AUDUSD Price Analysis – February 4

The AUDUSD pair keep gains while its upside bias stays contained below the key hurdle at mid 0.7600 level. Signs of progress on additional US stimulus measures pushed the yield on the benchmark 10-year government bond to a near 10-month high touched in January with a lid on any meaningful upside for the AUDUSD.

Key Levels

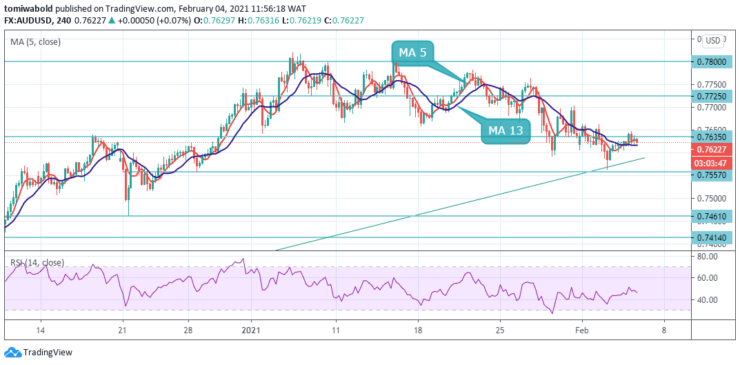

Resistance Levels: 0.7980, 0.7800, 0.7725

Support Levels: 0.7557, 0.7461, 0.7414

The Australian dollar rebound back towards mid 0.7600, posting modest gains in a largely lackluster session. After its rebound, the pair drops to 0.7614 in the latest pullback from the intraday high of 0.7647 during early Thursday. In doing so, the Aussie pair steps back from the key resistance, previous support, comprising multiple levels marked since the mid-December 2020.

Trading sustainably beyond the ascending trendline will encourage a bullish scenario and prove that the bounce may hold. The attention may return to the 0.7820 high again. On the other hand, a breach of the 0.7600 marks would extend the pullback from 0.7763 Jan 27 high to a retracement from 1.1079 (high) towards 0.5506 (2020 low) at 0.7557.

AUDUSD’s correction from the 0.7800 regions is still in progress. A steeper plunge could be seen to 38.2% retracement of 0.7000 to 0.7800 at 0.7557. Strong support is expected there to bring rebound. On the upside, the break of 0.7725 minor resistance will argue that the correction has been completed.

The intraday bias will be turned back to the upside for retesting 0.7819 high. Further advances are still under consideration as long as the 0.7557 support level stays intact. A breach of 0.7557 level may target the 0.7414 level in subsequent sessions.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.