During the previous week, the stock market rebounded following a major bank release. The Australia 200 market managed to close in the green last week. This has kept the market slightly above key levels and, as such, suggests that further moves may be seen.

Key Price Levels

Resistance: 9,000, 9,500, 10,000

Support: 8,500, 8,000, 7,500

Australia 200 Bulls Keep Their Edge

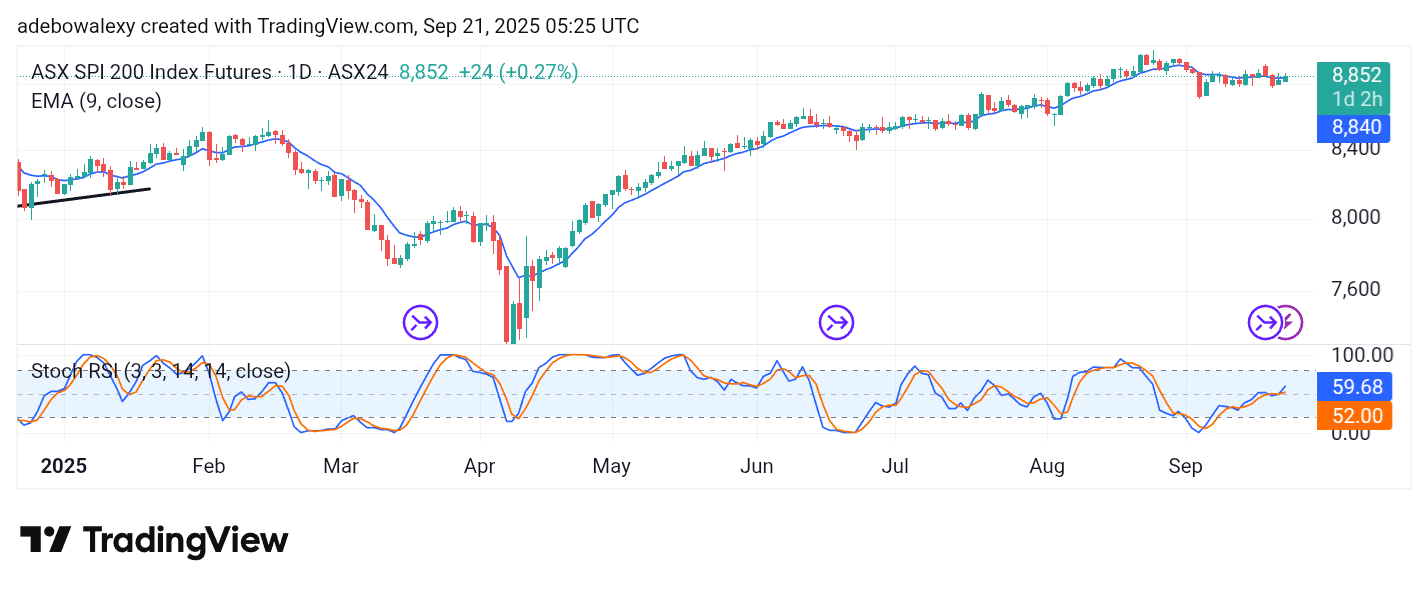

As mentioned earlier, the ASX 200 index edged upward and closed in the green. However, a contraction can be observed on the last price candle. Still, trading remains above the 9-day Exponential Moving Average (EMA) line.

Likewise, the Stochastic Relative Strength Index (SRSI) indicator lines have just delivered an upward crossover just above the 50 threshold of the indicator. The SRSI lines are diverging and proceeding upward. Technically, this favors continued bullish momentum.

ASX 200 Registers a Negative Bounce

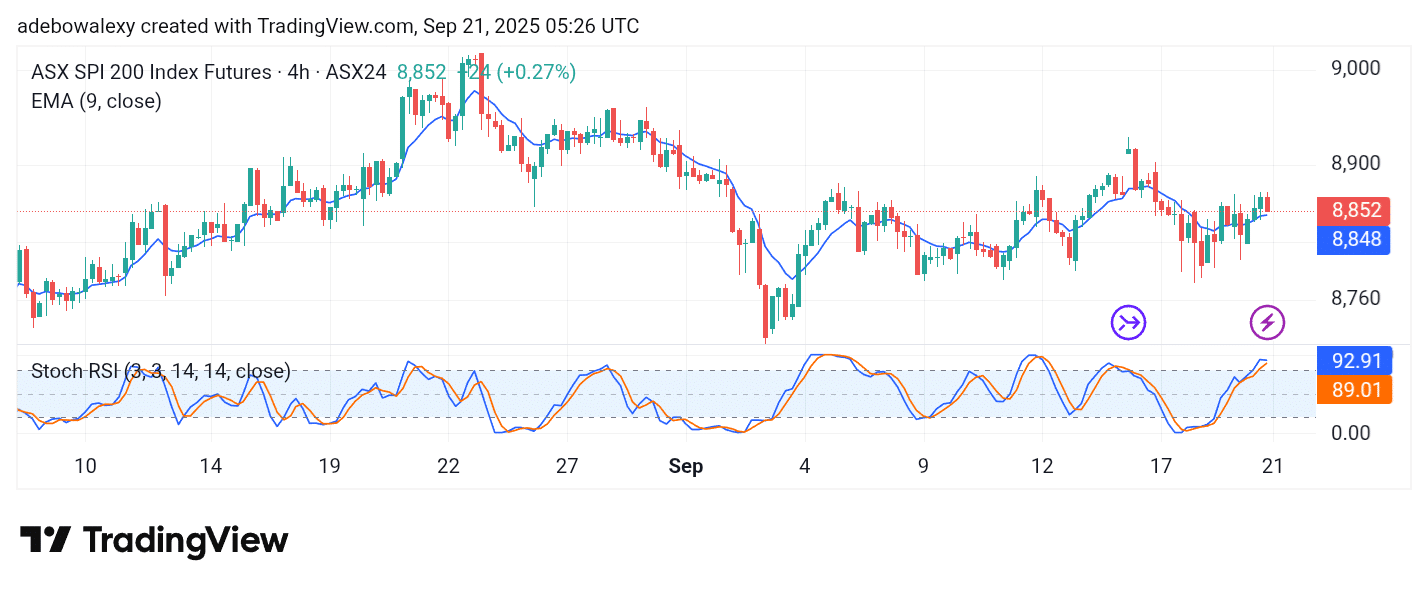

The Australia 200 market has recorded a downward move on the 4-hour price chart. Nevertheless, trading activity has remained above the 9-day EMA curve. While the immediate impression reflects a bearish move, the fact that price action is still above the 9-day EMA line indicates that upward forces are still likely to persist.

At the same time, the SRSI lines have reached a considerable level in the overbought region, but due to the negative rebound, a deflection can be observed on the lead line of the indicator. At this point, traders can anticipate an upward rebound off the 8,848 price level toward the 9,000 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.