USDWTI Price Analysis – January 20

Earlier in the session, WTI climbed towards the $ 60 area per barrel after news of supply disruptions in Libya and Iraq. A new decline in prices signals that immediate fears are beginning to fade, as the global oil market remains well provided by oil production and reserves.

Key Levels

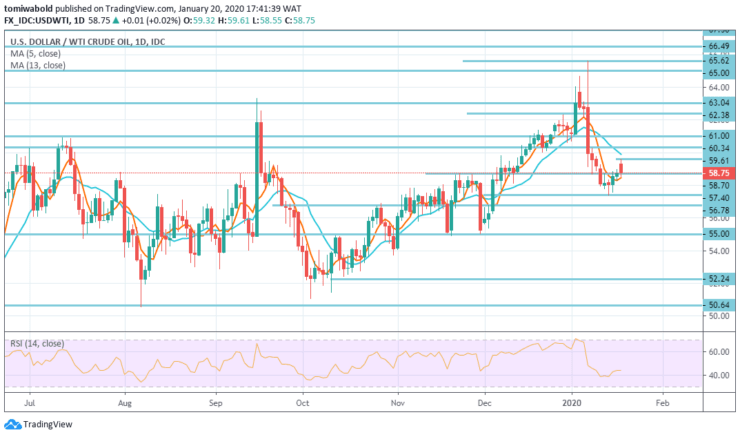

Resistance Levels: $ 63.04, $ 60.34, $ 58.70

Support Levels: $ 57.40, $ 56.78, $ 55.00

USDWTI Long term Trend: Ranging

The price returned beneath the initial barrier at $ 58.70 around the horizontal support zone under the moving average of 5 and 13, with daily exit beneath to generate a negative signal and retest the lower horizontal support zone at $ 57.40, which has the recent strong pullback from a new multi-month high on the level at $ 65.62.

The daily technical analysis remained mixed, while the momentum is in negative territory, RSI remains flat, and moving averages record a mixed setting in which there is no clearer direction signal.

USDWTI Short term Trend: Bearish

On the 4-hour time frame at the moment, the barrel of WTI is losing at $58.62 and faces the initial hurdle on the level at $59.61 seconded by the level at $60.34 and finally $65.62 (2020 high Jan.8).

On the other hand, a break beneath the level at $57.40 near term horizontal support zone would aim for $56.78.

On a 4-hour time frame, the WTI barrel is currently losing on the level at $ 58.62, while it’s facing an initial hurdle of $ 59.61 level, accompanied by a level of $ 60.34 and finally, $ 65.62 (January high 2020).

On the other hand, a break beneath the $ 57.40 in the immediate horizontal support zone could lead to $ 56.78.

Instrument: USDWTI

Order: Buy

Entry price: $ 58.00

Stop: $ 57.40

Target: $ 61.00

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.