The yellow metal began its retracement from the $1992 level (its 2-week high) and has continued on a depressing sentiment for the second consecutive session now. The slide was mostly due to the strong recovery in the US dollar (DXY) and the upbeat risk appetite across markets.

The greenback’s strong recovery from a two-year low was largely sponsored by the better-than-expected US ISM Manufacturing PMI report on Tuesday. Increased demand for USD tends to thwart the safe-haven appeal of the dollar-denominated commodity.

Expectations of an additional US stimulus and Thursday’s upbeat Chinese Caixin Services PMI have further bolstered investors’ risk appetite.

Additionally, the US Treasury bond yields saw a decent bounce this week which piled extra pressure on the non-yielding commodity.

Moving on, market participants will be looking at the US economic docket today—which features the ISM Non-Manufacturing PMI—for clues. This data report might produce some short-term volatility as the markets brace for tomorrow’s NFP data.

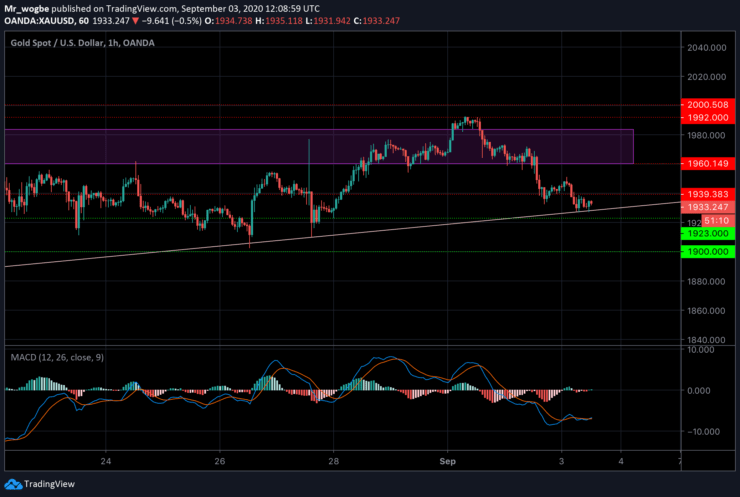

Gold (XAU) Value Forecast — September 3

XAU/USD Major Bias: Bearish

Supply Levels: $1940, $1960, and $1983

Demand Levels: $1923, $1909, and $1900

Gold failed to hold on to its previous consolidation phase yesterday and has fallen below the key $1940 resistance. A sell-off was triggered (as projected in an earlier analysis) but the precious metal found strong support at our ascending trendline. At press time, gold is still battling with this line but will likely find its footing from here and bounce back to its previous highs.

That said, a break below this trendline could precipitate further declines for gold and could drag the price to the $1900 psychological line once again.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.