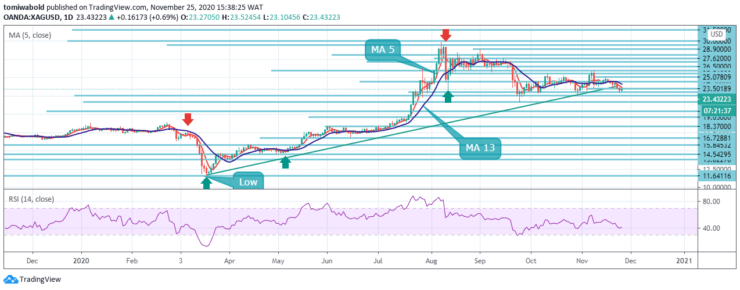

XAGUSD Price Analysis – November 25

Silver (XAGUSD) extended its rally after a rebound from lows around the vicinity of $23.00 zones during the European session on Wednesday. The dollar is keeping a little milder on the session now as it pares its earlier advance against the shining metal.

Key Levels

Resistance Levels: $26.00, $24.50, $23.50

Support Levels: $23.00, $22.60, $21.66

Bulls are gearing up for another upside cycle, especially after buyers managed to defend the $23.00 support zone, avoiding channel breakdown on the daily chart. The 14-day Relative Strength Index (RSI) is in retracement mode, albeit as high as 40, indicating a small bounce could occur before the rally continues.

Further north, the bulls may try to bounce towards the powerful obstacle around the $24.50 level, followed by the $25.07 resistance level, which could challenge the bullish commitment. Alternatively, a drop below the $23 level could lead to openings to September lows at $21.66.

In the 4 hours chart, Silver is trading beneath $23.50 in the short-term uptrend line and continues to trade within the lower channel, which means that the shining metal’s short-term trend remains in the consolidation.

Aside from the $23 psychological level, which has already proven solid support, the next level to look out for is the $22.60 level, which could allow a retest of the September low of $21.66, where we look for signs of stabilization. On the other hand, if XAGUSD can break short term resistance at $23.50, the next level to watch out for will be $24.50.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.