The improving mood in the general stock market has also extended to the Australia 200 market. This is evident as price activity managed to reverse course after hitting the 7,200 price level. Additionally, the market recently pulled back slightly from a nearby resistance level but still appears to be on track for further recovery.

Key Price Levels

Resistance Levels: 7,500, 7,750, 8,000

Support Levels: 7,000, 6,750, 6,500

Australia 200 May Proceed Higher Toward the 20-Day MA

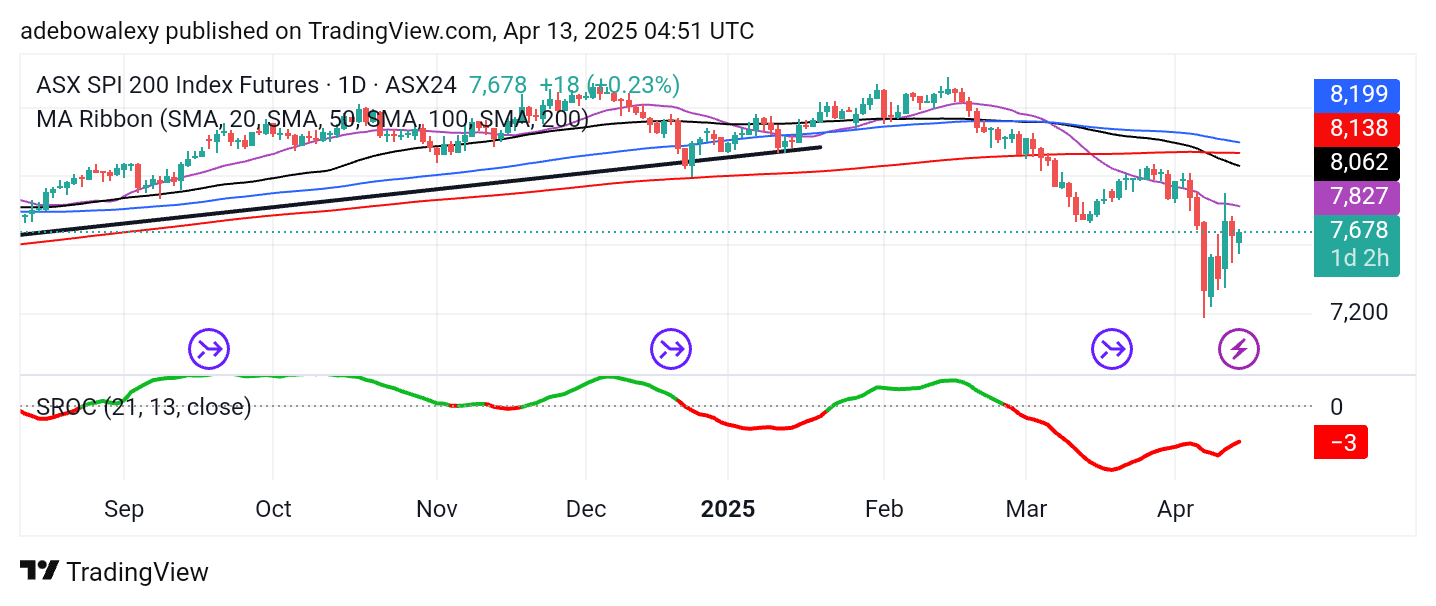

The ASX 200 market has shown significant activity on the daily chart. The market tested resistance at the 20-day Moving Average (MA) curve in the past two sessions. Price action rebounded downward with moderate momentum, causing the market to trade below the 7,600 price mark.

However, the market has since contracted upward, and the latest session at the time of writing appeared green. This supports the impression that price action is still moving toward higher levels. The Stochastic Rate of Change (SROC) indicator also has an upward trajectory from below the equilibrium level.

ASX 200 Retains a Favorable Base Level

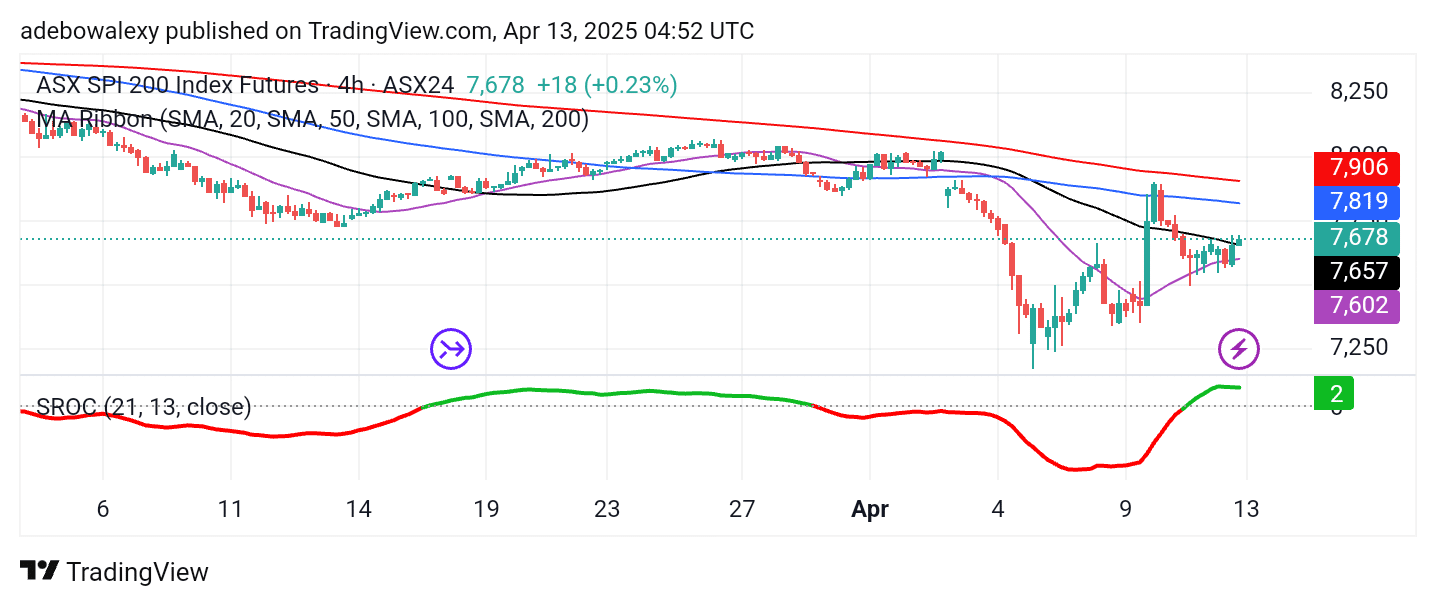

On the daily chart, price activity remains in the green. However, the 4-hour chart presents an even more favorable outlook. In this timeframe, price action sits above the 50-day MA line, which itself is positioned above the 20-day MA line. Meanwhile, the most recent price candle is green.

The SROC indicator remains above the equilibrium level, and the terminal end of the indicator line appears green—signaling that bullish forces still dominate. Although upward momentum appears somewhat weakened, bullish pressure continues to hold the upper hand. Therefore, price action may still push toward the 8,000 level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.