Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Avalanche Price Forecast – November 21

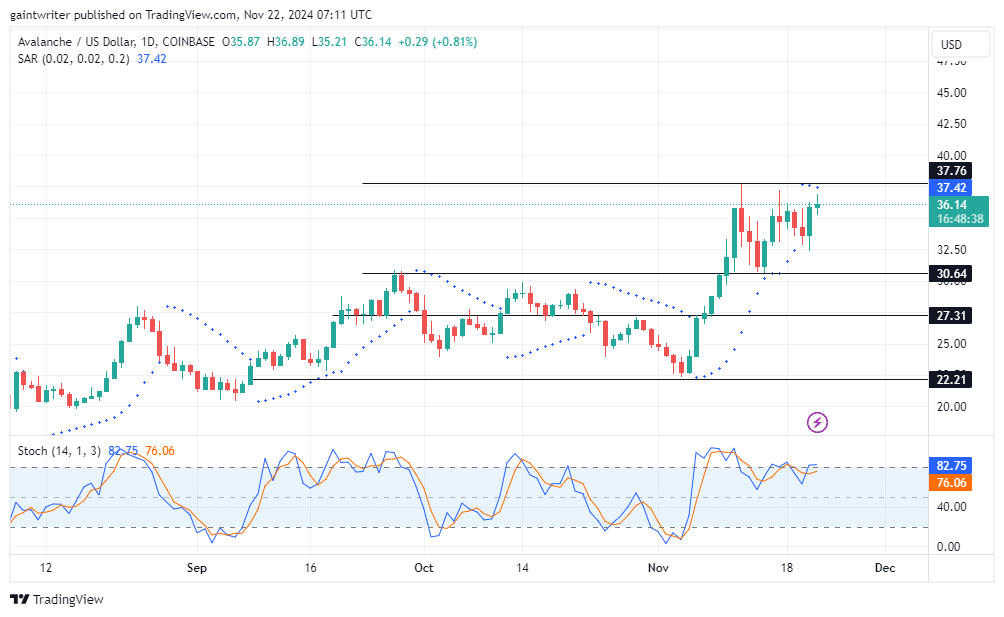

The Avalanche price forecast highlights intensified buyer efforts to overcome the $37.420 resistance level, a significant barrier to further bullish progress.

Avalanche Long-Term Trend: Bullish (Daily Chart)

Support Levels: $37.760, $30.640

Resistance Levels: $27.310, $22.210

Avalanche Price Forecast – AVAXUSD Outlook

The upward movement enabled buyers to drive prices toward $37.760, marking the month’s high so far. However, stiff resistance at this level has led to a period of consolidation. Buyers are steadily regrouping to maintain their push toward $37.420, though a decisive breakout has yet to materialize.

The Parabolic SAR indicator, now positioned above the current price, signals a decline in buyer control, while its continued ascent reflects a possible attempt to regain dominance. Meanwhile, the Stochastic Oscillator hovers near the overbought zone, signaling strong buyer activity but also warning of a potential slowdown or reversal.

On the daily chart, the market reflects a tug-of-war between bullish and bearish forces. Buyers remain determined to break through $37.420, but the Stochastic Oscillator suggests market momentum is approaching a critical turning point.

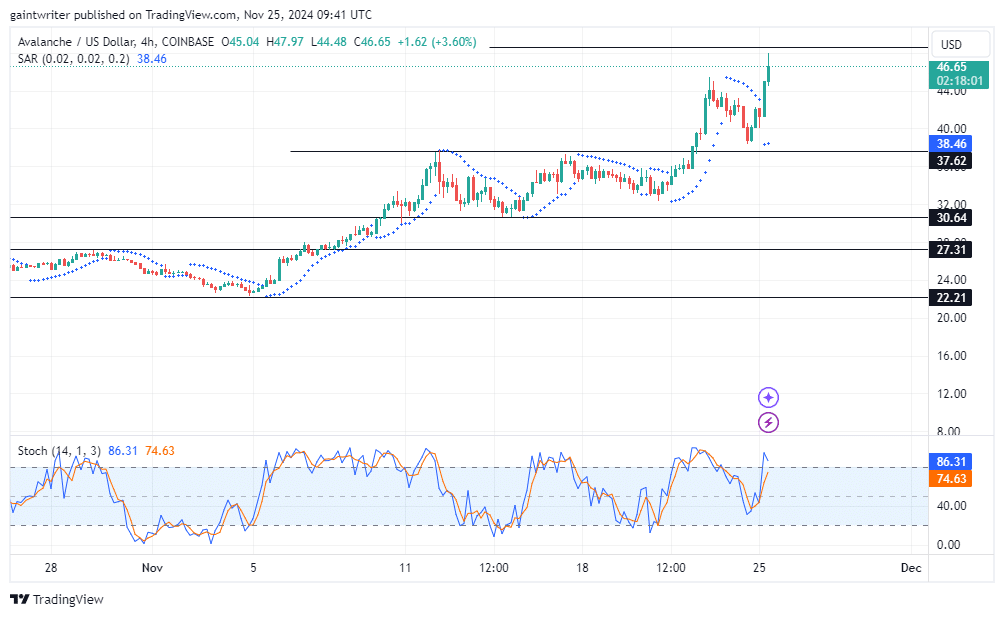

Avalanche Medium-Term Trend: Bullish (4-hour chart)

If buyers successfully break the $37.420 resistance, Avalanche could resume its bullish rally, potentially targeting new highs above $37.760. On the other hand, failure to overcome this level might lead to a temporary retracement, allowing the market to consolidate before buyers make another breakout attempt.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.