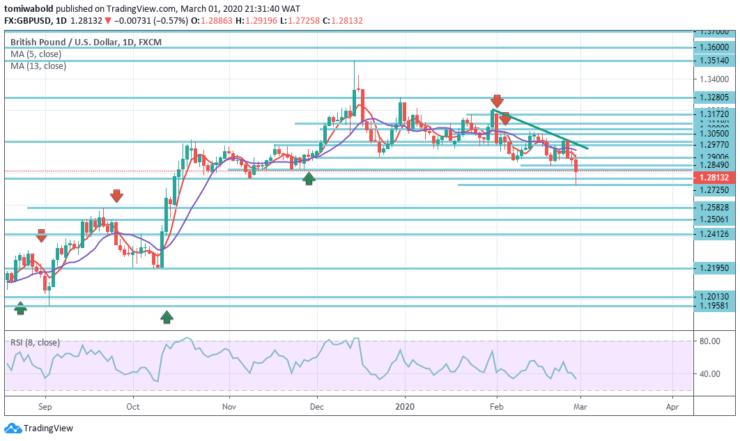

GBPUSD Price Analysis – March 1

The market has experienced recovery from its lowest levels since 2016, while the price is now pushing for a consolidated structural shift. Ultimately, only returning beneath the 1.2500 level could jeopardize the freshly created constructive perspective. In the previous session, GBPUSD plunged from 1.2920 to a low of 1.2725 level, while exiting at the level of 1.2813.

Key Level

Resistance Levels: 1.3514, 1.3172, 1.2900

Support Levels: 1.2582, 1.2195, 1.1958

GBPUSD Long term Trend: Ranging

In a larger structure, the current decline from the level of 1.3514 is considered as a correction of the rally at the level of 1.1958. It is anticipated that this rally will continue later towards the key resistance at 1.3514 level. Reactions from there will decide whether it is in consolidation from 1.1958 (low) level.

Or a sustained breakout of 1.3514 levels may indicate a long-term bullish reversal. However, a steady breakthrough of resistance turned support at 1.2582 level may weaken these views and lead to repeated testing of the low level of 1.1958 instead.

GBPUSD Short term Trend: Bearish

GBPUSD declined to the level of 1.2725 in the previous session, and a break of 1.2725 level will indicate the resumption of the correctional fall from the level of 1.3514. The intraday bias returned to decline for a 50% recovery from 1.1958 to 1.3514 at 1.2813 levels.

On the other hand, a break of 1.3000 level is necessary to indicate a short-term bottom, otherwise, a further fall may stay in favor of recovery in the event of such a recovery.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.