XAGUSD Price Analysis – January 11

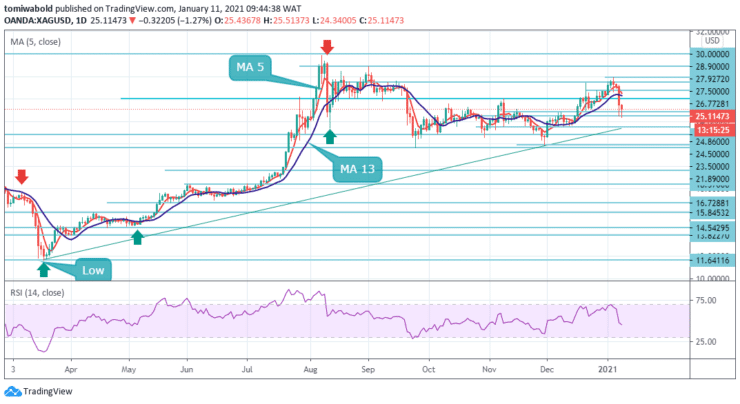

Silver plunges to $24.34 level, down 1.25% during the early European session trading on Monday. The metal has been pressured for the last four days and is currently in a rebound from the $24.50 horizontal level. Meanwhile, a sustained downside breach will empower the sellers to increase pressure on the white metal.

Key Levels

Resistance Levels: $28.90, $27.50, $26.00

Support Levels: $23.50, $22.83, $21.89

Overall, XAGUSD risks remain skewed to the downside with the next relevant downside target seen at the $23.50 support level. The level at $22.83 will be the level to beat for the bears. It should be noted that the plunging RSI conditions are likely to bolster the silver bears towards the ascending trendline support, at a $21.89 level.

The white metal now trades with weakness slightly around the $25.12 level while trying to recover. On the other hand, if Silver price trades beyond the $26.00 level confluence zone, the upside traction might gain speed and activate buy orders seemingly triggering the abrupt upside move in silver towards the $27.50 high level.

On the lower time frame, technical analysis indicates that XAGUSD has broken into the downward channel and may range between the near term resistance level at $26.00 and short term low at $24.50 level. Any such breakout lower will keep the white metal selling towards the next support $23.50 level.

Above the $25.50 level may attempt recovery to the $26.00 level. Silver may recover from extremes and trades back in the $27.00s but may still trade lower with losses compared to the recent high of $27.92. The likely scenario will be short positions below $24.50 with targets at $23.50 & $23.00 levels in extension.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.