XAGUSD Price Analysis – November 16

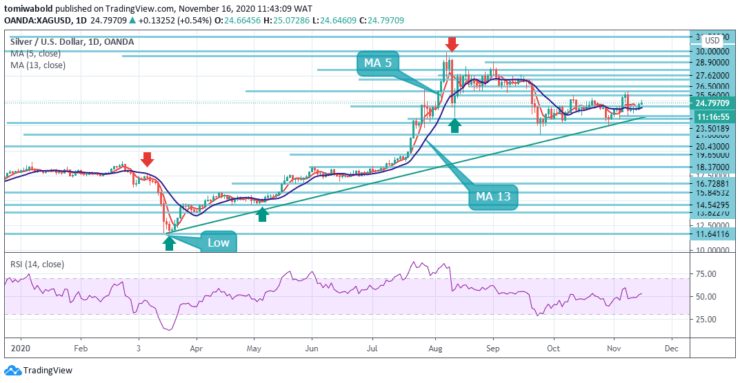

Silver (XAGUSD) edges higher starting a fresh week, eyes beyond the $25 hurdle amid a broadly mild US dollar, and COVID-19 vaccine optimism. A sharp rally could be in the offing following a breach beyond $25, with a test of the critical $26 barrier inevitable.

Key Levels

Resistance Levels: $27.62, $26.50, $25.56

Support Levels: $24.50, $23.25, $22.83

Silver is currently trading 0.87% higher on the day at the $24.79 level and the white metals moving average 5 and 13 have almost produced a bullish crossover, however, the crossovers do not necessarily imply a price surge. XAGUSD needs to topple near term high of $26 to confirm a bullish revival.

On the downside, $23.25 is the level to beat for the bears. That level has acted as strong support multiple times since the end of September. The initial sentiment may stay neutral as long as prices are held within the prior week’s trading range of $23.50 to $26.00 levels.

On the 4-hour time frame, the white metal made attempts to recover from the losses over the week. However, the rebound from $23.50 stays weak for the moment, with the overall set up in consolidation. For the moment, the hidden bearish divergence from the RSI suggests a move back to its midlines at 50.

As a result, this could see the $24.50 level of support being tested a bit more firmly. Following this, Silver prices might remain trading flat above the $24.00 mark for the short term. However, if the $24.50 level is lost, then Silver prices could be looking at a further downside to the $23.50 level in the near term.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.