AUDUSD Price Analysis – May 6

In the European session on Thursday, the AUDUSD pair gathered momentum and recovered from its lows at 0.7700 and climbed to the top end of its initial trading range, past the mid-0.7700s. A modest US dollar weakness and a generally positive tone around the equity markets sponsored the intraday uptick.

Key Levels

Resistance Levels: 0.8000, 0.7850, 0.7800

Support Levels: 0.7700, 0.7650, 0.7600

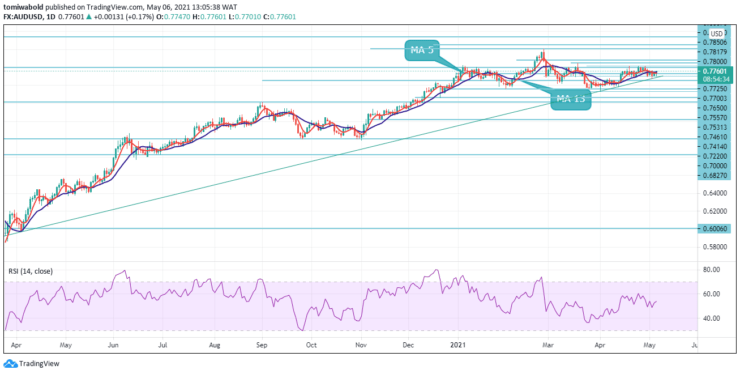

The bullish trend in the AUDUSD needs to be confirmed by a sustained break above the 0.7750 marks, as seen on the daily charts. Growth is also hampered by the moving average (5 and 13 zones). Meanwhile, a return beneath the 5 and 13 moving average at 0.7750 could temporarily dampen bullish sentiment, sending AUDUSD sellers to a weekly low around 0.7674 level.

In a wider sense, continued trade above horizontal resistance at 0.7725 indicates a medium-term bullish bias. To potentially signal the continuation of a long-term rebound from 0.5506. AUDUSD will need to break out of the 0.7850 yearly highs registered on Feb. 25, On the other hand, a break of the 0.7700 marks will sustain the long-term bearish trend.

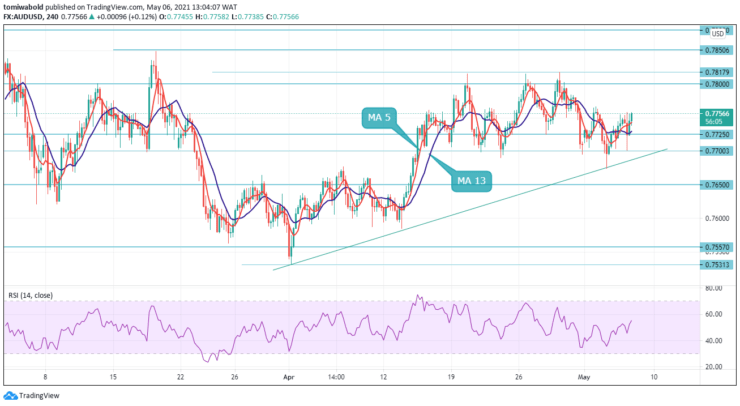

The overall AUDUSD rally stays, attaining a temporary high of 0.7850 as seen on the 4-hour chart. Today, intraday bias is back to the pivotal 0.7750 regions. A strong bullish outcome could result from a decisive breakout. The 61.8 percent projection from 0.5506 to 0.7413 levels from 0.7001 to 0.7850 levels is the next goal.

A break of the 0.7700 support band, on the other hand, would imply a short-term high in the event of a pullback, however, the pattern may remain bullish. The uptrend line, which is currently near the 0.7700 marks, may provide technical support to the AUDUSD bulls. Any step below the ground, on the other hand, could stoke the bears.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.