AUDUSD Price Analysis – March 4

The AUDUSD pair witnessed some buying on Thursday and seems to stall around the 0.7815 level of its daily trading range. AUDUSD buyers are holding the higher ground above 0.7800, extending the recovery gains in early European trading. The Aussies advance is led with support from better than expected GDP data released earlier.

Key Levels

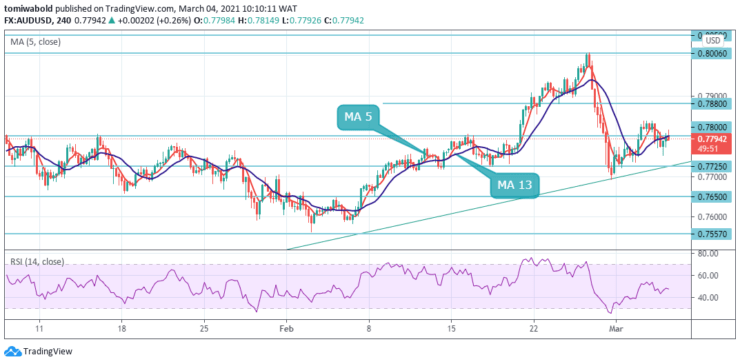

Resistance Levels: 0.8136, 0.8050, 0.7880

Support Levels: 0.7725, 0.7650, 0.7557

From the daily chart technical perspective, the recovery from the level at 0.7752 pushed the pair beyond the 0.7800 psychological area. Given the recent sharp pullback from the key 0.8000 marks or three-year tops, the rebound constituted the formation of an upside continuation chart pattern.

On the flip side, weakness below the daily swing lows, around mid-0.7700s may validate the retracement set-up and drag the pair back towards the 0.7700 marks. Some follow-through selling should pave the way for a further near-term depreciating move towards the 0.7650 intermediate support en-route the 0.7600 round-figure marks.

The trend in AUDUSD stays unaltered on the 4-hour time frame and intraday bias stays in a range initially. The correction from the 0.8006 level could still extend with another fall through 0.7691 temporary low around the ascending trendline support. However, the trend may stay bullish as long as the 0.7557 support level holds intact.

On the upside, above 0.7880 minor resistance level may alter bias to the upside for retesting 0.8006 level. The breach there may extend a larger uptrend from 0.5506. Meanwhile, a decisive breach of the 0.7557 level may usher in a steeper correction.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.