XAGUSD Price Analysis – January 4

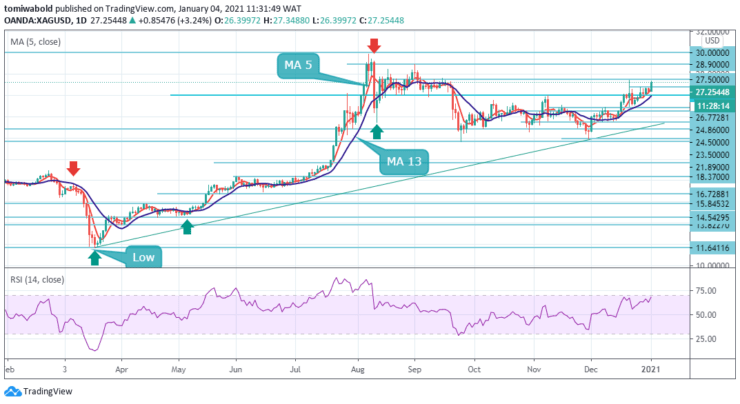

Spot silver (XAGUSD) is looking to break the $27.50 level as the white metal breaks out of its recent high of $26.77 during Monday’s early European session. Overall, the market remains patchy, but the dollar as a whole is weakening as markets wait to see what happens with US fiscal stimulus and Georgia’s run-off on January 5.

Key Levels

Resistance Levels: $30.00, $28.90, $27.50

Support Levels: $26.00, $24.50, $23.50

XAGUSD price has convincingly broken to the upside of its range and the main resistance level to watch out for is the $27.50 that has capped its upside since 15th September. To the downside, the previous top of the old December range at around $24.86 level ought to offer immediate support, in case of an unexpected decline.

Alternately, if the $27.50 level gives way then silver prices could be looking towards posting further gains in the medium to long term. Price action has been broadly consolidating near the $26.00 levels over the past few sessions. If it does break above, a gradual move towards the mid-September highs above the $27.50 level will be likely.

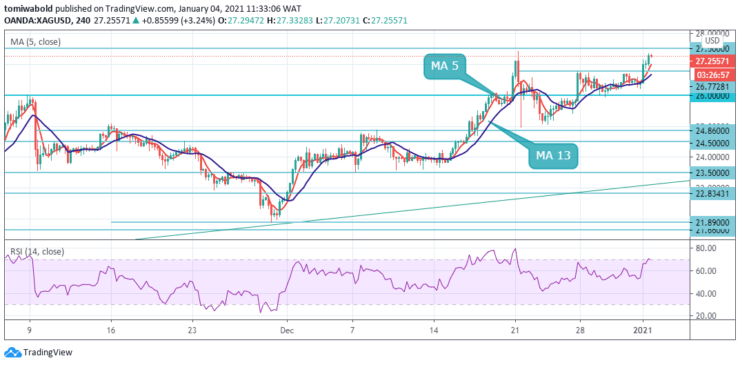

As seen on the 4-hour chart, silver appears to be launching toward a major technical barrier at the $27.50 level. In the event, the barrier holds intact XAGUSD is likely to gain support from 4 hours moving an average of 13 near the $26.77 level and return to extend gains against the US Dollar in the short term.

A possible upside target is the upside range at $28.90 and $30.00 levels, in the meantime, it is unlikely that bears could prevail in the market. That said, a sustained break below will be seen as the first signs of bullish exhaustion and turn the pair vulnerable to fall further towards challenging the key $24.50 psychological mark.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing result

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.