XAGUSD Price Analysis – March 21

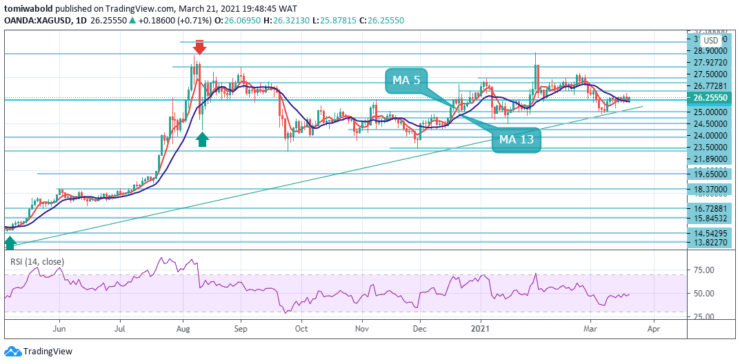

The prior week’s price action has confirmed Silver (XAG) to be constrained within a sideways run within and above the $26.00 zone. The XAGUSD pair is attempting to safeguard its gains after its rebound from the Mar. 5 lows at $24.83 levels. In the new week, the Silver market will react to key data, preliminary Markit PMI report for March from the United States.

Key Levels

Resistance Levels: $30.00, $28.50, $27.50

Support Levels: $25.00, $24.00, $23.50

In the prior week, XAGUSD bulls attempted to crush the old barrier around the $26.77 zone but retreated beneath the $26.00 level. As a result, the quote’s further upside may be challenged by a psychological horizontal line at the $27.50 level. The RSI is also in a sideways territory around 50, so a rebound is not out of the question. The $26.77 acts as an initial barrier.

Alternatively, Silver (XAG) may attempt the immediate support line, which is currently around the weekly low at $25.38 level, and may take silver prices towards the low level at $25.00. However, any further weakness needs to break the yearly low of $24.01 to invalidate the XAGUSD bullish run-up.

On the 4-hour time frame, the bulls may wait for a further pullback to the $26.00 level to enter the upside market, which is around the prior week’s high at $26.63 level. Below the ascending trendline support is the $25.00 level (which is also near the lows of March). The first resistance is at the 27.50 level, then the Feb. 22 highs at $28.32.

If the price breaks above there, the high at $28.90 is the next focus for the bulls & extension from there may attempt the yearly highs at the $30.13 level. Thus, some upside potential could prevail in the market during subsequent sessions. XAGUSD may continue moving in a sideways pattern until anticipated fundamentals coming from the united states are released this week.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.