Decentralized exchanges, or DEXs, have emerged as a game-changing force in the world of cryptocurrencies. These innovative trading platforms are built on blockchain technology and operate without the need for central authorities or intermediaries.

In this deep dive, we’ll explore the inner workings of decentralized exchanges, their rapid growth, and the key projects shaping the future of decentralized trading.

What Are Decentralized Exchanges?

Think of DEXs as automated market makers (AMMs). Unlike centralized exchanges (CEXs) that rely on order books, AMMs use smart contracts and liquidity pools to facilitate trades. Liquidity providers (LPs) contribute their tokens to these pools, earning trading fees in return.

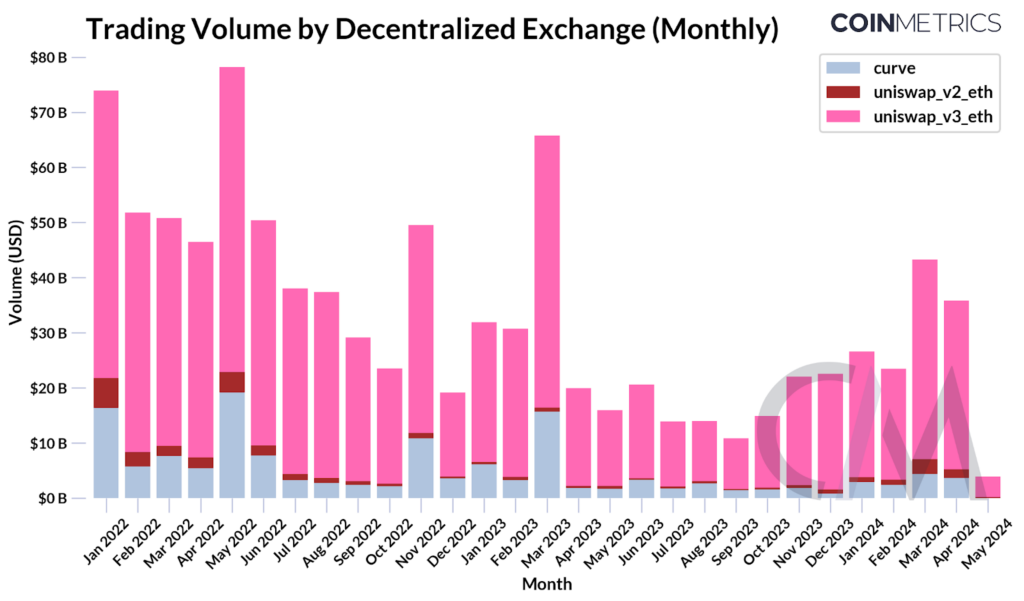

Uniswap, the largest DEX on Ethereum, has seen tremendous growth since its launch in 2018. In the first quarter of 2024 alone, Uniswap processed a staggering $84 billion in trading volume, up from $54 billion in the previous quarter, according to Coin Metrics’ latest State of the Network report.

One of the key advantages of decentralized exchanges is their permissionless and non-custodial nature. Users maintain full control over their funds, trading directly from their own crypto wallets. This eliminates the need for trust in a central entity and reduces the risk of hacks or unauthorized access to user funds.

Top Decentralized Exchanges on the Market

Uniswap’s success can be attributed to its constant evolution and innovative features. With the introduction of Uniswap v2 in 2020, the platform enabled the creation of liquidity pools for any ERC-20 token pair.

This permissionless token listing process has made Uniswap a hub for a wide range of trading pairs, from established tokens to emerging DeFi projects.

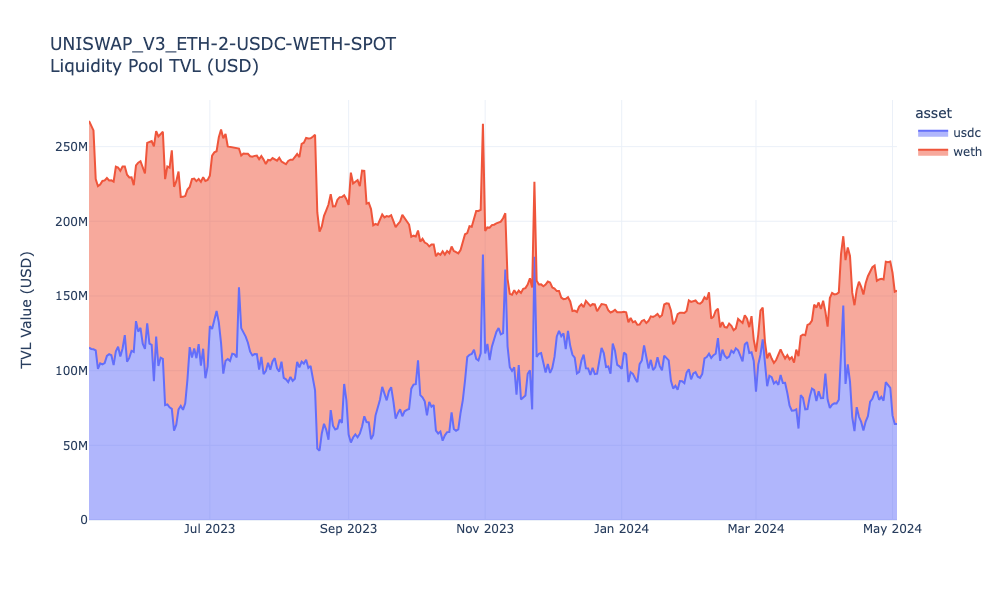

Uniswap v3, launched in 2021, introduced a groundbreaking feature called concentrated liquidity. This allows LPs to allocate their capital within specific price ranges, dramatically increasing capital efficiency.

For example, the USDC/WETH pool on Uniswap v3, with a fee tier of 0.05%, has become one of the most liquid and actively traded pairs due to its low transaction costs and the popularity of both assets.

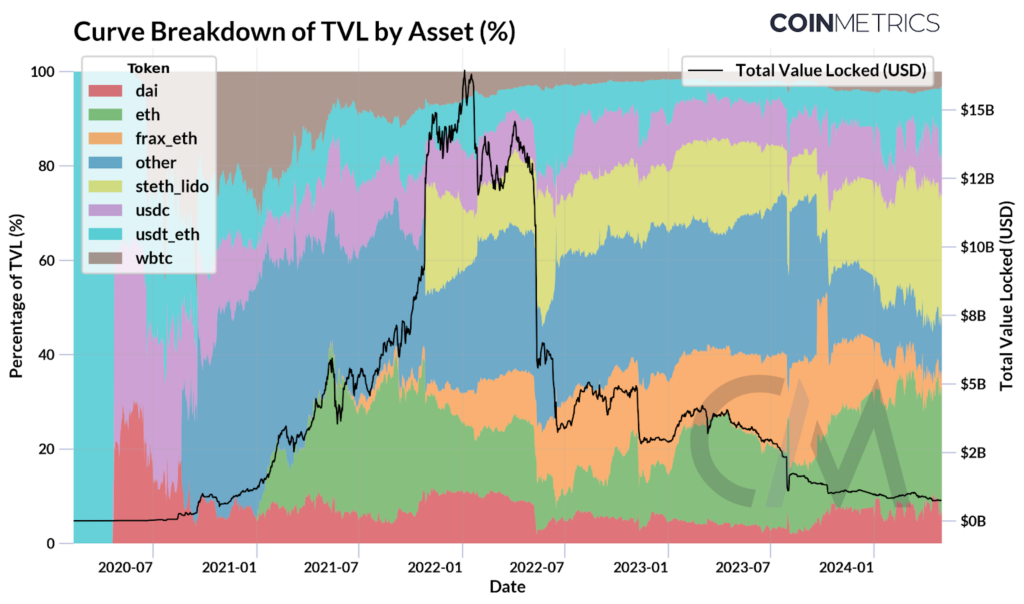

Another notable DEX is Curve Finance, which focuses on efficient stablecoin swaps and minimizes slippage. By utilizing a unique AMM model called StableSwap, Curve has become the go-to platform for trading stablecoins and other pegged assets like wrapped tokens and liquid staking derivatives.

The total value locked (TVL) in Curve peaked at over $15 billion in 2021 before experiencing a decline due to market conditions and the USDC depegging event in March 2023.

Despite the challenges, Curve has adapted and expanded its offerings. The platform now supports a wide range of stablecoins, including USDC, USDT, DAI, and newer entrants like PayPal’s PYUSD and Frax Finance’s FRAX.

Additionally, Curve has introduced support for swapping volatile assets, offering varying fee tiers and dynamic parameters to cater to different risk profiles.

The Future of DEXs

The DEX landscape continues to evolve, with projects exploring new AMM models, liquidity optimization techniques, and cross-chain interoperability.

Uniswap v4, set to launch in the near future, promises a “singleton” architecture that will significantly reduce gas costs and introduce customizable pool functionalities through “hooks.” This will enable developers to build advanced features like limit orders, MEV protection, and custom trading logic for tokenized real-world assets.

As Ethereum scales with more upgrades and layer 2 solutions mature, decentralized exchanges are poised for even greater adoption. Lower transaction costs and faster settlement times will make DEXs more accessible to a broader user base, driving liquidity and trading volumes to new heights.

Wrap Up

Decentralized exchanges have come a long way since their inception, revolutionizing the way we trade and interact with digital assets.

With a combined trading volume of over $120 billion in Q1 2024 across major decentralized exchanges like Uniswap and Curve, it’s clear that they are here to stay.

As the DeFi ecosystem continues to mature and innovate, projects on decentralized exchanges will play a pivotal role in shaping the future of finance, offering users unparalleled access, control, and opportunities in the world of crypto trading.

Want reliable crypto signals to capitalize on market swings? Join us on Telegram.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.