AUDUSD Price Analysis – February 18

The AUDUSD pair is gaining upside traction against the US dollar from the prior days plunge to 0.7724 level. The Aussie opened higher at 0.7749 during Thursday’s European session but stays vulnerable under the 0.7800 level. Australia’s jobless rate dipped to 6.4% in January, versus expectations for a drop to 6.5% from December’s 6.6%.

Key Levels

Resistance Levels: 0.8136, 0.7980, 0.7800

Support Levels: 0.7725, 0.7650, 0.7557

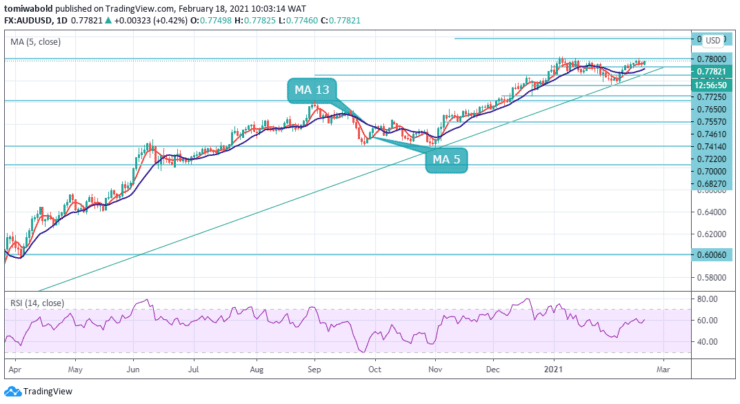

AUDUSD is preparing to break out of the MA 5 and MA 13 convergence zone as seen on the daily chart. Within the hurdles, AUDUSD has put in a session low of 0.7746 level and an intraday high of 0.7774 level trading inside a narrow range. A convincing break higher would expose the recent high of 0.7805 level.

However, the MA 5 is now trending south and may limit its advance, indicating bearish pressure. As such, a sustained move above 0.7800 level looks unlikely. Nevertheless, the path of least resistance appears to be on the higher side given the established support levels beneath 0.7725 level.

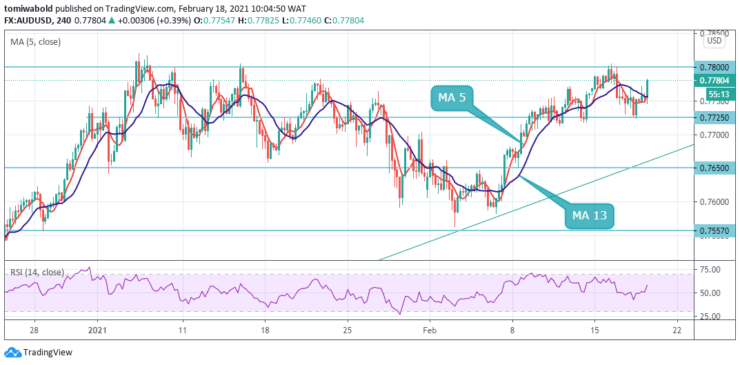

The AUDUSD pair has broken above a falling price channel on the four-hour time frame and looks to be targeting the 0.7800 level. A failure to scale the technical hurdle will likely invite selling pressure, yielding a drop toward Wednesday’s low of 0.7724. All things being equal, the exchange rate could continue to consolidate during the following trading session.

The potential target for bearish traders would be near known support at 0.7650 level. The AUDUSD pair is only bearish while trading below the 0.7725 level, key support is found at the 0.7700 marks. The AUDUSD pair is only bullish while trading above the 0.7725 level, key resistance is found at the 0.7800 and 0.7980 levels.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.