The Australia 200 market closed in the green previously but has declined toward lower price levels over the past week. This movement appears linked to uncertainty surrounding U.S. trade negotiations. However, the market could experience a recovery in the coming week, although this may largely depend on the outcome of key anticipated fundamental developments.

Key Price Levels

Resistance Levels: 8,700, 9,100, 9,500

Support Levels: 8,300, 7,900, 7,500

Australia 200 Remains Positioned for Further Upside

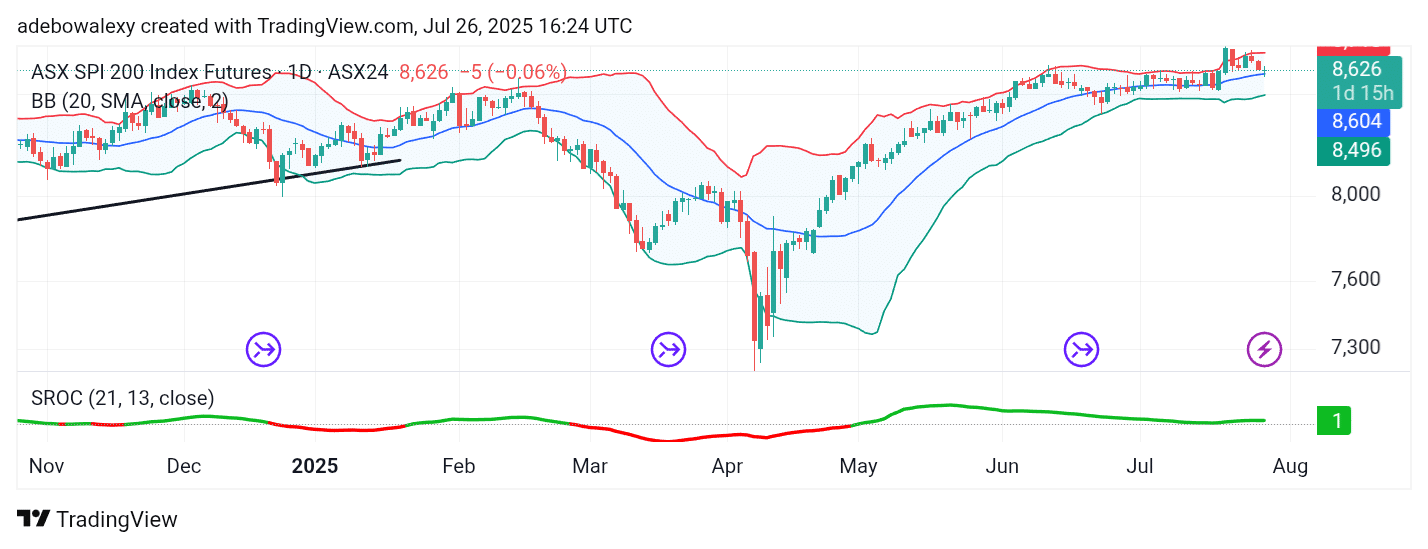

On the daily chart, the ASX 200 has managed to climb above the 8,500 mark. The current trading session is represented by a small green candlestick that holds above the midline of the Bollinger Bands (BB) indicator. The BB indicator maintains a slight upward slope, with its terminal end appearing steeper—suggesting increased bullish pressure.

Meanwhile, the Smoothed Rate of Change (SROC) indicator remains above the equilibrium level, positioned at exactly 1. This supports the technical outlook that the market may resume its upward trajectory in the near term.

ASX 200 Shows Signs of Strengthening Momentum

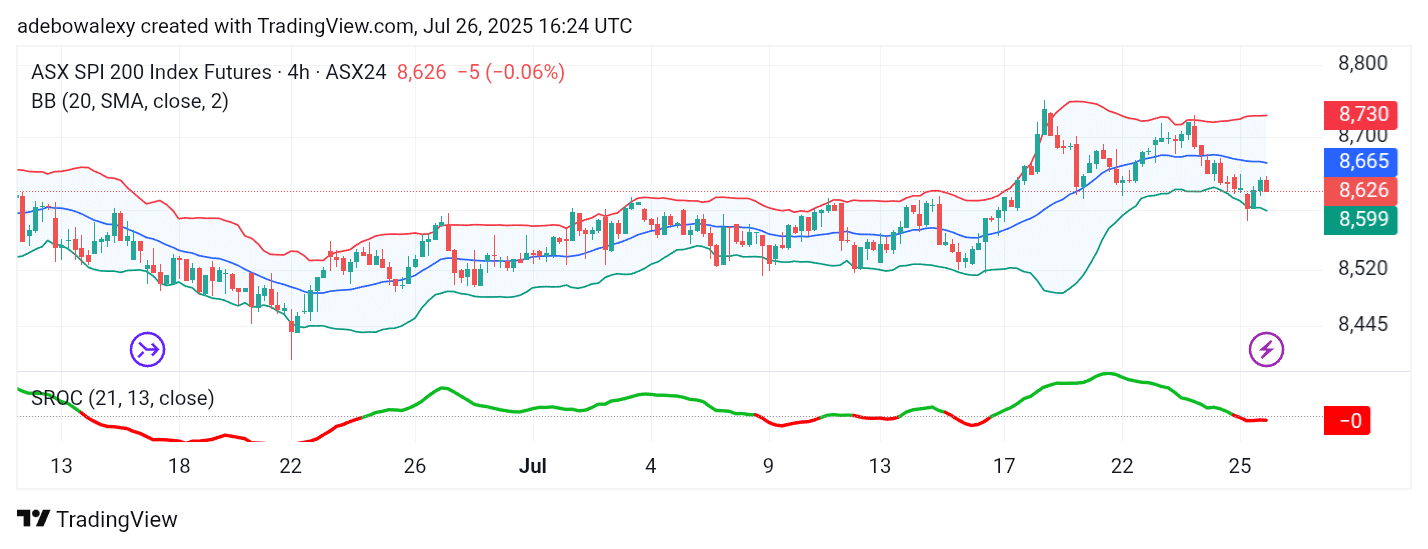

The Australia 200 market appears more active, displaying an overall upward trajectory. Price action has rebounded from a support level higher than that observed around July 15–16. Despite closing in the red, the index remains above the lower band of the BB indicator.

The BB indicator itself is taking on a more sideways orientation, with price action currently positioned below its midline—indicating consolidation rather than full bearish control. The SROC indicator line is also moving sideways just beneath the equilibrium level, reflecting a potential pause in bearish momentum.

Given these conditions, traders should watch developments related to U.S. trade talks and other major economic events, which could serve as a catalyst toward a rebound targeting the 8,750 level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.