Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The recent session in the AVAX market witnessed a significant downward correction after the price action reached the $23.00 mark. However, there has been a subsequent moderate upside correction in the ongoing session. As the token has only been able to recover barely half of the previously incurred losses, let’s see how things may develop shortly.

Key AVAX Statistics:

Current Avalanche Value: $21.73

Avalanche Market Cap: $7,397,313,800

Circulating Supply of AVAX: 355,588,040

Total Supply of AVAX: 432,964,220

Avalanche CoinMarketCap Ranking: 13

Key Price Levels:

Resistance: $21.73, $22.00, and $23.00

Support: $21.00, $20.00, and $19.00

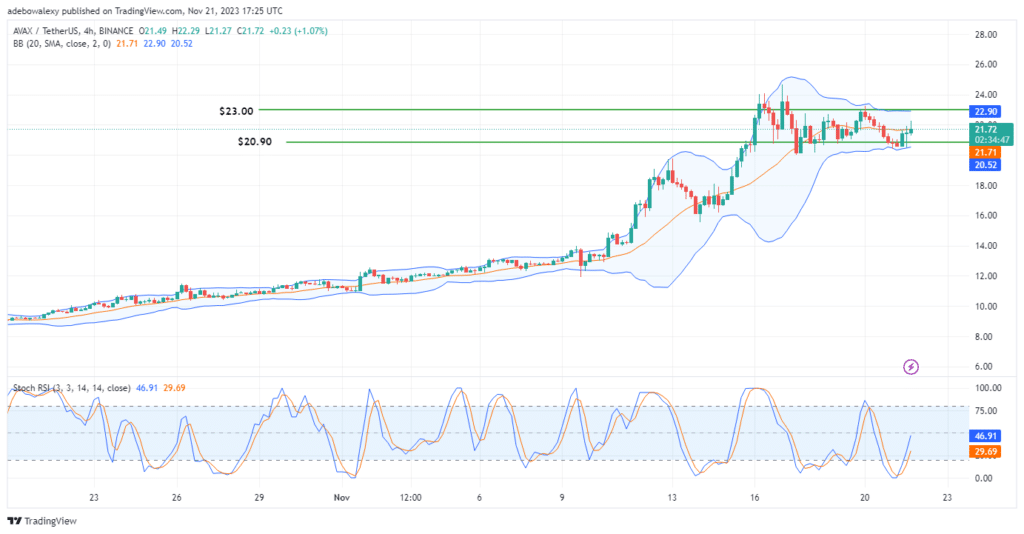

Avalanche Aims for the $23.00 Price Mark

AVAX’s price movements in the daily market suggest that buyers are making efforts to return prices to an upward path. This can be seen as today’s trading session has seen the token correct upwards by over 3.20%, following more significant losses penned in the previous session.

Trading activities remain above the middle limit of the Bollinger Bands, while the Relative Strength Index (RSI) indicator lines maintain a bearish stand. The lines of the RSI can be seen dipping further into the oversold region. Nevertheless, given the recorded profits in the ongoing session, one can still anticipate an additional upside correction.

AVAX Bulls Challenging a Key Resistance

In the Avalanche 4-hour market, price action can be seen going head-to-head with a resistance formed by the middle band of the Bollinger Bands indicator. Likewise, the upper shadow of the current session can be seen popping through the mentioned resistance. Furthermore, the Relative Strength Index indicator lines are still trending upwards to reveal a continued gain in upside momentum.

However, by carefully examining the RSI line, one may see that these lines are a bit hypersensitive with respect to the observed price move. Despite this, it’s still fair to anticipate an upside correction towards the $23.00 mark at the very least.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.