In recent weeks, the Japanese Yen has experienced a rapid decline against its G10 counterparts as other central banks reinforce their hawkish stance. This simultaneous occurrence of events, coupled with supportive comments regarding the Bank of Japan’s unconventional monetary policy, has created an unfavorable situation for the Yen.

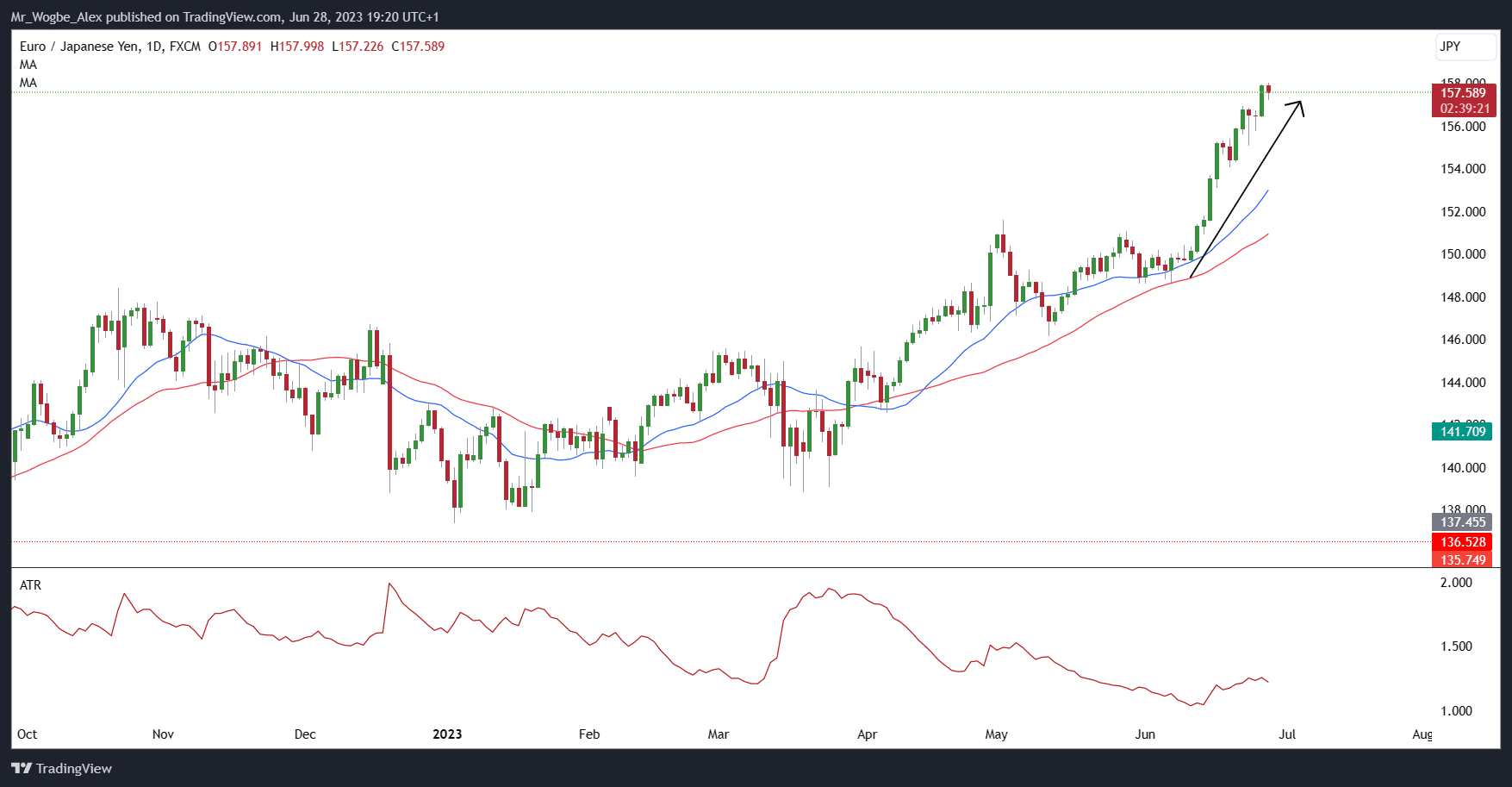

Currency diplomat Masato Kanda has expressed concerns about the FX market’s one-sided movements, emphasizing the need for continuous monitoring. Such concerns have further contributed to the downward spiral of the Yen. As such, the EUR/JPY pair has reached levels not witnessed since the 2008 financial crisis, influenced by the European Central Bank’s (ECB) assertive hawkish stance, as showcased at the recent ECB Forum in Sintra.

Japanese Finance Minister Suzuki echoed Mr. Kanda’s apprehensions, highlighting the existence of one-sided movements in the FX market. He assured that Japan is prepared to respond appropriately to excessive market fluctuations. While Suzuki’s comments briefly strengthened the Yen, the currency quickly resumed its decline during the European trading session.

However, there is a glimmer of hope for the Yen. The Bank of Japan released a summary of opinions on Monday, revealing ongoing debates about potential adjustments to the Yield Curve Control (YCC) policy.

Some analysts speculate that a revision to the YCC policy could be implemented as early as the July meeting, despite efforts by BoJ Governor Ueda to downplay its likelihood. Considering the current path of the Yen, a surprise move by the Bank of Japan could have a more significant impact than the intervention measures executed in 2022.

Yen Traders are Closely Monitoring the BoJ’s Actions

As the Japanese Yen continues to face losses against major currencies, the market remains attentive to any further developments that could influence its trajectory. Traders and analysts are closely observing the potential for a BoJ policy shift, which may offer a turning point for the Yen’s performance in the coming months.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.