XAGUSD Price Analysis – August 24

Silver stays lackluster at around $26.45 level, up 0.25 percent a day, during Monday’s trading session in European markets. The White metal bounces off near-term lows near $26.20 level while prices increased as risk sentiment improves after the U.S. drug regulator approved the use of blood plasma from recovered COVID-19 patients as an alternative for treatment.

Key Levels

Resistance Levels: $30.00, $29.27, $28.15

Support Levels: $25.00, $23.78, $21.38

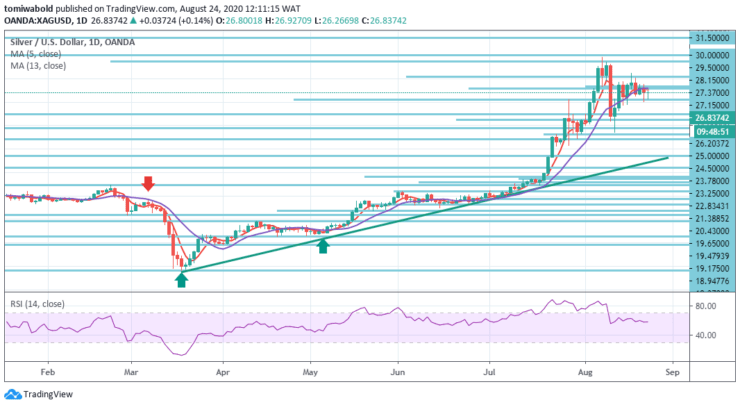

Silver prices are holding above the near term support level at $26.20 level, with the long-term ascending trendline acting as a further downside vital support. Psychologically, holding beyond $26.20 level would also imply growth in the long-term bottoming prospects of silver.

It now suggests that silver rates ranged from $23.44 level to $29.85 level in a sideways bias. To this end, the rallying of silver prices into the consolidation amid a long-term bottoming effort suggests a bull flag has been formed; an upper side breakout beyond $29.85 level is anticipated.

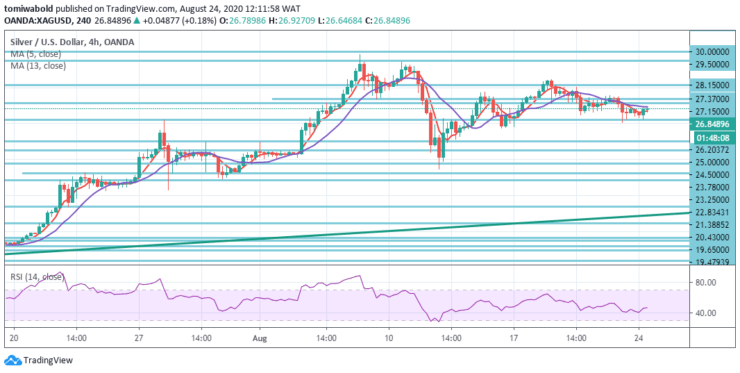

In the short-term frame, Silver (XAGUSD) ranges on the 4-hour holds within the horizontal channel, validating the $26.20 level bounce upwards. The bulls may seek to test the $29.50-level target which is near to the $29.85-level 7.5-year highs hit last week.

The Relative Strength Index (RSI) of 4 hours points to its midline region at 50, which means there is more room for the upside. Instead, a fall beneath the support level of $26.20 might call for a $25.00 level horizontal support test. To eliminate the near-term bullish momentum, a daily exit is required beneath the moving average of 5 and 13.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.