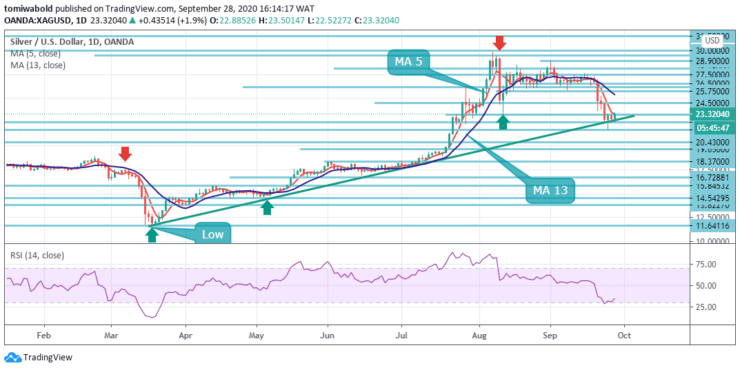

XAGUSD Price Analysis – September 28

Silver price is hovering around $23.28 level as markets traded from European to American open for Monday’s trading. The shinning metal earlier surged to $23.50 level but failed to keep the gains. A flight to safety amid growing fears over coronavirus resurgence and its implications on the global economy may keep the demand for Silver limited.

Key levels

Resistance Levels: $30.00, $27.15, $24.50

Support Levels: $22.50, $21.66, $19.65

XAGUSD buyers are once again in medium to long term control, as the price continues to attack near term horizontal resistance zone currently at the $23.50 level. At the level it also coincides with moving average 5, making it a strong barrier for the bulls.

The white metal rebounded from the ascending trendline hurdle at the $22.50 level, a break below could open doors for a test of the horizontal support zone at the $21.66 level. The daily Relative Strength Index (RSI) is recovering towards the north allowing for further upside.

From a short-term technical perspective, the white metal is attempting a recovery after meeting strong support at $21.66 level, and the momentum indicators are painting a gloomier short-term picture as well.

A firm break above the horizontal barrier at $23.50 level could open the door towards a higher mark at the $24.00 level. The next upside target awaits at the level of $24.50 level. The near-term key support comes at the $22.50 level that holds the gate for silver’s further weakness towards the monthly low of $21.66 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.