AUDUSD Price Analysis – April 29

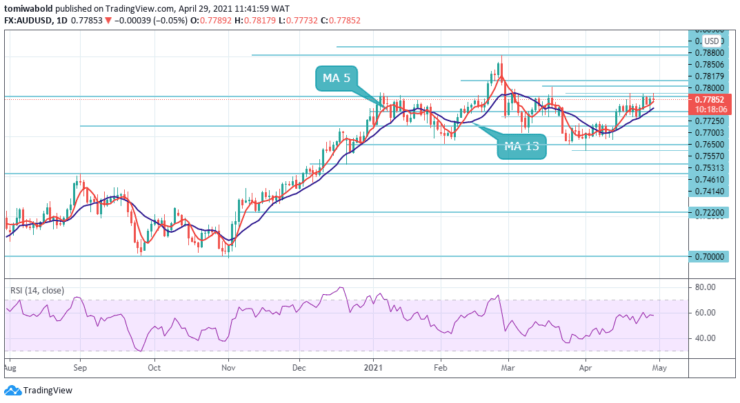

The AUDUSD pair fell from one-month highs of 0.7817 to register a low at 0.7773 at the time of writing and was last seen floating near the lower end of its daily trading range during the European session. The recent rebound in US bond yields can be counted as fundamental precursors behind the quote’s pullback.

Key Levels

Resistance Levels: 0.7880, 0.7850, 0.7817

Support Levels: 0.7725, 0.7650, 0.7513

Although the bears are expected to lose power near the 0.7770 marks, they will target the 0.7725 level and moving average (MA 200) support zone for more control before confirming the days low while hitting the round support number near the 0.7700 level.

For now, an upside breakout past the resistance level of 0.7800 will need to meet the key resistance level of 0.7850 before the bulls can take charge. While doing so, the 0.7817 mark, which is a multi-month high, can attract investor interest before the yearly peak, hitting the 0.7880 level.

The AUDUSD’s intraday bias tends to be neutral as convergence from level 0.7817 may tend to deepen further. With the 0.7725 support level intact, a rise from 0.7513 is still in favor of resuming trading from the 0.7880 level as soon as possible.

A definitive break of the 0.7817 marks, on the other hand, could confirm short-term topping and shift the downside bias to a steeper correction. In the not-too-distant future, the exchange rate will begin to rise again. The AUDUSD pair’s likely goal for the following trading session will be around 0.7850 points.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.