XAGUSD Price Analysis – October 26

XAGUSD confronts selling pressure on Monday as coronavirus concerns weighed over the risk sentiment and strengthened the haven demand for the US dollar. The white metal dropped to the $24.09 level, the lowest level since Oct.15, during the early trading hours. The risk-off occurs as the US registered a surge in the number of coronavirus cases.

Key Levels

Resistance Levels: $30.00, $27.62, $25.56

Support Levels: $23.25, $21.66, $19.65

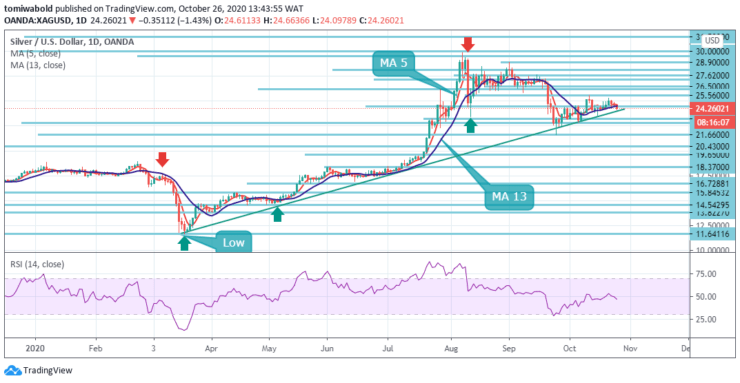

From a technical analysis perspective, a break above the Oct. 12 high of $25.56 level is needed to confirm an end of a pullback from the record high of $29.85 level and resume the broader uptrend. On the downside, the ascending trendline support is the level to beat for the sellers.

On the flip side, the bulls are likely to have a hard time recovering ground above the $25.50 level, as a dense cluster of resistance is aligned around the zone, the intersection of the daily moving average 5 and 13. Meanwhile, the acceptance above the $25.56 level is critical to reviving the near-term bullish momentum.

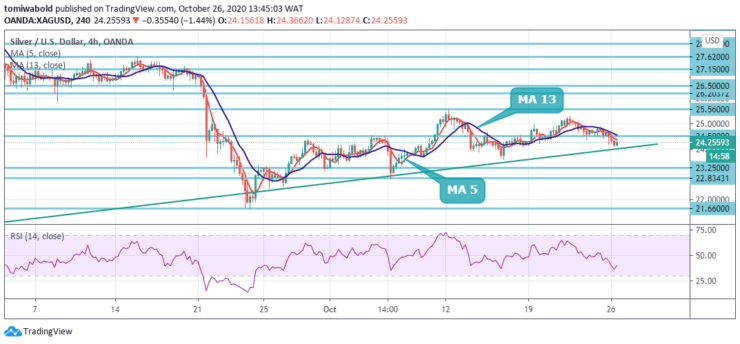

On the shorter time frame, the XAGUSD breached the horizontal support turned resistance line at the $24.50 level down south. Some downside potential could likely prevail in the market, as white metal is pressured by the moving average 5, as well the moving average 13 in the $24.50 area.

Meanwhile, note that the exchange rate could gain support at the $23.50 level. Therefore, Silver could trade sideways against the US Dollar in the short term. Below here, a clear break might increase bearish traction, sending the pair towards $22.83 (October 6 low level) and $21.66 (September 24 low level).

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.