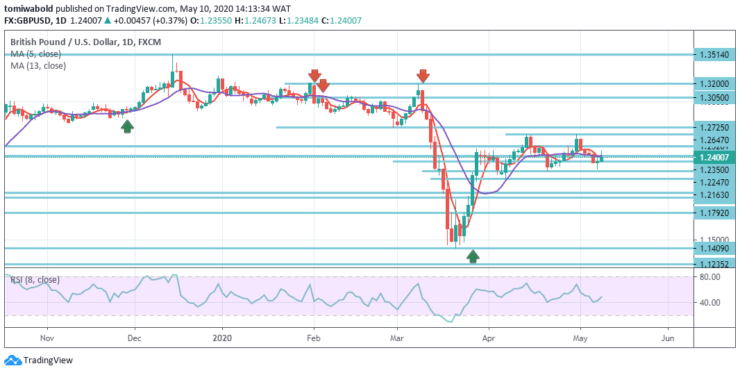

GBPUSD Price Analysis – May 10

Pound Sterling’s growth from low level 1.2266 on Thursday, May 7th may have amassed intensity with the GBPUSD stepping past level 1.2400. iThe pair tends to recover lost territory from the previous session into this week, with a reported intra-day high at 1.2467 regions backed by risk-on market sentiment and potentially fending long positions in the US dollar regardless of the UK market shutting down.

Key Levels

Resistance Levels: 1.3514, 1.3050, 1.2647

Support Levels: 1.2247, 1.1792, 1.1409

GBPUSD Long term Trend: Ranging

From a longer-term viewpoint, the pair is still moving horizontally around 1.2247 and 1.2647 levels, although in the new week and beyond its likely to stay in that region. The Wednesday (06 May) breach of the ‘solid support’ level at 1.2350 implies that the 1.2647 high-level last week may be a near-term peak.

All that said, the downward trend is sluggish and a prolonged downturn is too early to conclude. From here GBP is somewhat more inclined to stabilize over a while and trade around 1.2247 and 1.2520 levels.

GBPUSD Short term Trend: Ranging

Last week, GBPUSD lingered in the 1.2247/2647 level range and the trend remains intact. First this week the initial bias stays neutral. On the contrary, a continuous breach of 1.2247 level may imply the conclusion of an entire 1.1409 level recovery.

Intraday bias may head back to the downside to retest that low. On the upside, the 1.2647 level breach may accelerate the recovery from 1.1409 to the next level of 1.3200 resistance.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.