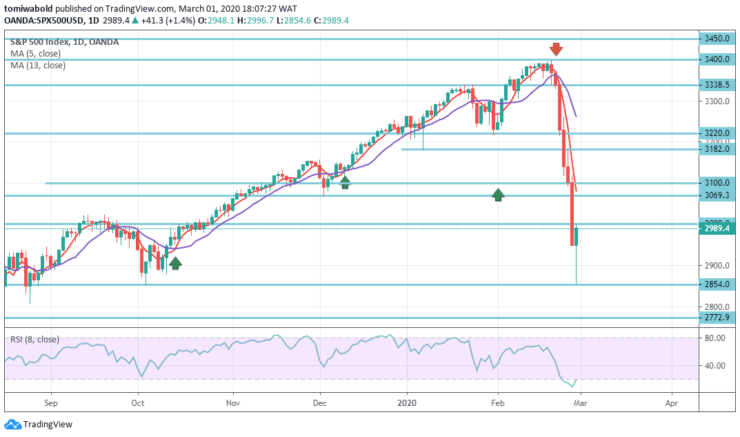

S&P 500 Price Analysis – March 1

The S & P 500 had a terrible past week, when it broke past the level of 3000 during the end of the week, the market seems to be starting to change its setting as a whole, but is showing extreme volume downward. As the coronavirus begins to spread, fears in the world market are spreading and the results are unpredictable.

Key Levels

Resistance levels: 3400, 3220, 3000

Support level: 2854, 2772, 2600

S&P 500 Long term Trend: Ranging

The S & P 500 has been in a free-fall mode since February 20, as it has reached a resistance level at a record high of 3,392.21 level.

The price creates the longest sell-off period since December 2018 and broke through the main horizontal support lines, posting a new four-month low at 2854 with a rebound to 2996 levels today.

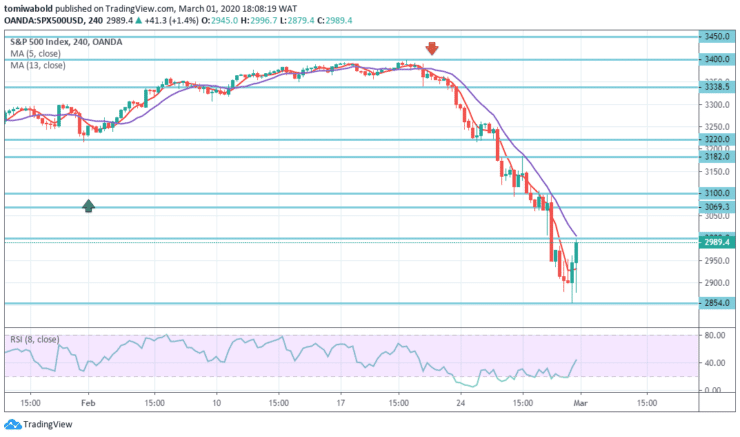

S&P 500 Short term Trend: Bearish

Currently, the index is trading at 2989.00 level after an attempt to close the breakdown of the support zone, the breakdown of which plunged past 3000.00 level in the previous session.

We could see attempts to hold onto 3000.00 level; however, if this fails, the following two supports are valued at 2854.00 and 2772.9 level.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.