Market Analyst – April 25

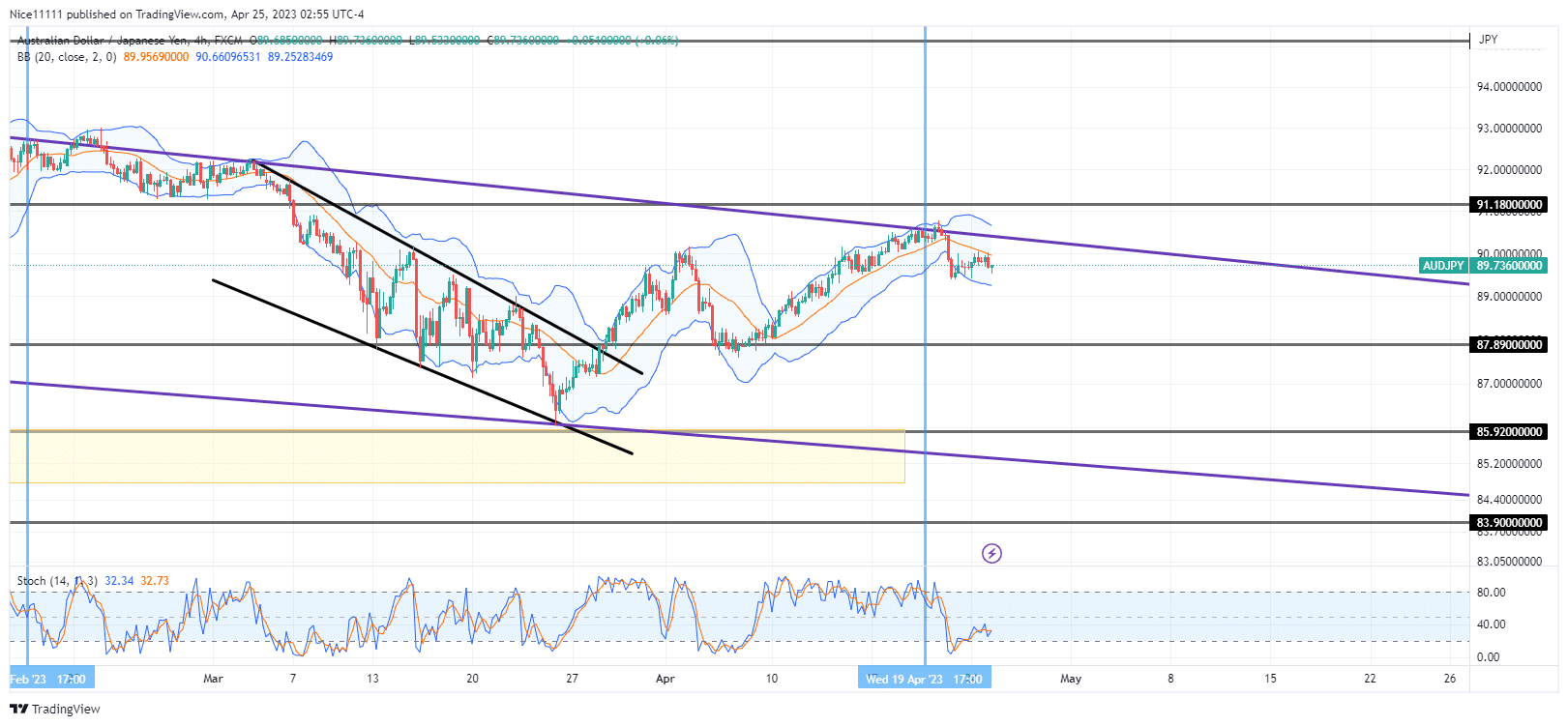

AUDJPY is currently bearish on the daily timeframe. The short-term ascent has reached a bearish confluence. The short-term ascent on the lower timeframe (4-hour chart) is expected to reverse to correlate with the higher time institutional order flow.

AUDJPY Significant Levels

Supply Levels: 91.180, 95.140, 98.270

Demand Levels: 87.890, 85.920, 83.900

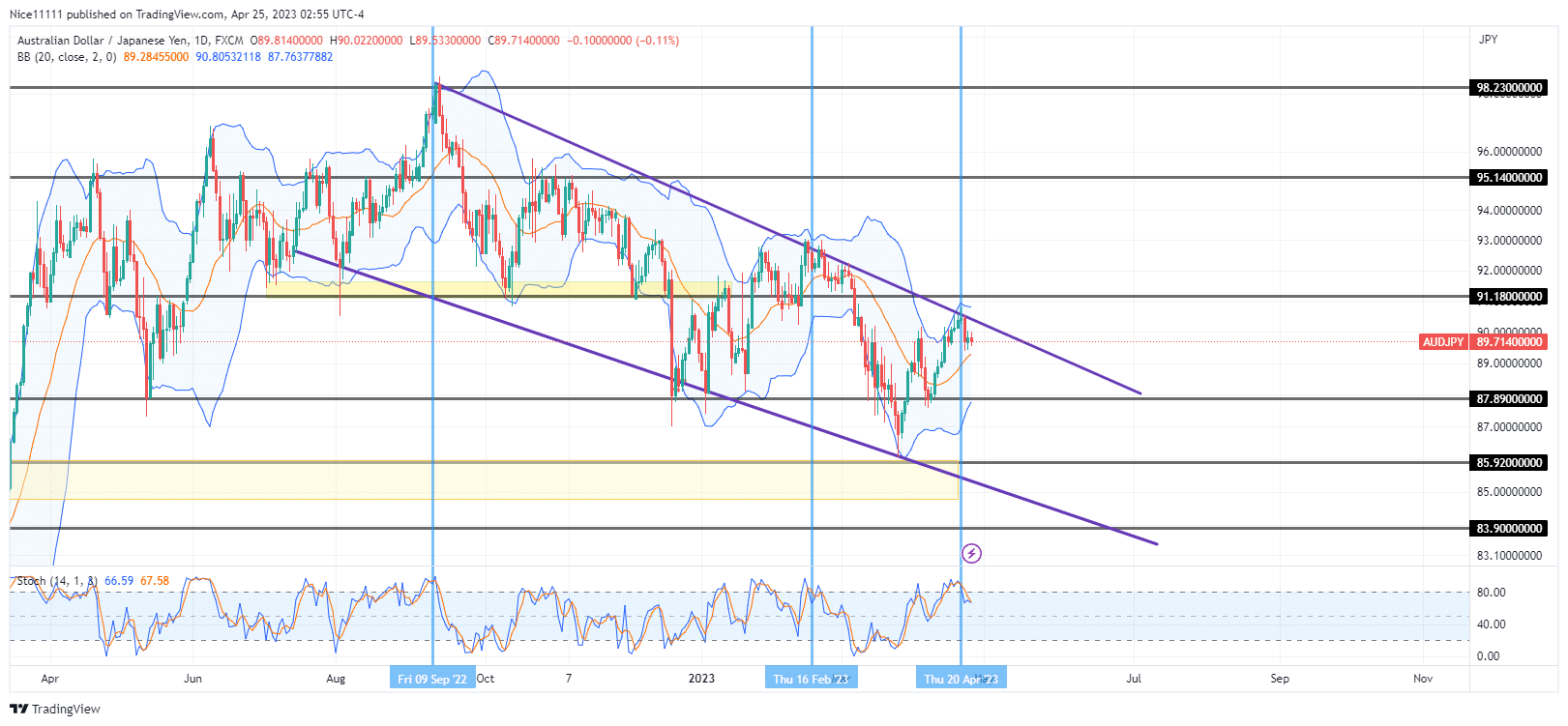

AUDJPY Long-term Trend: Bearish

AUDJPY buyers got exhausted after striking the supply level of 98.230 on September 9, 2022. The Stochastic indicator revealed the market was already in an overbought state. The Bollinger Band resting above also resisted the price rise. The market crashed to the next demand level of 91.180. The demand zone prevented a further price decline.

The test of the demand zone in October was the third attempt by the sellers to break the zone. After a failed attempt by the sellers, they struck once more, shorting from a closer supply level of 95.140. Currently, the Stochastic is overbought on the higher timeframe. The market price is expected to plummet soon.

AUDJPY Short Trend: Bullish

The price is currently in the crosshairs. The supply zone of 91.180 has crossed the resistance trendline. The sellers are expected to utilize the opportunity for shorts on USDCHF to the next support level of 87.890.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.