Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Price action in the BNTUSDT daily market has rebounded upwards near the 0.4000 price mark. Consequently, long traders have been gathering moderate profits since the previous session until now. What are the chances that this will continue?

BNT Statistics:

Bancor Value Now: $0.4275

Bancor Market Cap: $62,921,745

BNT Circulating Supply: 145,924,803

Bancor Total Supply: 161,196,921

BNT CoinMarketCap Ranking: 298

Major Price Levels:

Top: $0.4275, $0.4330, and $0.4400

Base: $0.4200, $0.4100, and $0.4000

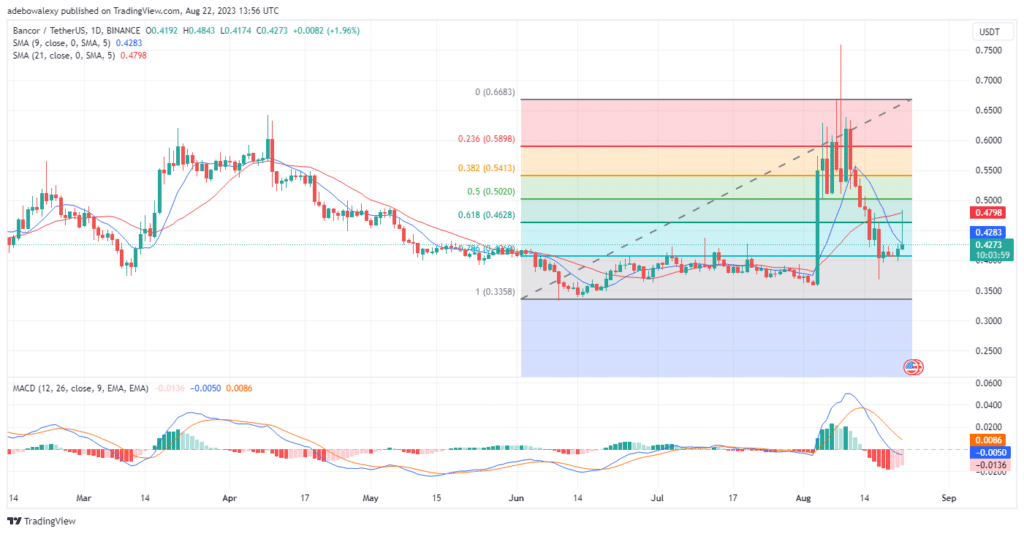

Bancor Price Action Rebounds off Strong Support

Price action in the BNTUSDT market has stayed around the 78.60 Fibonacci Retracement level since five trading sessions ago. As a result, it appears that buyers were able to weary out the bears in their zone. And since the last session, prices have taken off to the upside, while the ongoing session has advanced the upside correction.

This has moved price action closer to the 9-day Smooth Moving Average (SMA) curve. Furthermore, the Moving Average Convergence Divergence (MACD) indicator has started revealing that headwinds are exhausted. This can be observed as the indicator’s histogram bars have started appearing pale red and are getting progressively shorter.

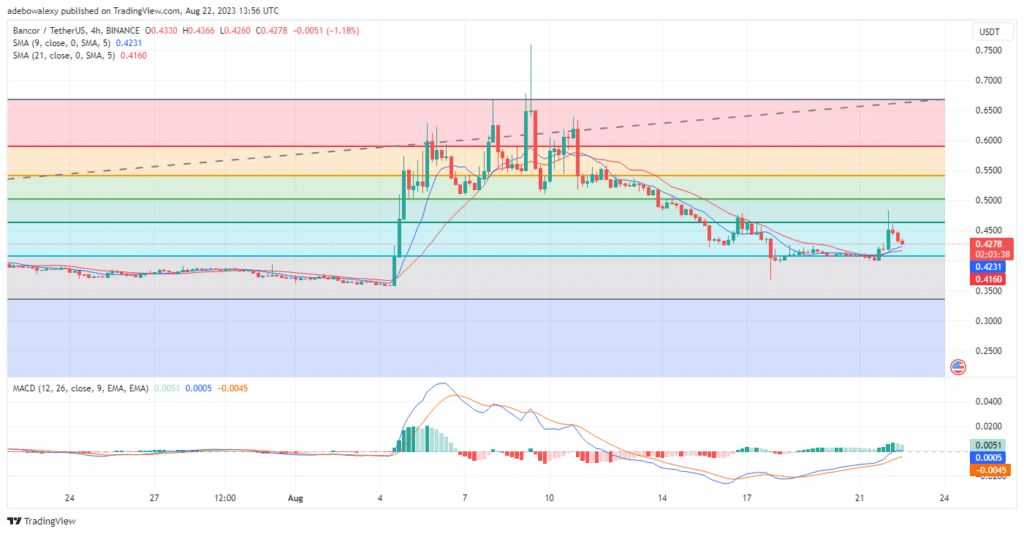

BNT Headwinds Continue to Weaken

The Bancor 4-hour market has revealed that headwinds are growing weaker as trading activities continue. Here, price action can be seen to have corrected off the resistance at the $0.4500 mark. This occurred about four trading sessions ago. The last price candle here can be seen to appear smaller than that of the previous session above the SMA lines.

In addition, the bars of the MACD continues to appear above the equilibrium level despite turning pale green, while its lines maintain a generally upward bearing. Consequently, this suggests that traders can still anticipate an upside rebound of the 9-day SMA curve towards the $0.4500 price mark.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.