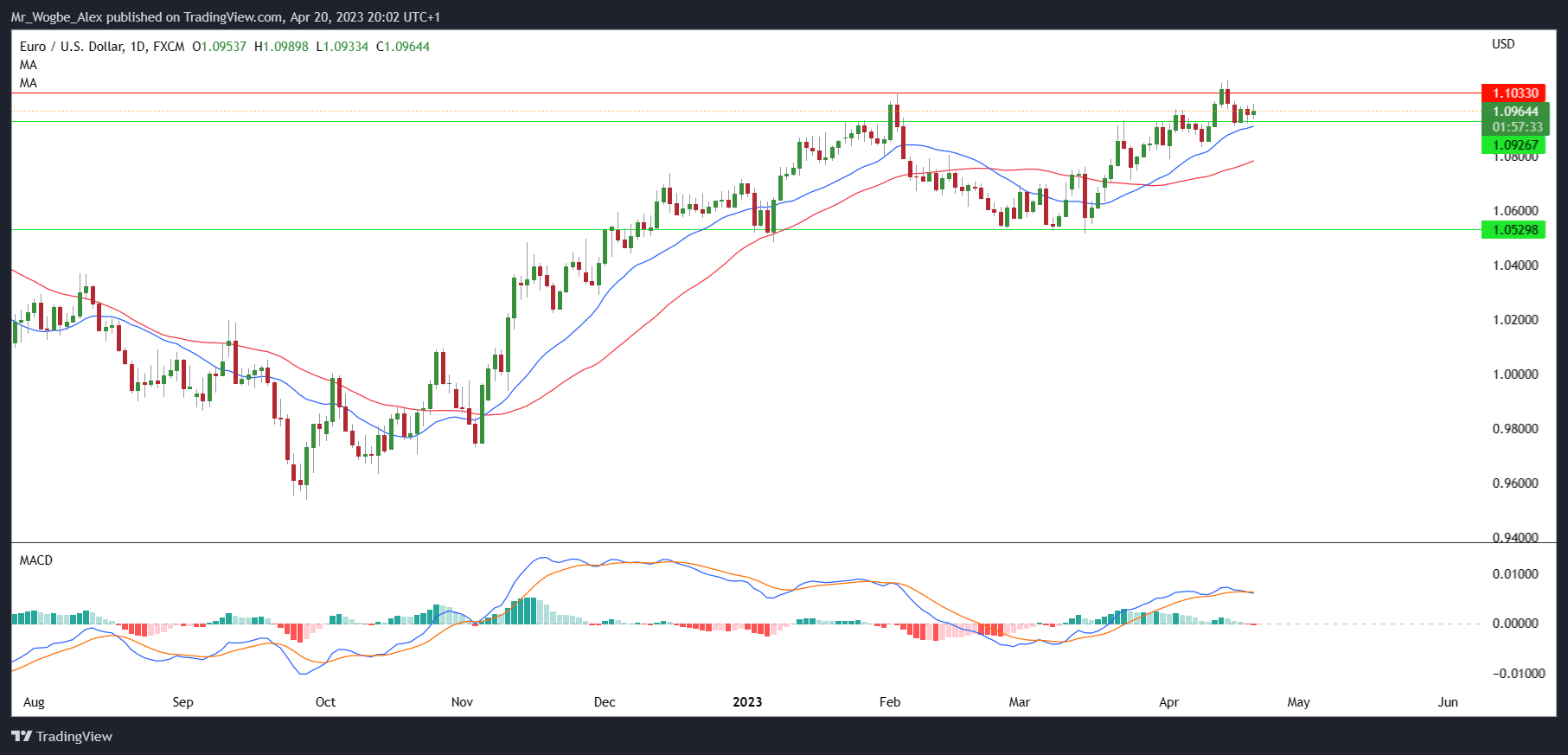

It’s a tale as old as time: the euro and the U.S. dollar (EUR/USD) battling it out for currency supremacy. And in recent days, it seems the euro has gained the upper hand, as the pair rebounded on Thursday after a subdued performance in the previous session. While gains were limited, the euro managed to outpace the U.S. dollar, going up about 0.15% to 1.0970.

U.S. Economic Reports: Cause for Concern?

The U.S. economy has been under the microscope in recent weeks, with economic reports indicating potential concerns. On Thursday, data released by the U.S. Labor Department showed that the number of Americans filing for unemployment insurance rose to 245,000 in the week ended April 15, versus the 240,000 forecasts. Recurring jobless claims also reached 1.87 million, the highest level since November 2021. This development suggests that people are struggling to find new work quickly due to the slowdown in hiring.

To add insult to injury, March’s existing home sales also fell short of expectations, clocking in at 4.44 million, compared to an estimate of 4.5 million. Taken together, these reports suggest that the U.S. economy is buckling under the weight of the Fed’s aggressive hiking cycle and could be heading toward a recession.

ECB’s Hawkish Commentary: The Euro’s Savior?

But all is not lost for the euro—the European Central Bank’s (ECB) hawkish commentary has given it some much-needed support. ECB President Christine Lagarde indicated that the Governing Council “still has a bit of way to go” to return inflation to the 2.0% target. This, along with remarks from other officials in recent days, suggests that the central bank will continue raising borrowing costs at upcoming meetings.

What’s Next for EUR/USD?

The EUR/USD has been trading in a tight range, but with the U.S. economic reports indicating potential concerns, the euro has gained support. The ECB’s hawkish commentary has also added to the bullish outlook. The market will be watching closely for further developments in the U.S. economy and the ECB’s upcoming policy meetings. In the meantime, traders will continue to speculate on which currency will come out on top in the ongoing battle of the currencies.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.