BNBUSD Coin may soar higher

BNBUSD Price Analysis 17 June

In case sellers gain more momentum before closing below the $240 psychological level, Binance Coin may crash to its most recent lows of $219 and $200. If buyers can fight the $254 resistance level, the $276 resistance level can be breached on the upside, testing the $286 resistance level.

BNB/USD Market

Key levels:

Supply levels: $254, $276, $286

Demand levels: $240, $219, $200

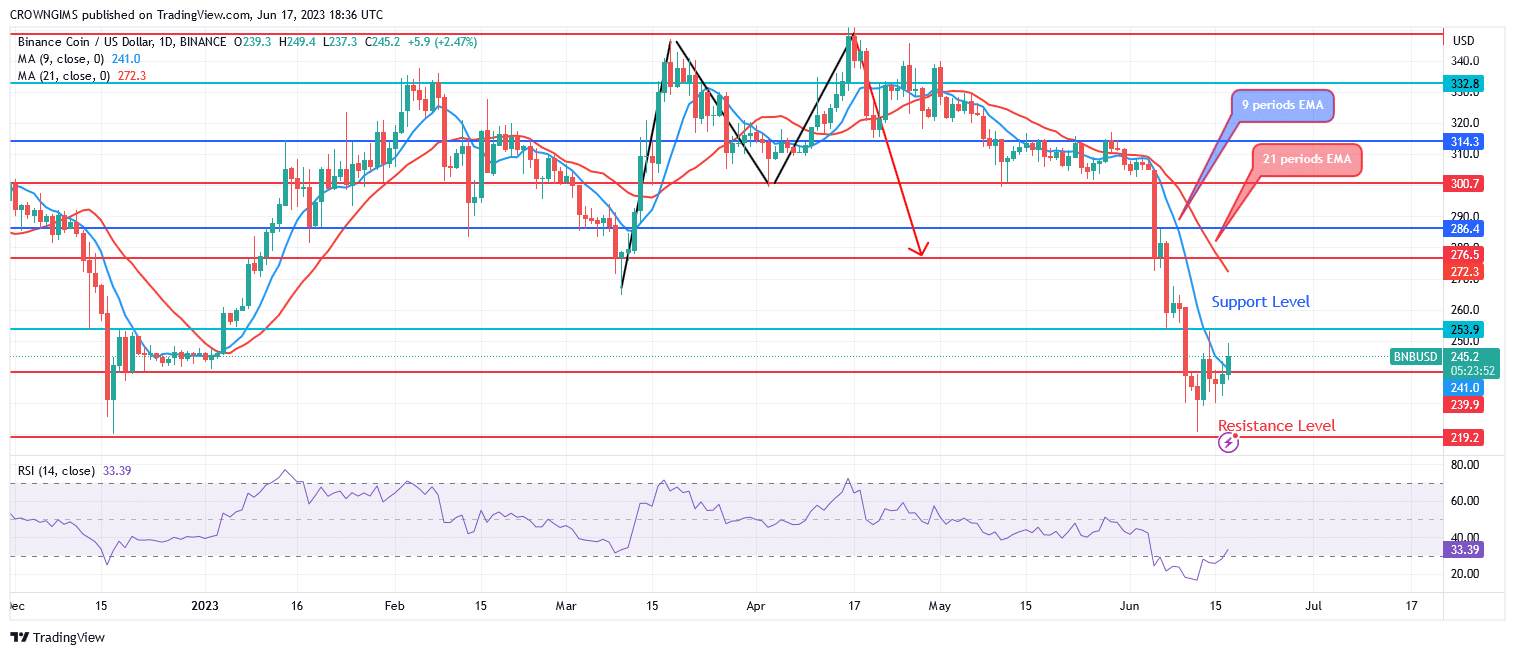

BNBUSD Long-term Trend: Bearish

On the daily chart, BNBUSD is negative. A bearish trend started when the Binance currency reached its peak on March 18 at $348. When the bullish trend came to an end, sellers took over. The price oscillates within a constrained range for a few days before dropping beneath the $314 support level. The $300 level came under increased pressure as the bearish trend grew stronger. As allowed by the $286 barrier, the price fell below the $276 and $254 levels. It seems the buyers are opposing further price reduction at $240 support level.

The downward crossover of the 21-period EMA by the 9-period EMA suggests a bearish swing. The two EMAs are currently being outperformed by the price of the Binance Coin. In case sellers gain more momentum before closing below the $240 psychological level, Binance Coin may crash to its most recent lows of $219 and $200. If buyers can fight the $254 resistance level, the $276 resistance level can be breached on the upside, testing the $286 resistance level.

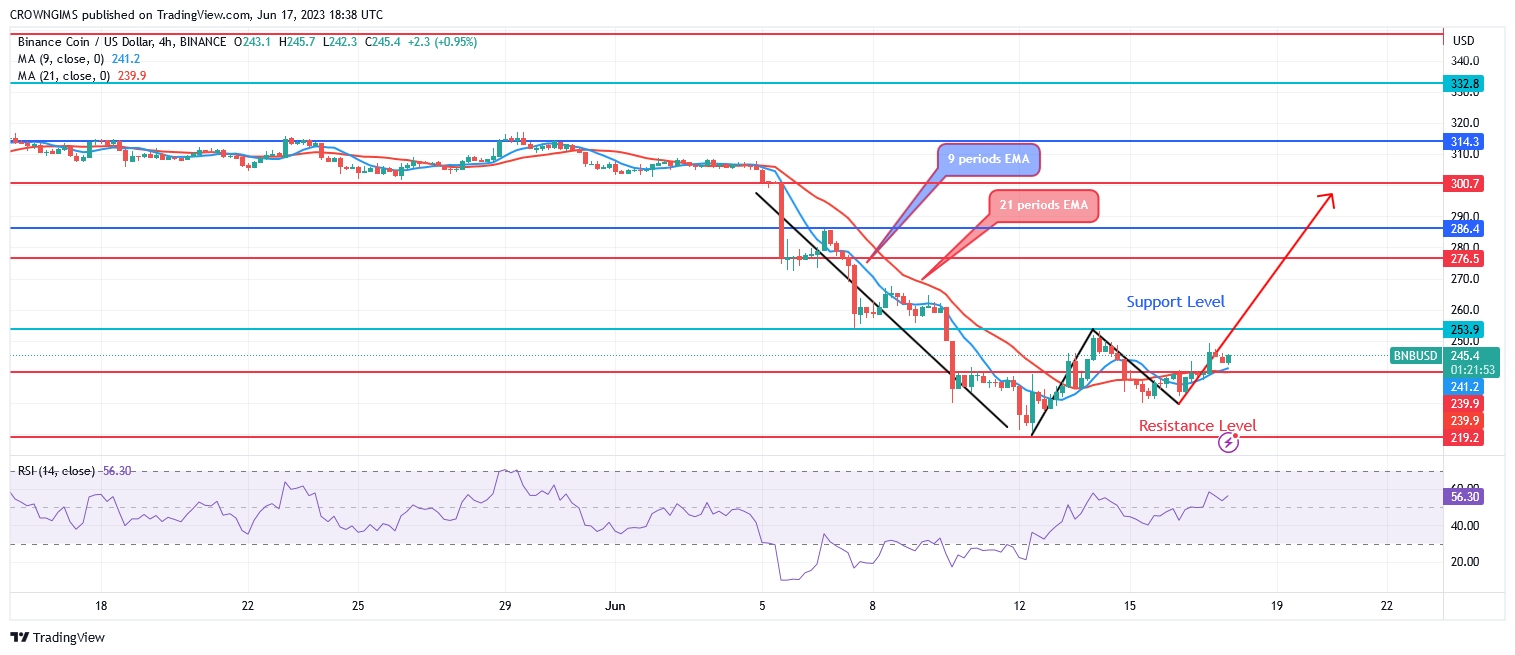

BNBUSD medium-term Trend: bullish

On the four-hour chart, Binance Coin is bullish. At a price of $219 on 12 June, the double bottom chart pattern appeared, signaling that the market is about to be taken over by buyers. The $253 barrier level forced price test decreased sellers’ interest. Prices is gradually increasing toward $254 as buyers’ impetus grew. The price of the Binance currency may reach the resistance level of $276.

Indicating a bullish market, Binance Coin is now trading above the 9- and 21-period exponential moving averages. Relative strength index period 14 implies a buy when the signal line is pointing up at 56 levels.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.