XAGUSD Price Analysis – September 14

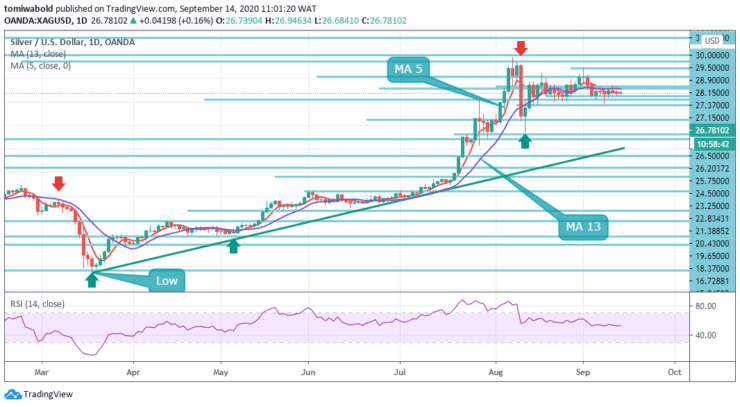

Silver (XAG) opened with a weak momentum on Monday, showing little interest to exit the one-month-old horizontal trajectory that is taking place within the $25.75-$28.90 area. However, the upside bias beyond the channel range may kickstart beyond the $27.15 level in the new week.

Key Levels

Resistance Levels: $30.00, $28.90, $27.15

Support Levels: $26.50, $25.00, $23.78

The white metal keeps hovering within the MA 13 and MA 5 after the last week’s failed attempt to cross upwards the horizontal resistance level at $27.37. While normal RSI conditions suggest the bullion’s further consolidation, it refrains from declining below the midline of 50.

However, a clear break of the $27.15 level, comprising the aforementioned horizontal resistance line, becomes necessary for the bulls to step in. It should also be noted that the moving average 13 level of $27.20 level offers immediate resistance to the quote.

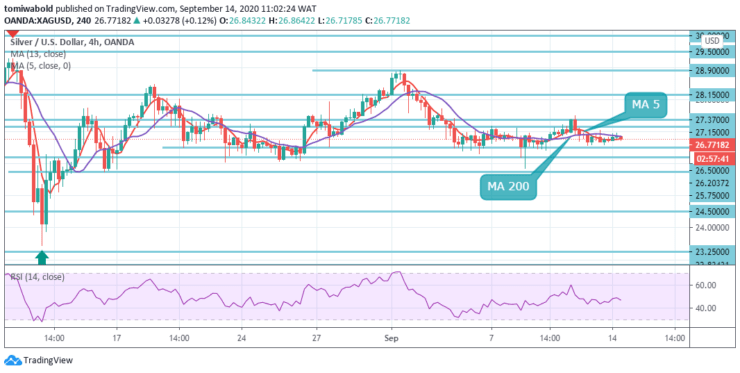

On the 4 hour chart, the latest XAGUSD may attack the weekly top surrounding the $27.50 level before targeting the $28.15 horizontal resistance level. Though, the 4-hour channel resistance line at $27.37 level will challenge the bulls, a break of which will quickly direct the quote towards the monthly high of $28.90 level.

Meanwhile, a downside break of moving average 5, at $26.81 level now, will fetch the commodity prices to the aforementioned channel support line, currently around $26.20 level. The preferred scenario would be a long position beyond the $26.50 level with targets at $27.37 & $28.15 levels in extension.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.