Market Analysis – February 6

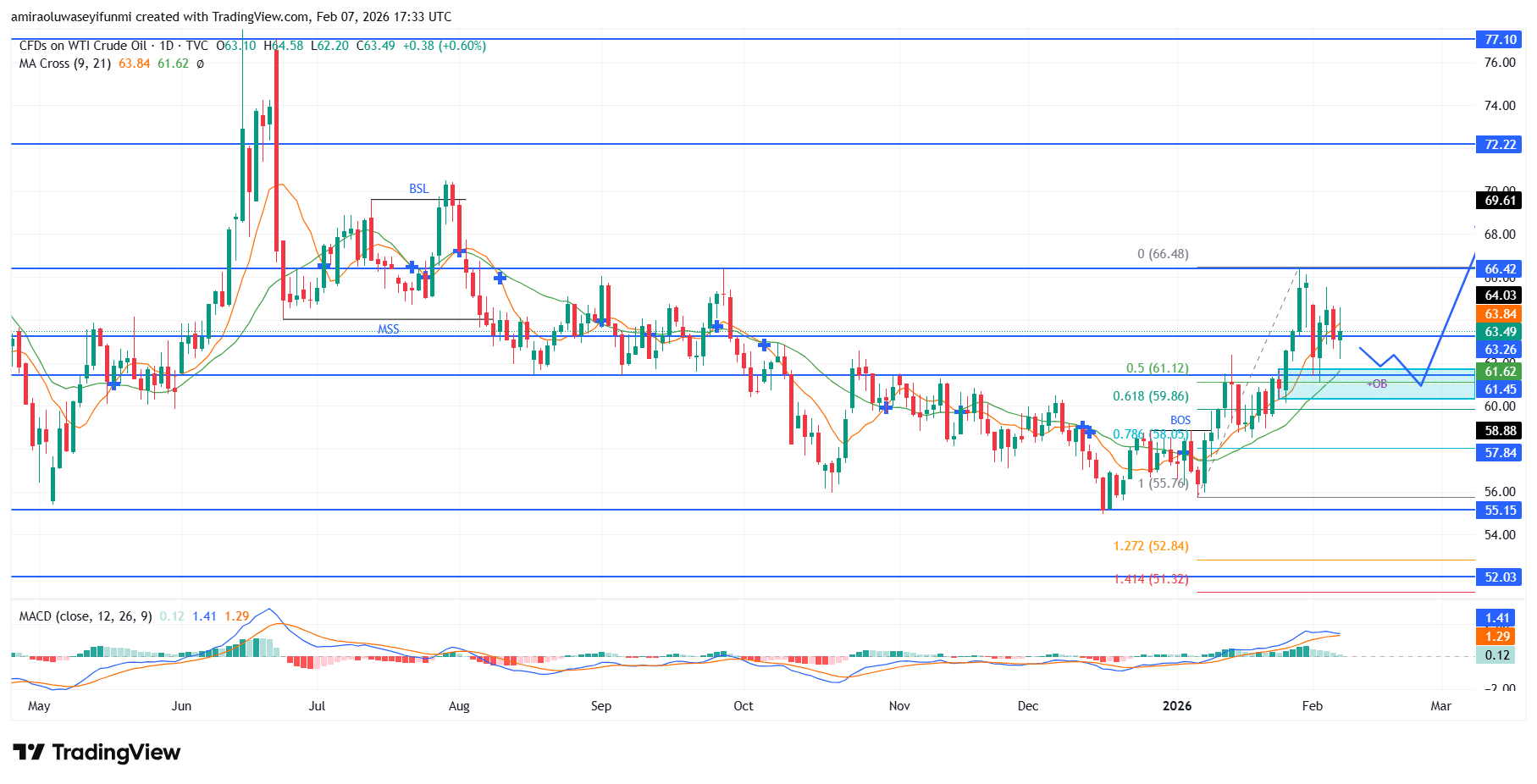

USOil tilts upward as latent bid strength reasserts. USOil is exhibiting an ascending bias, with overall price behavior aligning positively with both trend-following and momentum indicators. Market activity is now firmly positioned above its short- and intermediate-term moving averages, signaling strengthening directional support and a gradual reduction in sell-side pressure. The moving-average crossover maintains a positive slope, while the MACD remains firmly above equilibrium and its signal line, pointing to expanding upside momentum rather than a temporary technical rebound. Collectively, this configuration suggests a transition from recovery into the early stages of trend continuation.

USOil Key Levels

Resistance Levels: $66.420, $72.220, $77.100

Support Levels: $57.840, $55.150, $52.030

USOil Long-Term Trend: Bullish

From a technical standpoint, price has respected a consistent sequence of higher lows after defending demand within the $55.150–$57.840 region, confirming the establishment of a structural base. The bullish break of structure near $58.880, followed by a controlled retracement into the $61.450–$61.620 area, reflects orderly reaccumulation rather than distribution. Former resistance in the $63.260–$63.840 range has since been tested as support, reinforcing its significance as a technical pivot. The market’s ability to hold above these levels highlights improving buyer control and validates the integrity of the prevailing bullish structure.

Looking forward, USOil remains positioned for further upside provided price continues to hold above the $61.450 region. Sustained acceptance above $63.840 would likely encourage a measured advance toward the $66.420 resistance zone as the next upside objective. Beyond this level, continued bullish momentum could expose a broader recovery toward $72.220, in alignment with higher-timeframe resistance and historical supply. Short-term pullbacks are expected to remain corrective, with declines likely to attract demand in anticipation of continuation toward higher valuations, a scenario often monitored through forex signals.

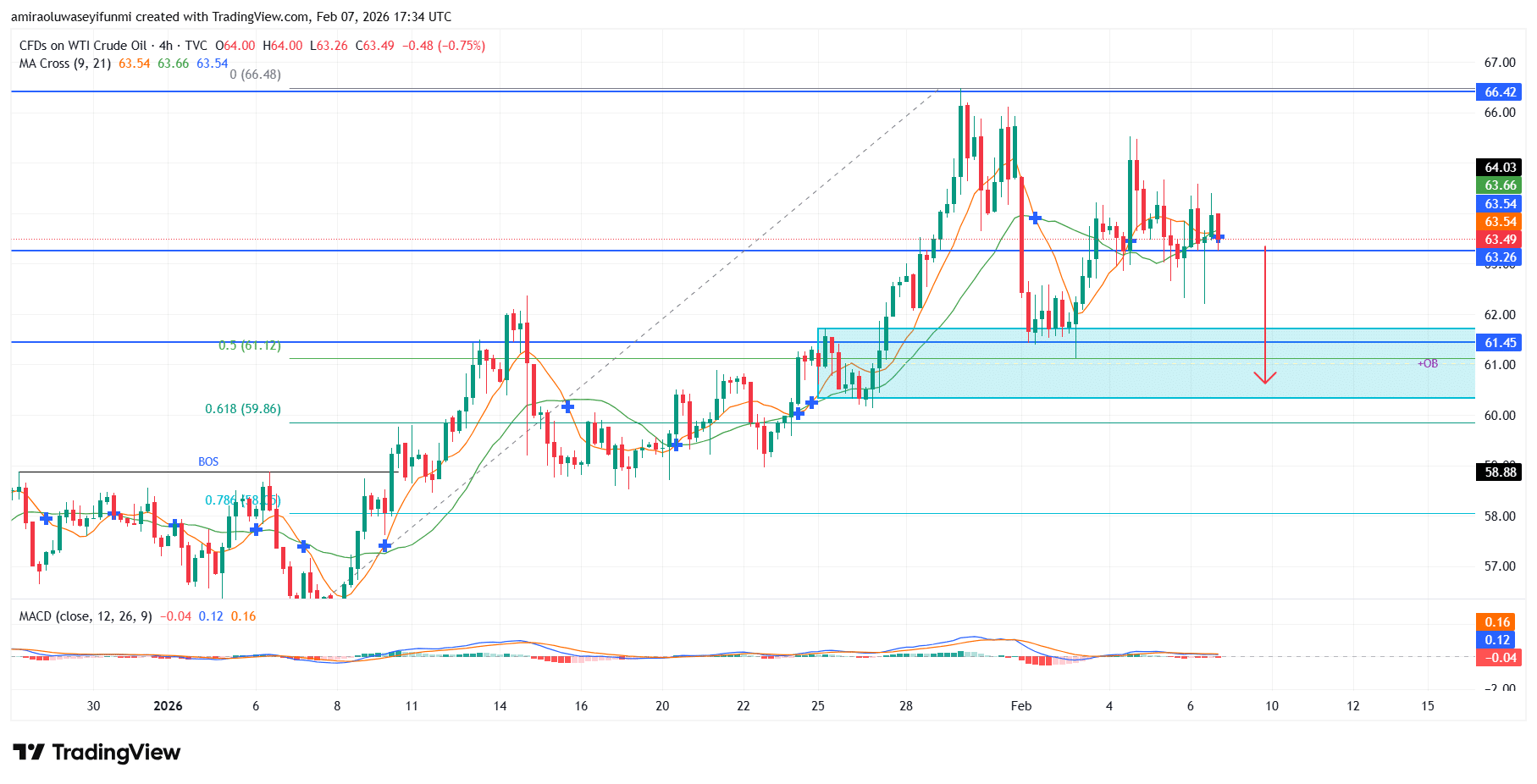

USOil Short-Term Trend: Bearish

USOil is displaying short-term bearish pressure as price consolidates below the $63.840–$64.030 resistance cluster, while momentum indicators flatten and the MACD drifts toward neutral territory. Recent price action reflects hesitation and localized supply absorption near $63.540, suggesting buyers are temporarily relinquishing near-term control despite the broader bullish context.

Technically, the inability to sustain trade above $64.000 increases the likelihood of a corrective retracement toward the $61.450 demand zone, which aligns with prior structural support and Fibonacci confluence. A deeper pullback toward $59.860 remains possible if $61.450 fails to hold, before the broader bullish trend can meaningfully reassert itself.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.