As we head into the final full trading week of December, the forex market is showing signs of fatigue after extended directional moves. Many currency pairs have pushed into key resistance areas, slowing momentum and compressing volatility. In this environment, clear structural cues and technical triggers will matter most.

Across the watchlist, EURNZD remains constructive, holding above major support even amid consolidation. Meanwhile, AUDNZD, EURGBP, and AUDCAD are showing early signs of slowing uptrends or potential reversal pressure. NZDCHF continues to reflect a dominant bearish structure, underscored by persistent Swiss Franc strength.

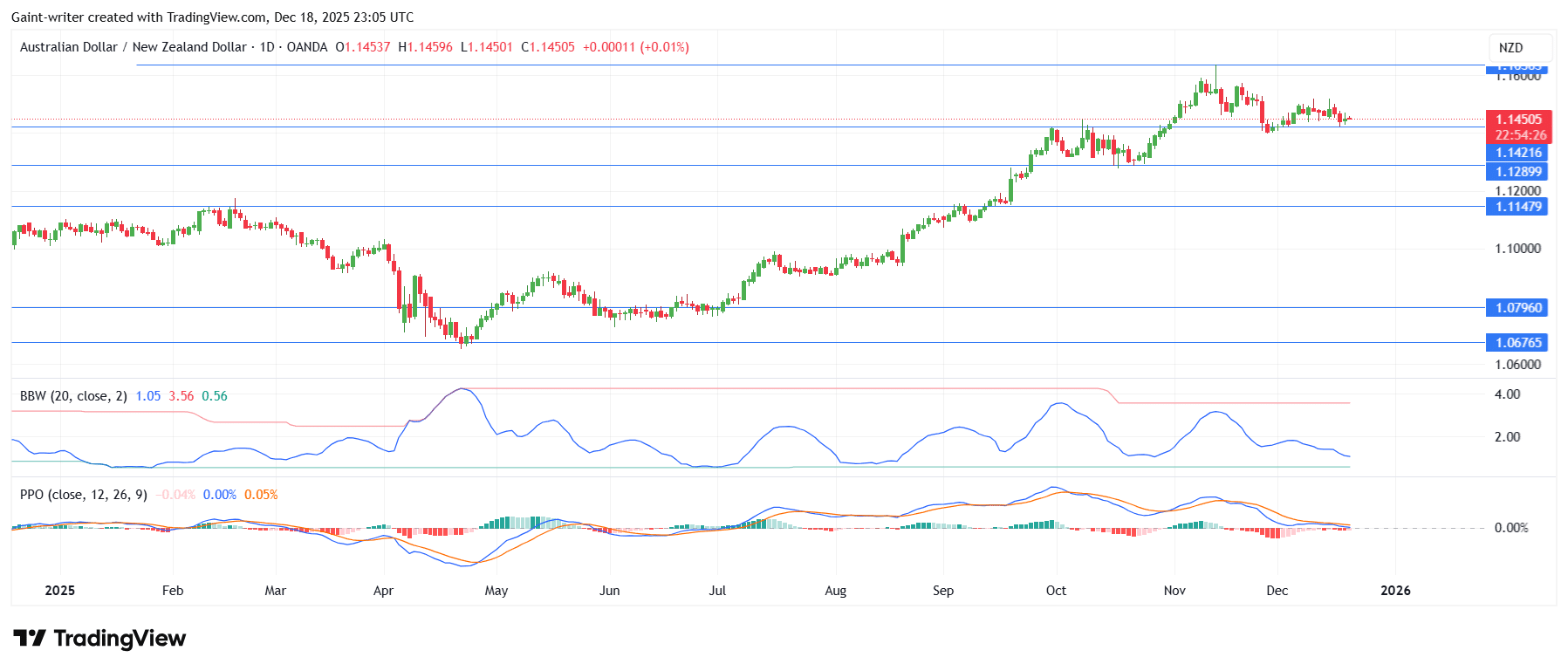

AUDNZD Outlook

AUDNZD’s strong advance through much of 2025 has stalled just below the key 1.1600 level. The pair is now trading around 1.1450, where upside momentum appears to have dissipated.

Momentum indicators are signaling a shift in tone. The PPO has crossed down, and histogram readings are negative, pointing to growing downside pressure. At the same time, Bollinger Band Width is narrowing, signaling a period of low volatility that often precedes a breakout.

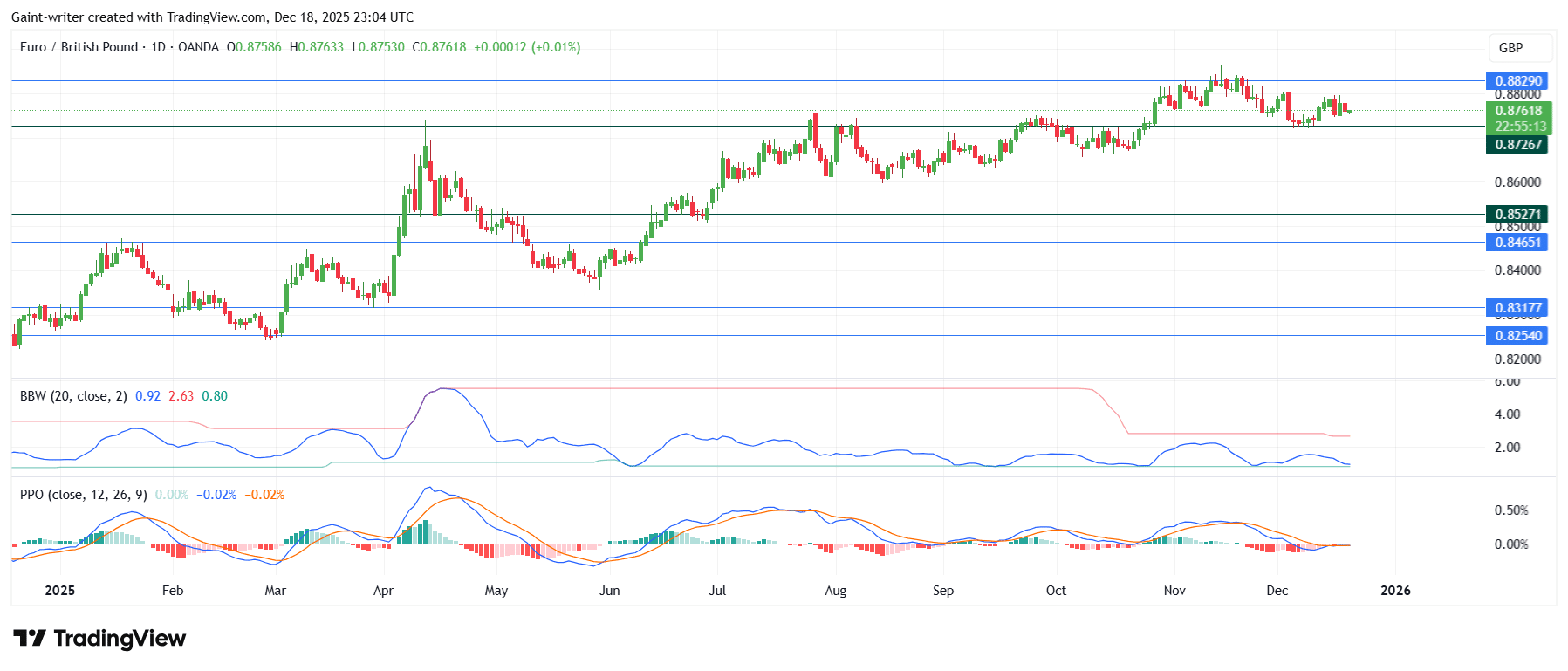

EURGBP

EURGBP continues to struggle beneath the 0.8820 resistance ceiling after a sustained climb over the past several months. Price action is now printing lower daily closes around 0.8760, suggesting that the bullish push has lost steam.

The PPO has flattened and begun to turn lower, showing that buying interest has waned and sellers are reasserting control. If price breaks and holds below the 0.8720 support area, it would affirm a tactical shift toward the downside, with the 0.8520 region in view as the next area of significant interest.

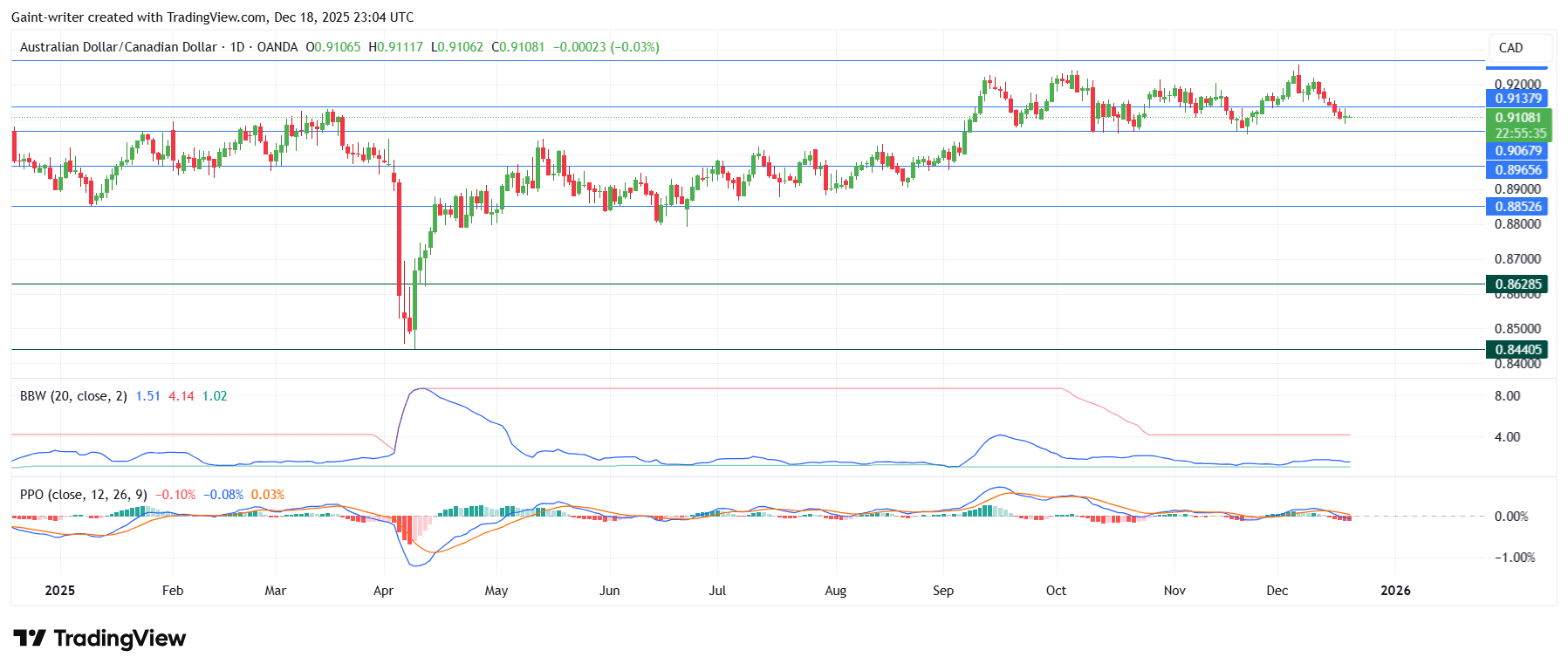

AUDCAD

AUDCAD is struggling to break above the 0.9130–0.9200 supply zone after multiple attempts. Price is currently trading near 0.9100, where recent action suggests the development of a potential reversal formation on the daily chart.

With the PPO trending lower and positioned below zero, the immediate bias remains to the downside. A breach of the 0.9060 support level would reinforce bearish conviction and could lead to a retest of 0.8960.

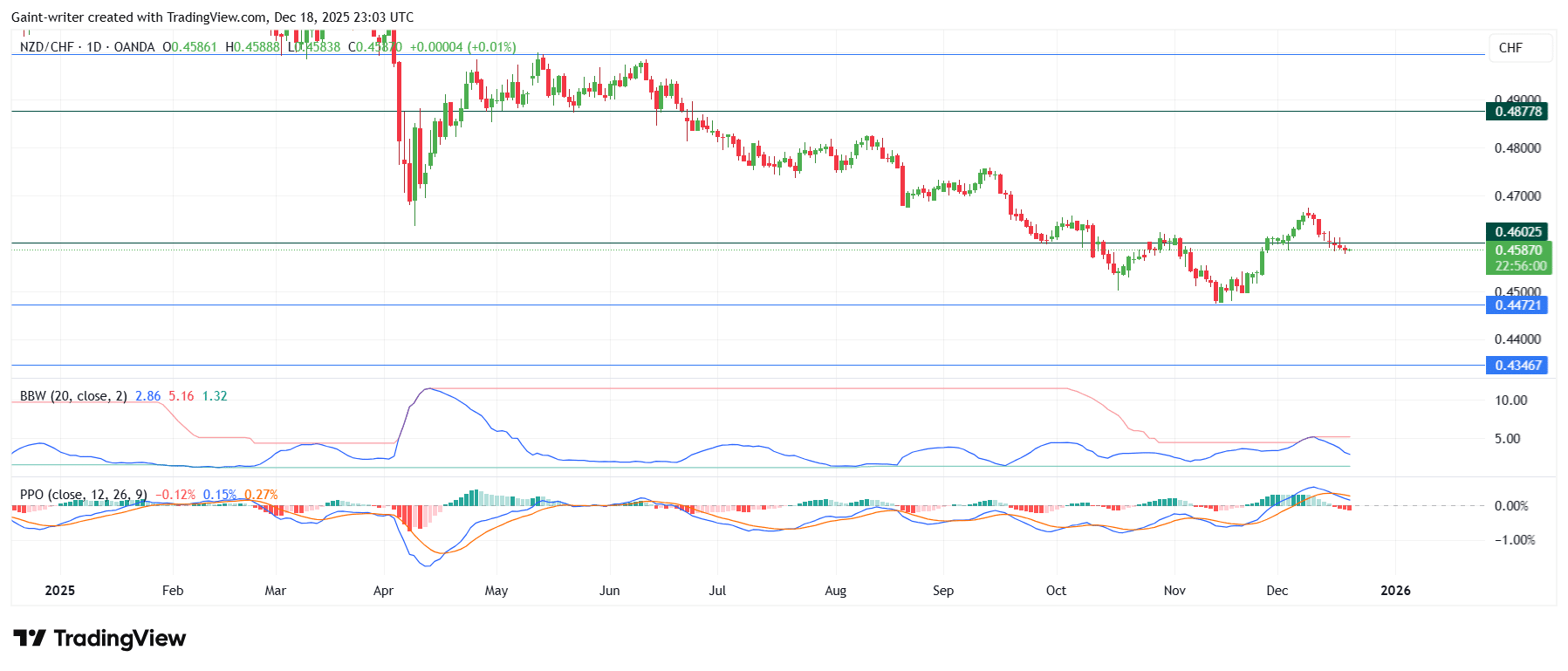

NZDCHF

NZDCHF has remained in a dominant downtrend, recently rejecting resistance near 0.4600 once again. A brief bounce from the 0.4470 yearly lows failed to produce higher highs, keeping the structural picture bearish.

The PPO shows bearish convergence, and price continues to drift lower, reinforcing the trend. Unless NZDCHF can clear and hold above 0.4600, the downtrend remains intact, with 0.4472 as the primary downside target.

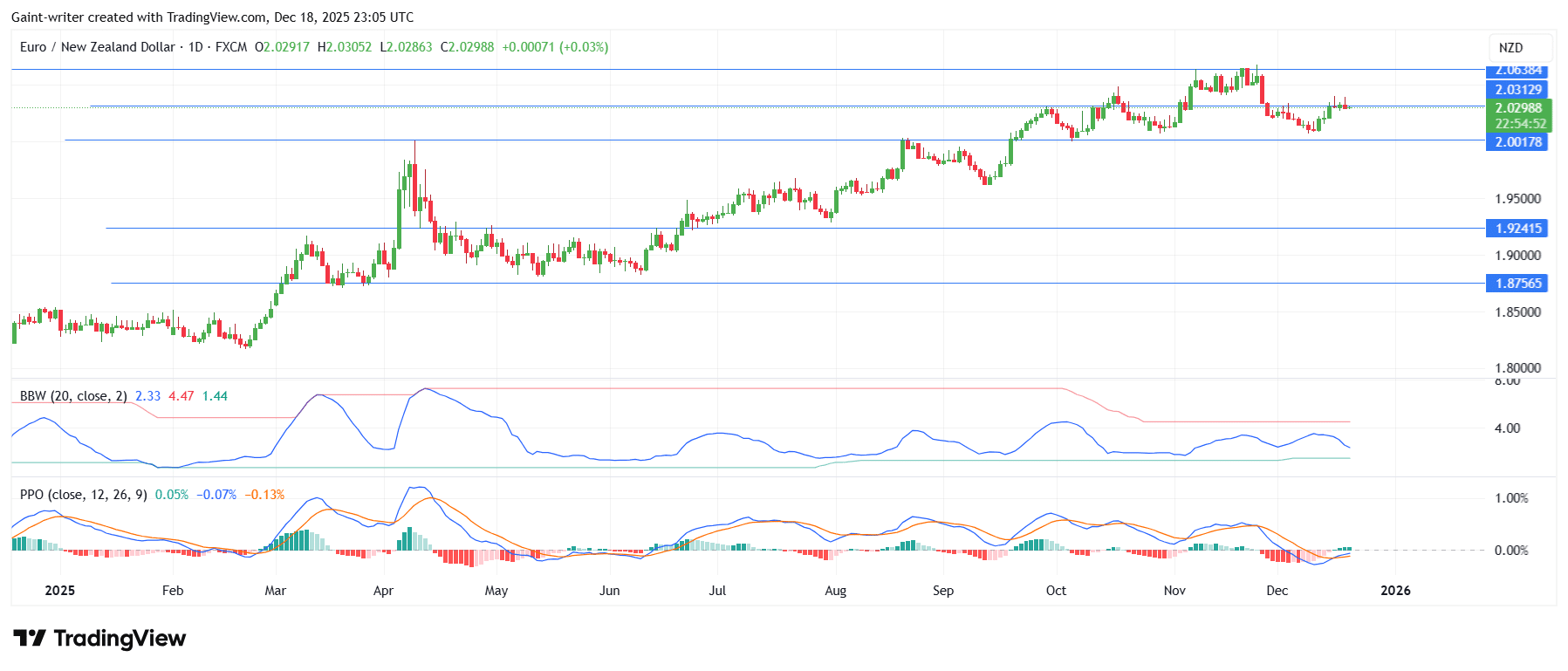

EURNZD

EURNZD remains the standout in this group, maintaining a strong bullish structure even as it consolidates near recent highs around 2.0300. Price action continues to respect the 2.0010 support level, reinforcing a base of higher lows.

The PPO remains positive, though showing signs of cooling, which reflects measured consolidation rather than exhaustion. A clean breakout above 2.0310 could extend the advance toward 2.0630. On deeper pullbacks, the 2.0000 area is expected to provide significant buying interest, keeping the broader bullish bias intact, a setup closely monitored alongside broader market themes such as forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.