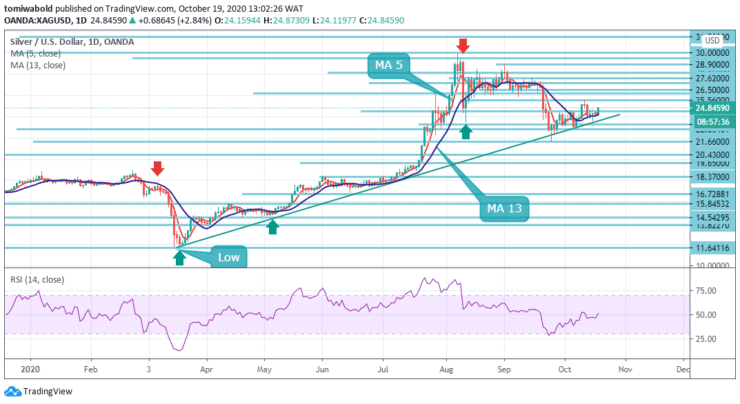

XAGUSD Price Analysis – October 19

The white metal confirms the move higher early in the European session past the $24.50 level as the upside favoring chart play may propel the quote towards the $25.00 threshold ahead of challenging the monthly top near the $25.55 level. Hopes for a US stimulus deal have risen, weighing on the safe-haven dollar.

Key Levels

Resistance Levels: $30.00, $28.15, $25.56

Support Levels: $23.25, $21.66, $19.65

From a technical point of view, Silver (XAGUSD) may have shown a false breakout from the $24.50 resistance level on the daily chart. The level at $25.56 level may be considered as the nearest resistance, while the 1st and 2nd support are expected to be located at $23.25 and $22.83 levels respectively.

Silver has been appreciating against the US Dollar since the end of July within a rising wedge pattern. Meanwhile, note that the rate could gain support from the ascending trendline support in the $23.50 area during this session. Thus, the silver price could continue to go upwards.

On a 4 hour chart, silver might have resumed its sideways trading following a recent rebound. It has formed a consolidation pattern after reaching an ascending trend line drawn from March. The level at $25.56 may be considered as the nearest resistance.

On the contrary, if the XAGUSD is unable to break past the $25.56 level a breakout south could likely occur within the following trading sessions. In this case, the XAGUSD exchange rate could gain support from the horizontal support at the $23.50 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.