The Australian dollar has been making decent headway as it continues to soar in value against the US dollar. The reason for the latest rally can be attributed to the disappointing US PPI final demand data, which fell short of the estimated 3.0% year-on-year figure for the end of March, settling instead at 2.7%.

Furthermore, the March month-on-month reading came in at -0.5%, when a flat number had been predicted. This triggered a downward spiral for the US dollar, with investors losing faith in the currency. The commodity complex and high-beta currencies, including the Australian and New Zealand dollars, were the biggest beneficiaries of this market downturn.

Australian Dollar and Kiwi Seen as Market Gauges

Wall Street cheered the news, as companies had the opportunity to increase profit margins or pass on lower prices to consumers, helping to stimulate growth in the global economy. The AUD and NZD are often viewed as bellwethers for the global growth cycle, and their sudden rise in value could indicate better times ahead.

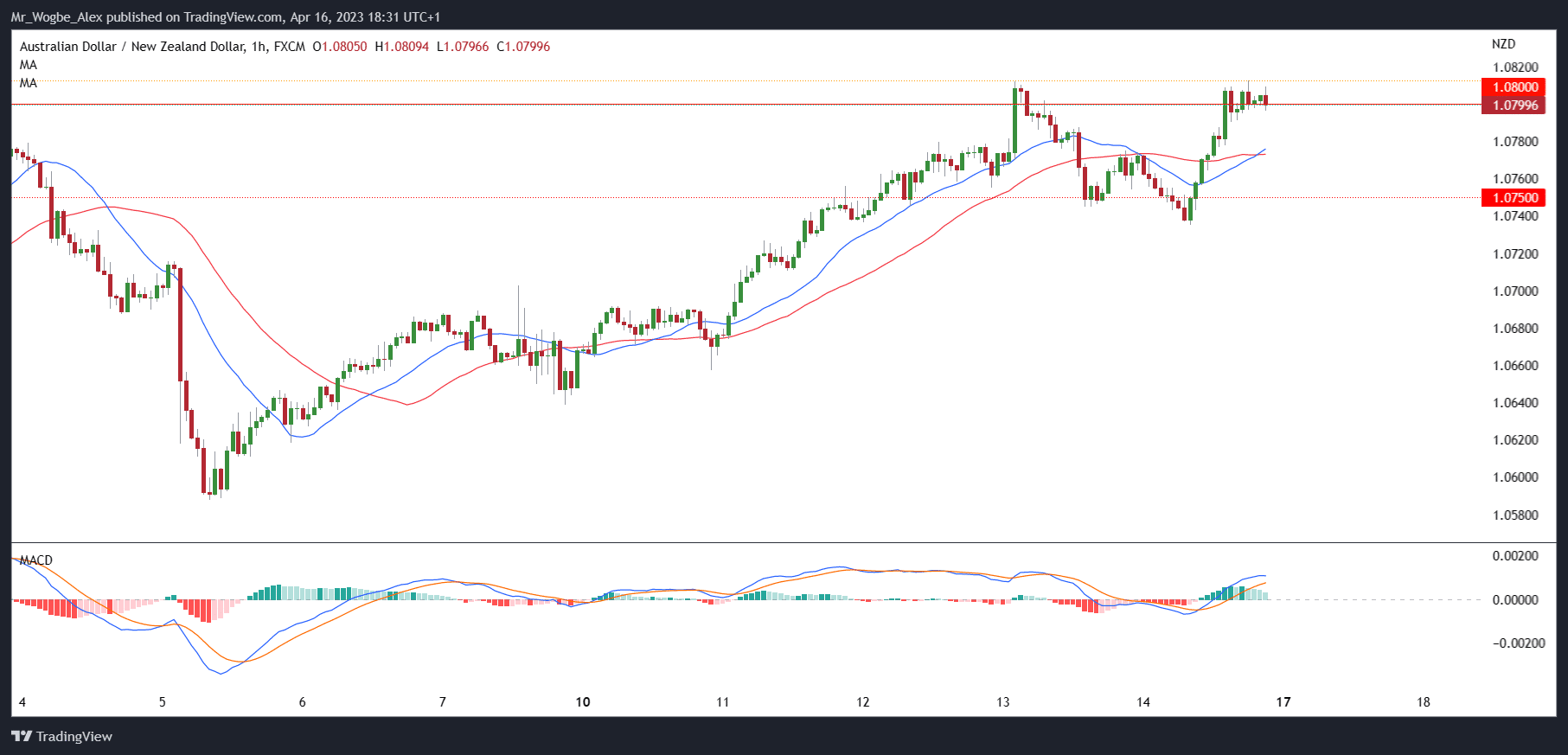

The AUD/NZD briefly surpassed 1.0800 on Friday but was unable to maintain its gains. This disparity in monetary policy can be seen between the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ). The RBNZ is expected to hike by 25 basis points in late May, while the RBA is expected to keep its rates steady during its upcoming meeting in early May.

Despite this, the Australian dollar is still riding high, and investors are eager to take advantage of the current market. The strong performance of the commodity complex and high beta currencies will continue to benefit the AUD in the short term, as will the renewed pressure on the US dollar.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.