The research hub stated that monetary and fiscal relief being injected into the global economy has now exceeded $10 trillion. Such huge sums of newly minted cash will likely induce global inflation, giving Bitcoin a suitable environment to thrive thanks to its deflationary policy.

Although it may take a while for Bitcoin to get fully indoctrinated into the global financial system, it is already outperforming many of the stronghold fiat currencies across the globe. For example, Bitcoin is up against the Russian ruble by more than 44% year-to-date (YTD). The benchmark cryptocurrency is up against the US dollar by more than 20% YTD, and up against the Brazilian real by more than 74%.

Furthermore, on-chain metrics also revealed in a recent post that the demand for Bitcoin is on a steep rise. Delphi revealed that the amount of BTC held by smaller wallets (<10BTC) was rising exponentially. This is believed to be indicative of “continued new user growth.”

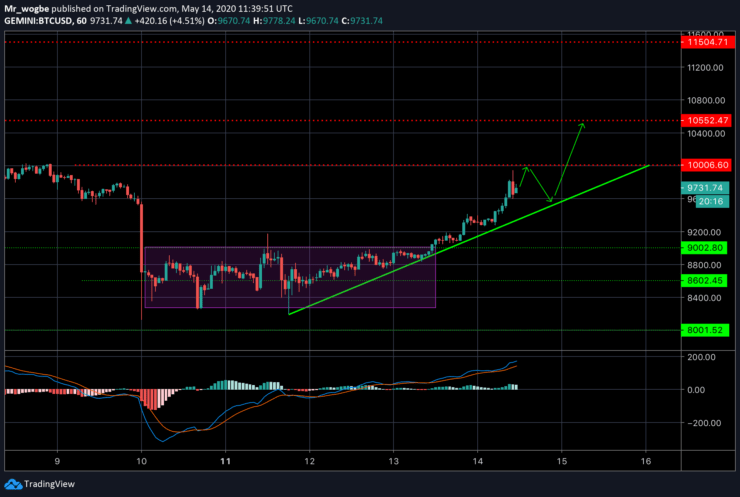

Bitcoin (BTC) Value Forecast — May 14

BTC/USD Major Bias: Bullish

Supply Levels: $10,000, $10,550, and $11,500

Demand Levels: $9,000, $8,600, and $8,000

Bitcoin, in an unprecedented move, has broken out of its consolidating region and key resistance levels and is now headed for the $10,000 level—once again. Given the momentum Bitcoin is on, it could very likely continue on this trajectory and take the $10,550 resistance and higher. Upwards is the path of least resistance for Bitcoin at the moment, hence its likelihood to continue on this path. Failure to take the 5-digit resistance could send Bitcoin into its previous consolidation region and even lower.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.