XAGUSD Price Analysis – February 21

Silver (XAGUSD) spot price continues to defy selling pressure under the $28.00 mark as the pair stays supported on dips to the $27.00 level. The white metal further raced higher towards the upside zone to maintain its positive bias due to reports of some suppliers running out during the weekend. The dollar edged lower despite its anticipated recovery.

Key Levels

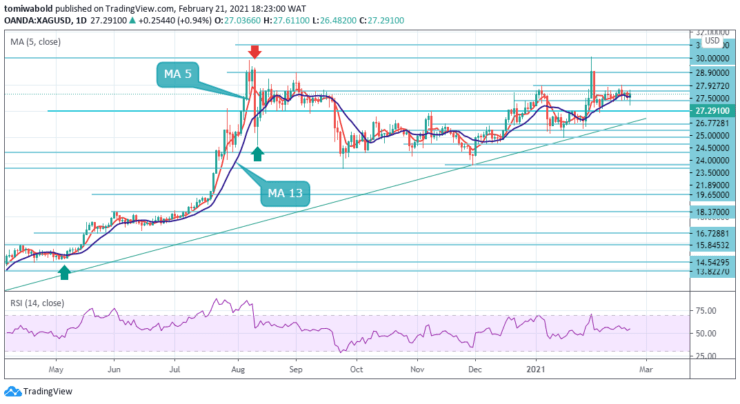

Resistance Levels: $30.00, $28.90, $27.92

Support Levels: $26.77, $26.00, $25.00

XAGUSD prices managed to rally momentarily to the north past the $27.50 mark in the prior session after it rebound from lows at the $26.48 level. As a result, the current recovery moves can extend towards the immediate resistance line near the $27.92 level. Meanwhile, the prior week high of $27.95 and the $28.00 round-number add to barriers while targeting the month’s peak of $30.00.

To the downside, the bears will be on the lookout for a test of the psychological $27.00 level, as well as a test of February low at $25.90, which is likely to come into play at the breach of the $26.77 support zone. Below that, the significant area of support is around the psychological zone at close to the $26.00 mark, which is under both moving average 5 and 13.

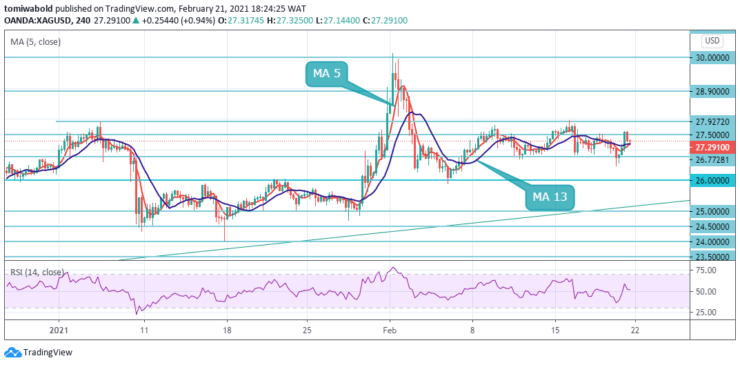

As seen on the 4-hour chart, silver appears to be trapped within the mid-channel at the $26.77 and $27.92 levels. In the event, the price channel holds intact XAGUSD is likely to further gain support from 4 hours MA 5 and 13 crossings near the $27.20 level and return to extend gains against the US Dollar in the short term.

A possible upside target is the upside range at $27.50 and $28.90 levels, in the meantime, it is unlikely that bears could prevail in the market. That said, a sustained break below will be seen as the first signs of bullish exhaustion and turn the pair vulnerable to fall further towards challenging the key $26.00 psychological mark.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.