Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Avalanche Market Analysis- November 30

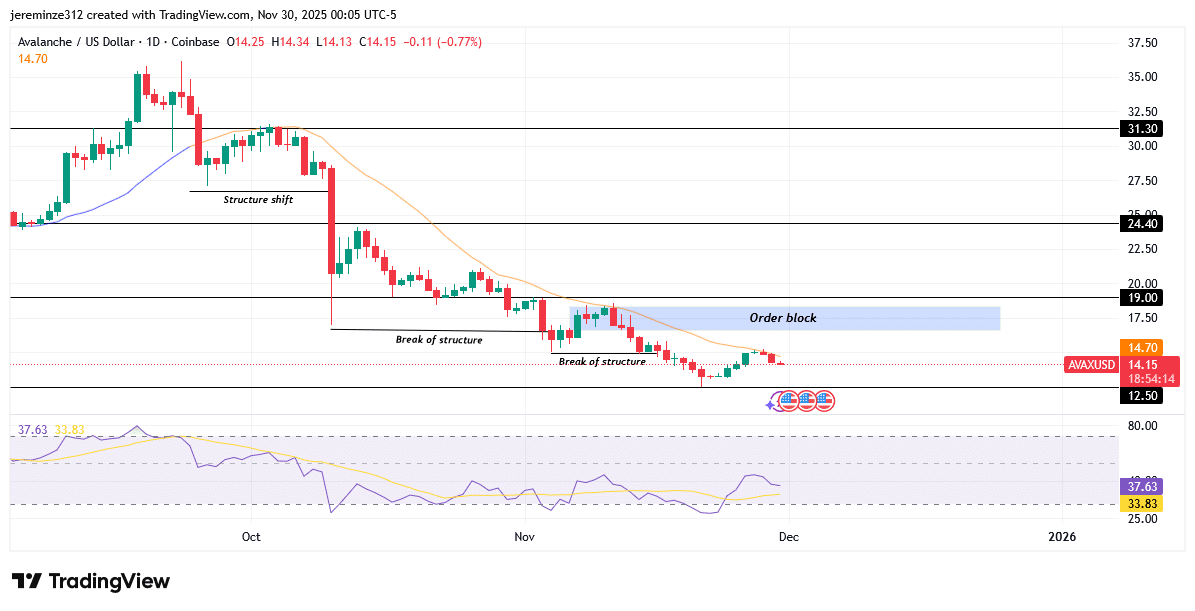

Avalanche continues to exhibit strong bearish behavior in the higher timeframe, as buyers are currently attempts a short-term corrective recovery.

AVAXUSD Key Levels

Support Levels: $19.00, $12.50

Resistance Levels: $24.40, $31.30

AVAXUSD Long-Term Trend: Bearish

Avalanche remains decisively bearish on the higher timeframe after the structural shift recorded in early October 2025. Price extended its decline from the $31.30 supply level, forming multiple bearish breaks of structure that confirmed seller dominance. This persistent downside movement continued until price tapped the $12.50 demand zone after breaching the $19.00 support level in November.

While the $12.50 zone induced a minor reaction, there is still no convincing evidence of a full bullish reversal. The daily RSI sits at oversold levels, suggesting a possible retracement toward premium pricing where sellers may re-enter the market. However, long-term sentiment remains bearish as price maintains its position below the daily moving average, reflecting continued downside momentum.

The most probable scenario is a temporary bullish correction into the daily order block before the broader downtrend resumes. Failure of buyers to sustain strength above $12.50 would further increase the likelihood of continuation into lower price territories.

AVAXUSD Medium-Term Trend: Bullish Correction

On the lower timeframe, Avalanche price reacted positively from the $12.50 demand zone, creating a failed low pattern, which initiated a medium-term bullish correction. Higher highs have formed as price gradually pushes toward the daily bearish order block, reflecting short-term buyer interest.

However, the 4H RSI has begun to turn downward, signalling early signs of weakness within the retracement. The bullish correction remains valid only while price holds above the $12.50 demand level; a break below this zone would invalidate the recovery and re-align price with the dominant bearish trend.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.