USDWTI Price Analysis – February 3

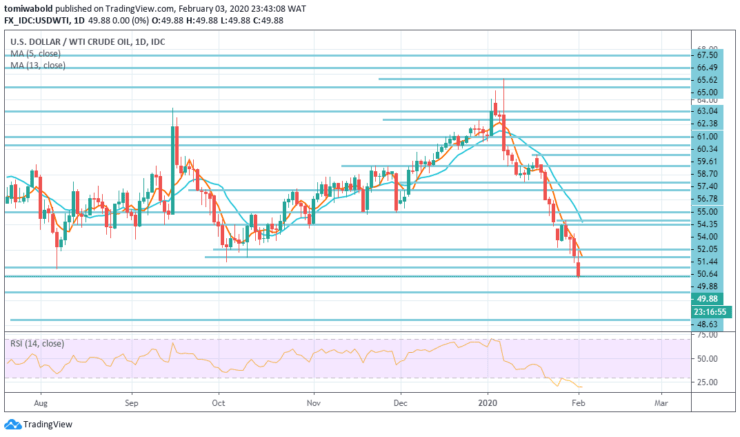

West Texas Intermediate barrel (WTI) lost nearly 16% in January and extened its decline on the first trading day in February as markets continue to price the impact of the Corona Virus outbreak on global oil demand with its lowest level since January 2019 at $ 49.88 in the last hour.

Key Levels

Resistance Levels: $ 63.04, $ 58.70, $ 54.00

Support Levels: $ 52.05, $ 51.44, $ 50.64

USDWTI Long term Trend: Bearish

During the past twelve months, the $ 50.00-51.00 corridor has provided support with prices, and with the RSI deeply in the oversold zone as of writing, the oversold bounce back from these levels cannot be excluded.

Meanwhile, if WTI exits beneath the $ 50.00 level, then the next logical level of support would be the closest horizontal support area that might rise near the $ 47.50 level.

USDWTI Short term Trend: Bearish

Crude oil prices are still under pressure, forcing West Texas Intermediate crude to extend the recent collapse of the $ 50.00 level a barrel mark.

Given that the momentum has decreased continuously, the oil may find it difficult to continue the currency devaluation as the $ 50.00 level price area has been breached. The next potential support area ranges from $ 47.57 level to approximately $ 46.45 level, which consists of a lower horizontal correction zone.

Instrument: USDWTI

Order: Sell

Entry price: $ 51.44

Stop: $ 52.05

Target: $ 47.57

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.