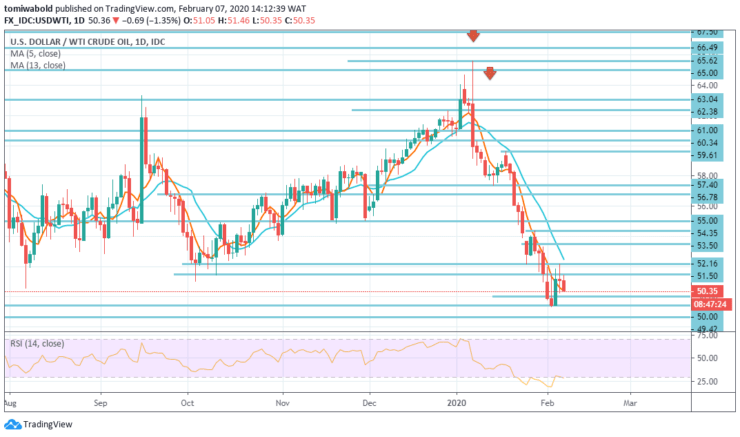

USDWTI Price Analysis – February 7

WTI is expanding its rally after recovering from a 13-month low of $ 49.42 to its second consecutive day on Friday, while buyers are cautious amid widespread risk aversion caused by the growing fear of Chinese coronavirus internationally. The price of a barrel of WTI seems to have cut a temporary base beneath $ 51.50.

Key Levels

Resistance Levels: $ 59.61, $ 55.00, $ 52.16

Support Levels: $ 50.00, $ 49.42, $ 47.57

USDWTI Long term Trend: Bearish

WTI was marked by volatile trading on Thursday, and this could continue on Friday, with close barriers to resistance and support. The level of $ 51.50 remains relevant and is a direct zone of resistance.

This is followed by resistance levels of $ 52.16 and $ 53.50. On the other hand, there is pressure on support at $ 50.00. Beneath there we find support at $ 49.42, which has been held since January 2019.

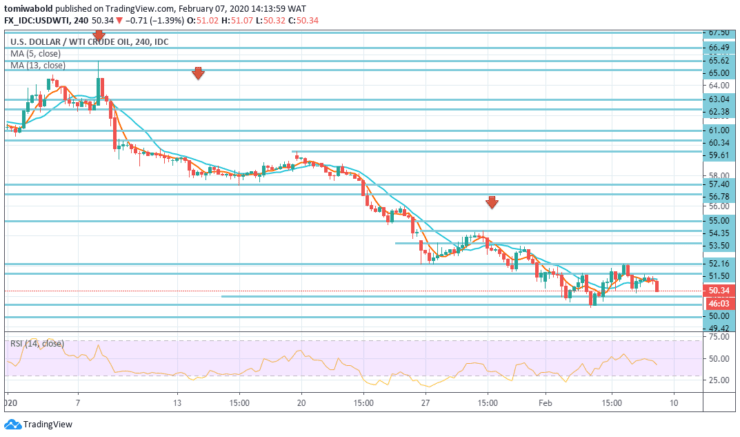

USDWTI Short term Trend: Bearish

WTI barrel price seems to have reached a short-term base of $ 49.42, however, the recovery has stalled at $ 52.16, while the decline in open interest and volume, coupled with an inconclusive price movement, open the door for some consolidating sentiment in the short term, at least.

Barrel of West Texas Intermediate (WTI) plummets amid these sentiments and last traded at $ 50.38, losing 0.9% per day.

Instrument: USDWTI

Order: Sell

Entry price: $ 51.50

Stop: $ 52.16

Target: $ 49.42

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.