Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The price of the Basic Attention Token has increased by 4.34% today. However, its price action maintains a weak appearance. Even technical indicators are revealing that upside momentum is weak. Nevertheless, lets take a closer look at possible developments that may occur in this market.

BAT Statistics:

Basic Attention Token Value Now: $0.1748

Basic Attention Token Market Cap: $259,589,570

BAT Circulating Supply: 1,489,950,992 BAT

Basic Attention Token Total Supply: 1,500,000,000 BAT

BAT CoinMarketCap Ranking: 109

Major Price Levels:

Top: $0.1748, $0.1800, and $0.1900

Base: $0.1700, $0.1600, and $0.1500

Basic Attention Token Bulls Are Looking Weary Too Soon

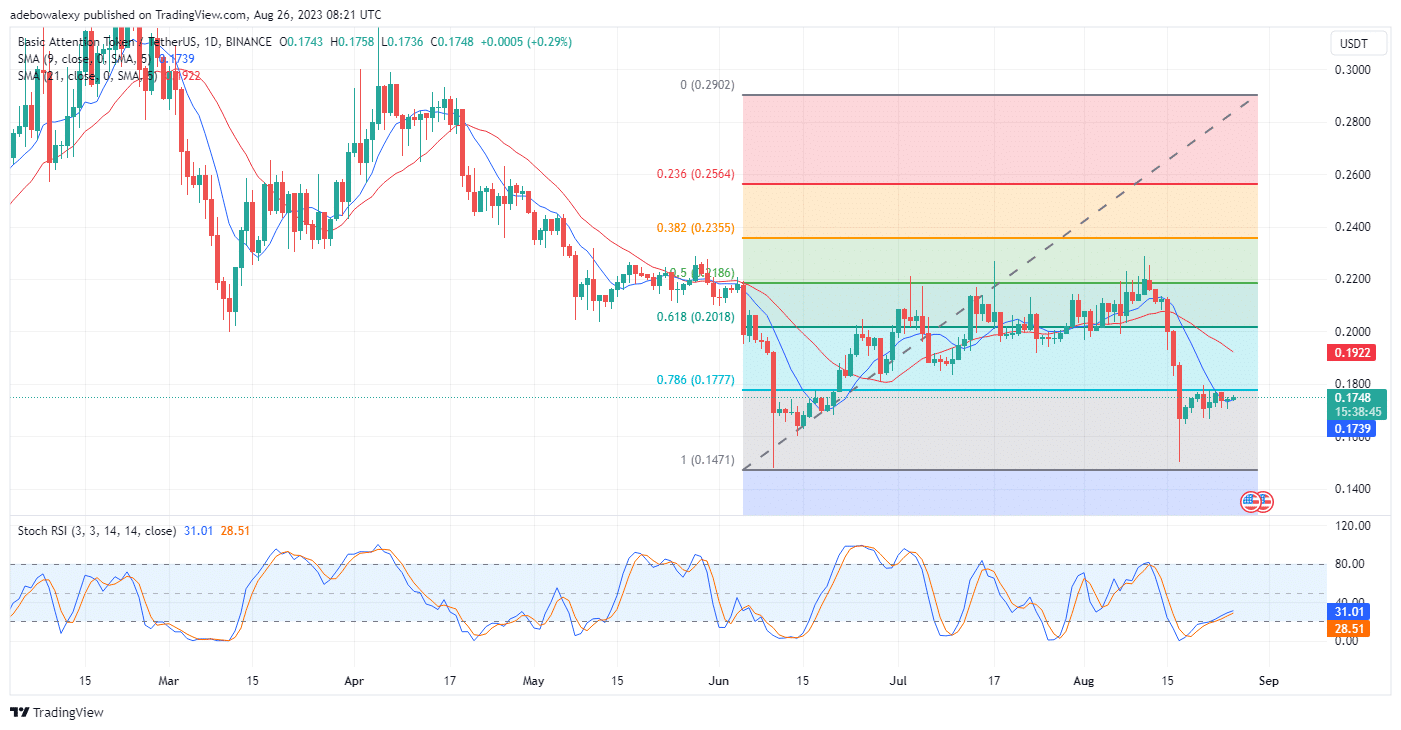

Price activity in the Basic Attention Token Market had regained upside consciousness following a downward retracement that took prices from near the $0.2200 price level to around the 1600 price level. Consequently, this caused traders to bleed out most of the gathered gains from June 15th until around August 11th.

The ongoing upside correction has been able to bring prices above the 9-day Smooth Moving Average (SMA) line. Likewise, the Stochastic Relative Strength Index (RSI) lines are also rising steadily towards the 40 level of the indicator. However, the distance between these lines suggests that volatility is weak in this market at this point.

BAT Market Bulls Are Striving to Keep the Upside Course

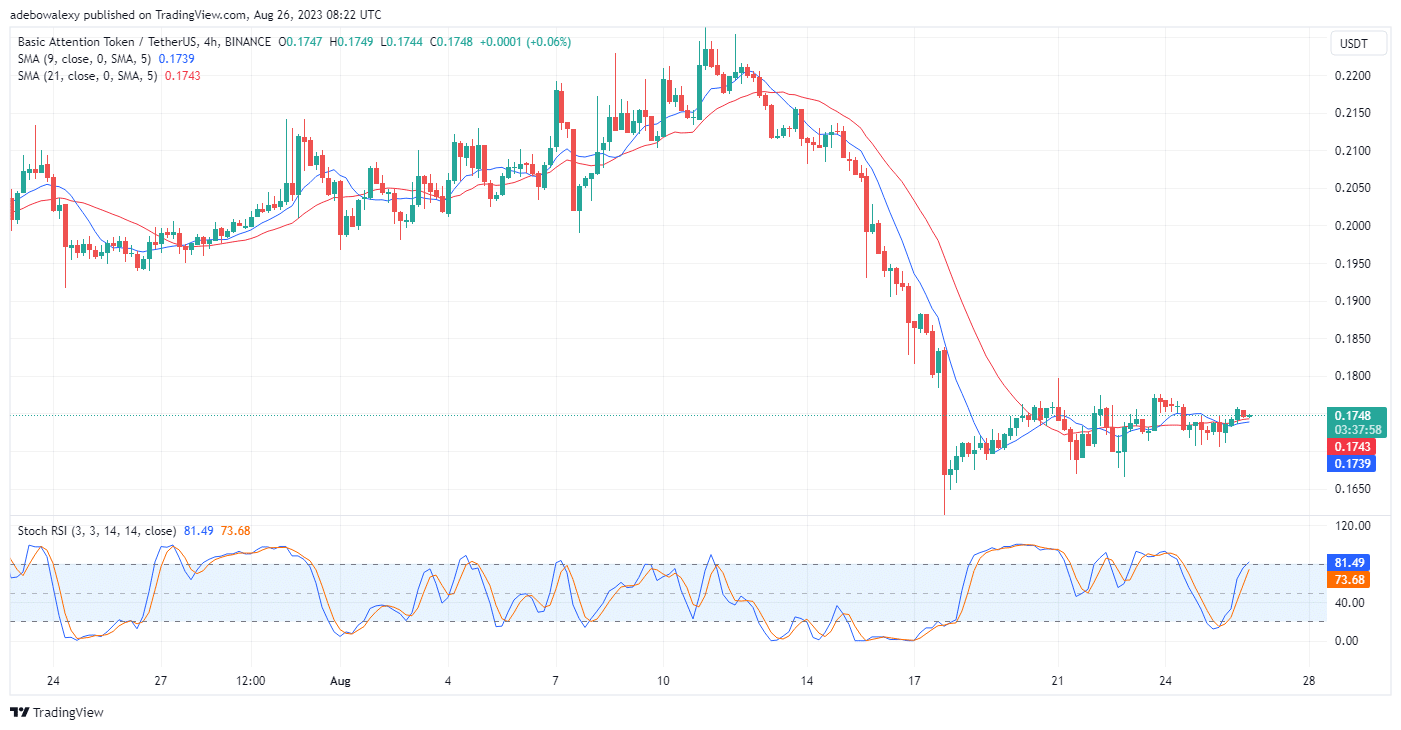

Coming to the BATUSDT 4-hour market time frame, it could be seen that prices may extend upside the correction. Here, the just-concluded session introduced a minimal downward correction. This pushed prices towards the support formed by the 9- and 21-day SMA curves. However, the ongoing session has raised hopes of an upside rebound. This can be seen as a green, almost dashed-shaped price candle appearing above the 9- and 21-day (SMA) curves.

Additionally, the RSI lines are still rising into the overbought region, though it seems too sensitive given the magnitude of price increases in recent times. All these points point to the fact that upside momentum is weak and an upside correction may only approach the $0.1800 mark.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.