Market Analysis – October 3

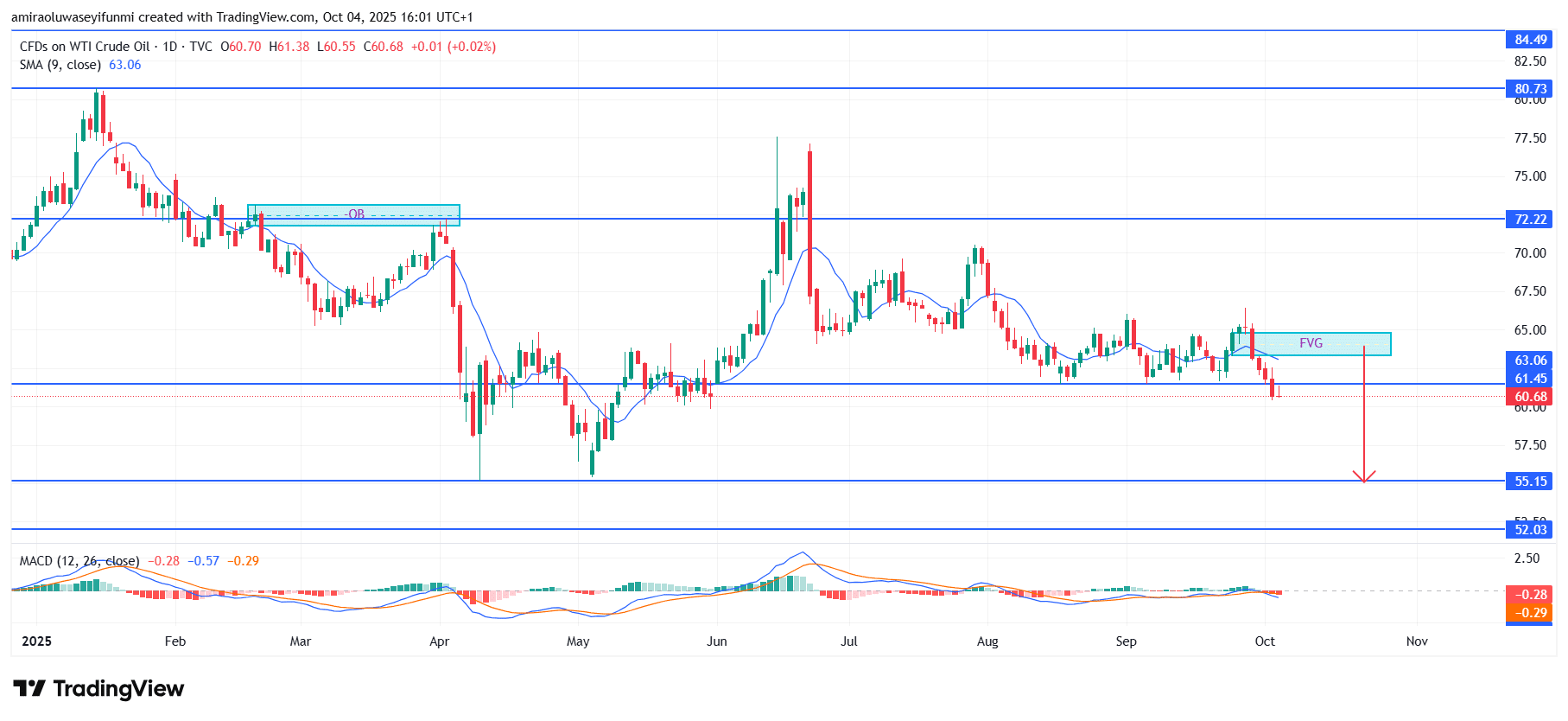

USOil sustains a downward trajectory as technical weakness intensifies. The commodity remains under significant selling pressure, with recent price action reflecting the continuation of a broader bearish cycle. Momentum indicators reinforce this weakness, as the MACD maintains a negative reading, highlighting subdued buying interest and a prevailing imbalance in favor of sellers. Price also continues to trade below the 9-day Simple Moving Average (SMA) near $63.10, underscoring persistent bearish sentiment and confirming that short-term rallies remain corrective within the dominant downtrend.

USOil Key Levels

Resistance Levels: $72.20, $80.70, $84.50

Support Levels: $61.50, $55.20, $52.00

USOil Long-Term Trend: Bearish

From a technical perspective, the market has once again failed to reclaim the Fair Value Gap (FVG) region between $63.00 and $64.50, establishing this range as a critical resistance zone. The consistent rejection from this area aligns with the broader formation of lower highs and lower lows that have characterized recent trading sessions. Additionally, the inability of price to sustain movement above $61.50 indicates structural weakness, signaling continued downside momentum and reinforcing bearish order flow across multiple timeframes.

Looking ahead, USOil appears poised to extend its decline toward the $55.20 support zone, with potential continuation to $52.00 if downward momentum strengthens. A decisive move below the $60.00 level would likely attract additional selling pressure, pushing prices even lower. Unless the market stages a firm recovery above $63.00 supported by strong trading volume, sentiment is expected to remain bearish, favoring an extended move downward over the coming sessions.

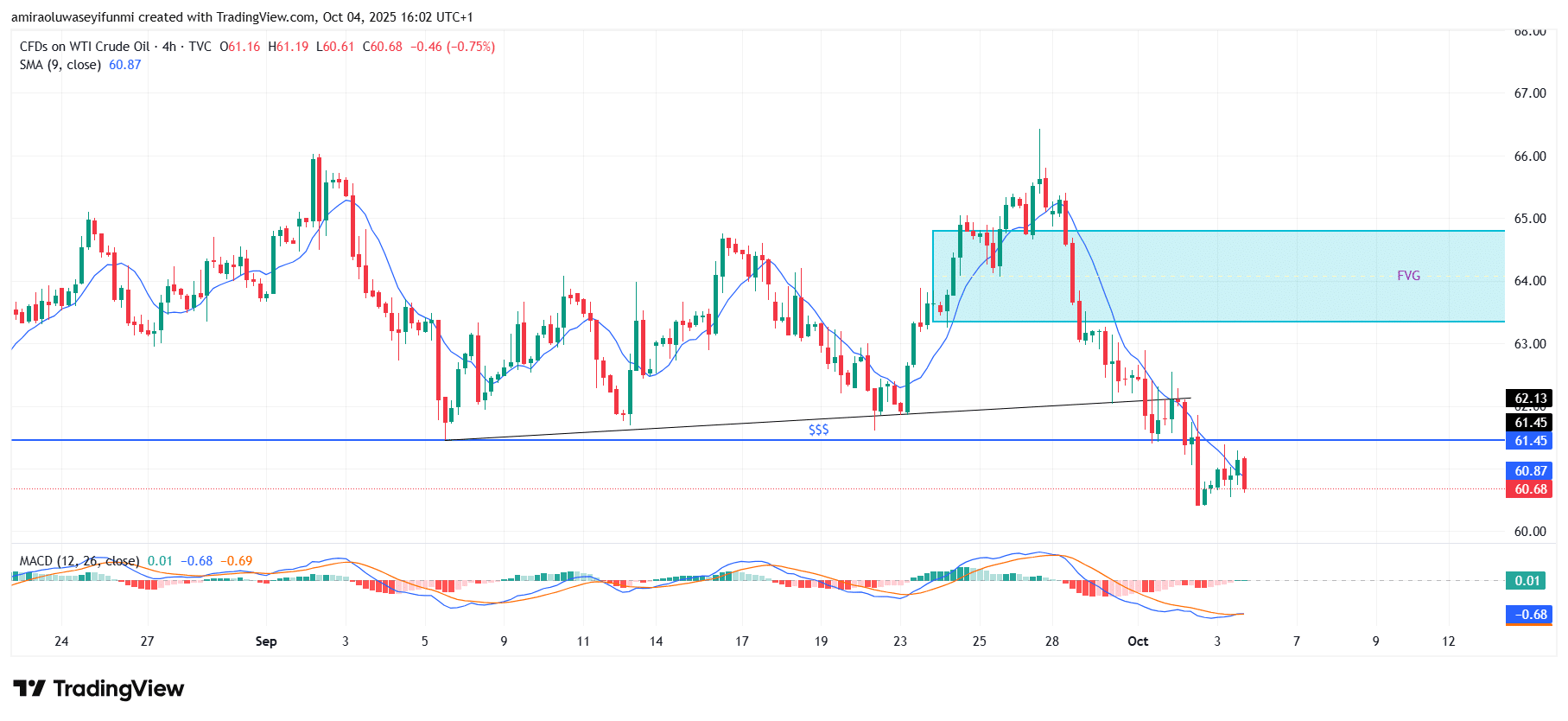

USOil Short-Term Trend: Bearish

USOil continues to exhibit bearish characteristics as price action remains below the 9-period SMA at $60.90, confirming sustained selling dominance. The MACD remains in negative territory, indicating weak buying participation and persistent downside momentum.

Price recently faced rejection around the Fair Value Gap (FVG) near $64.00, reinforcing the strength of resistance and ongoing market inefficiency. Unless price decisively reclaims the $61.50 level, further decline toward the $59.00 zone appears likely, offering traders a potential forex signals opportunity to monitor the continuation of the prevailing bearish movement.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.