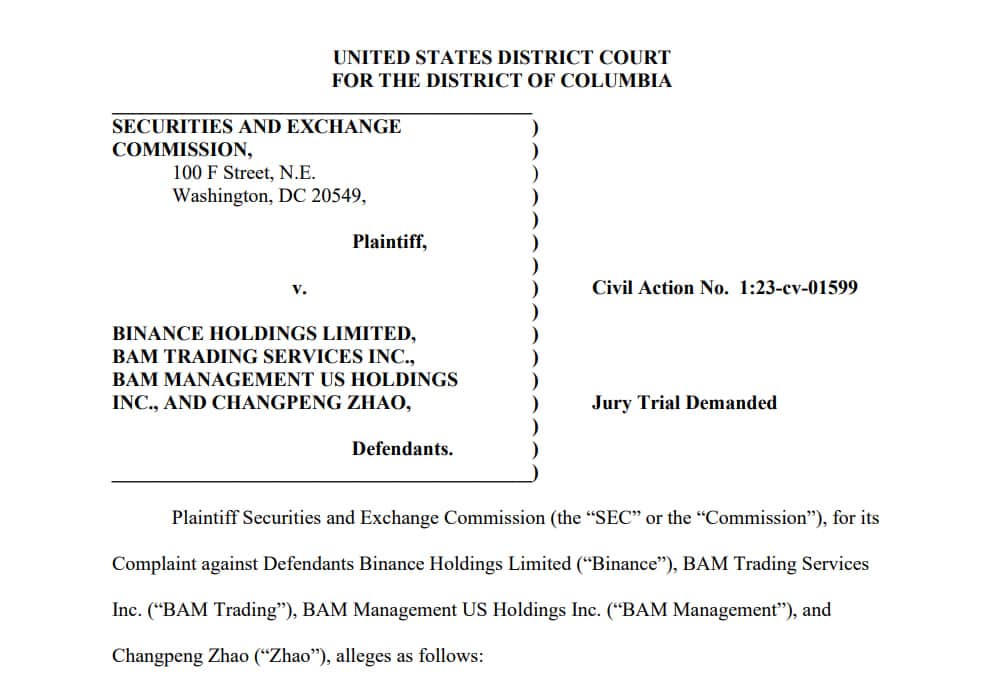

The SEC initiated legal proceedings against Binance and Binance.US back in June, asserting that both entities had violated US securities laws by offering unregistered digital asset securities to American investors. Furthermore, the SEC alleged that Binance and Binance.US were not distinct entities but, in fact, operated as a unified platform.

Binance.US Calls SEC’s Moves a “Fishing Expedition”

Binance.US has vehemently resisted the SEC’s inquiries, deeming the regulator’s demands a “fishing expedition” and overly broad. The SEC sought permission from a federal magistrate judge to inspect Binance.US’s technological infrastructure with the hope of uncovering evidence linking it to the global exchange.

However, Federal Magistrate Judge Zia Faruqui did not find the SEC’s case compelling enough to grant access to Binance.US’s documents. Consequently, the judge denied the agency’s request for immediate inspection access to the exchange’s software. Judge Faruqui urged the SEC to formulate more specific requests and engage with additional witnesses, as per a Bloomberg report.

The SEC failed to win immediate access to inspect Binance US software in ongoing lawsuit against crypto exchange https://t.co/frYUbaqVwB

— Bloomberg Crypto (@crypto) September 18, 2023

Significant Implications for the Crypto Industry

This decision represents a temporary setback for the SEC in one of its most high-profile cryptocurrency cases. The regulator has been intensifying its crackdown on cryptocurrency exchanges and platforms it believes are infringing upon US securities laws. The SEC is simultaneously embroiled in a legal tussle with Ripple, the company behind the XRP cryptocurrency.

Meanwhile, Binance.US has been grappling with its own set of challenges. The exchange lost its banking support, suspended US dollar deposits, and initiated staff layoffs. Furthermore, its former CEO, Brian Shroder, and the global head of product, Mayur Kamat, both departed from the company.

The outcome of this lawsuit carries significant ramifications for the broader cryptocurrency industry, given that Binance is one of the market’s largest and most influential players. The case is expected to continue unfolding in the coming months, with both parties preparing for the next stage of legal proceedings.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.