Market Analysis – December 4

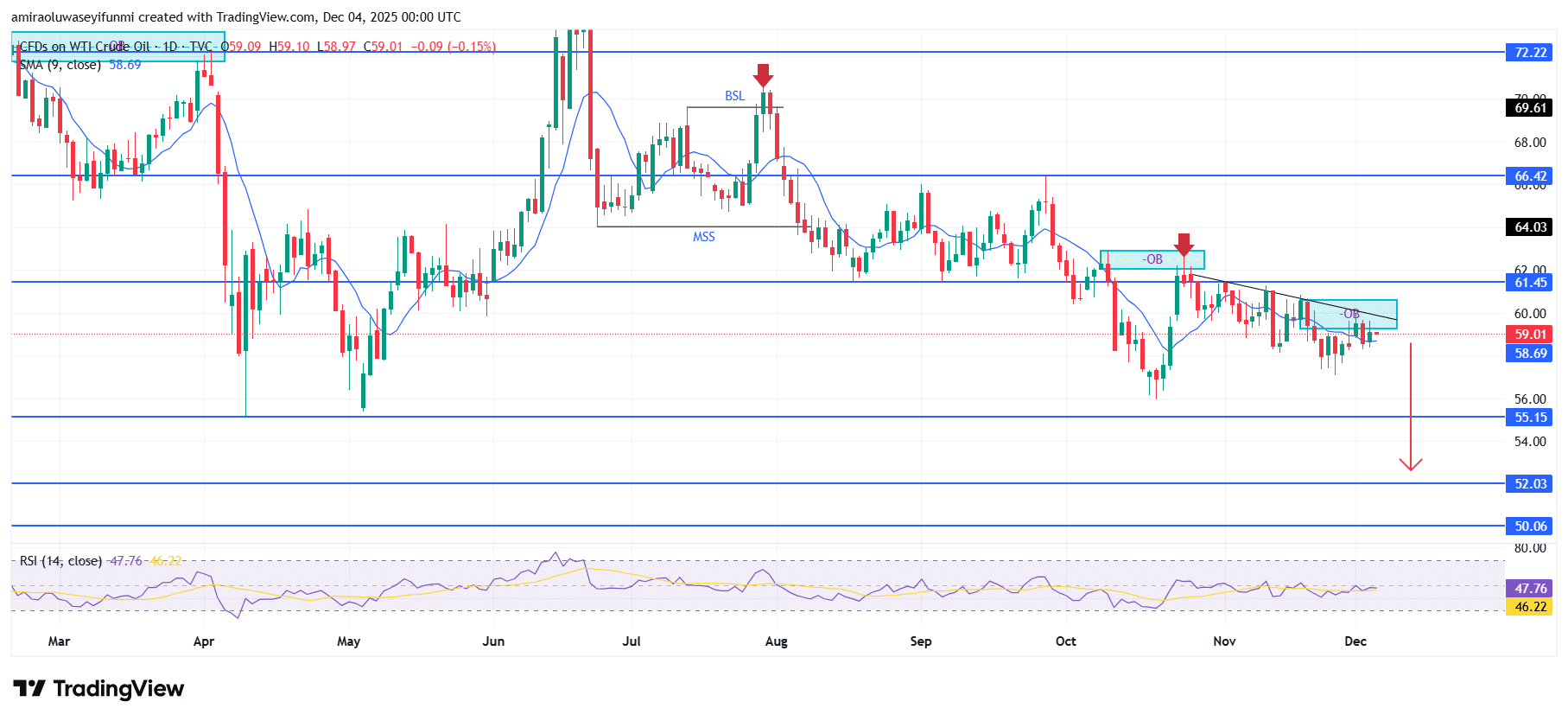

USOil signals continuing downside momentum toward lower price zones. The market maintains a broadly pressured outlook as short-term momentum stays aligned with sellers. Price action continues to hold below the 9-day SMA near $58.690, reflecting persistent downward traction and limited bullish strength. With the RSI hovering in the mid-40s, overall demand remains muted, reinforcing a market environment that favors continued weakness.

USOil Key Levels

Resistance Levels: $61.50, $66.40, $72.20

Support Levels: $55.20, $52.00, $50.10

USOil Long-Term Trend: Bearish

The broader structure has been shaped by a progression of lower highs and repeated rejections within the supply zones around $61.450 and $64.030. These regions continue to halt recovery attempts, clearly indicating where sellers overpower buyers. Consolidation beneath the descending trendline further supports the bearish outlook, as each revisit to premium areas triggers renewed selling activity.

Market expectations still point toward deeper downside movement, with liquidity targets near $55.150 and $52.030. A break below these thresholds could expose the chart to further weakness toward $50.060, where new buy-side interest may begin to form. Unless price successfully reclaims the upper resistance regions, the prevailing directional bias remains firmly bearish.

USOil Short-Term Trend: Bearish

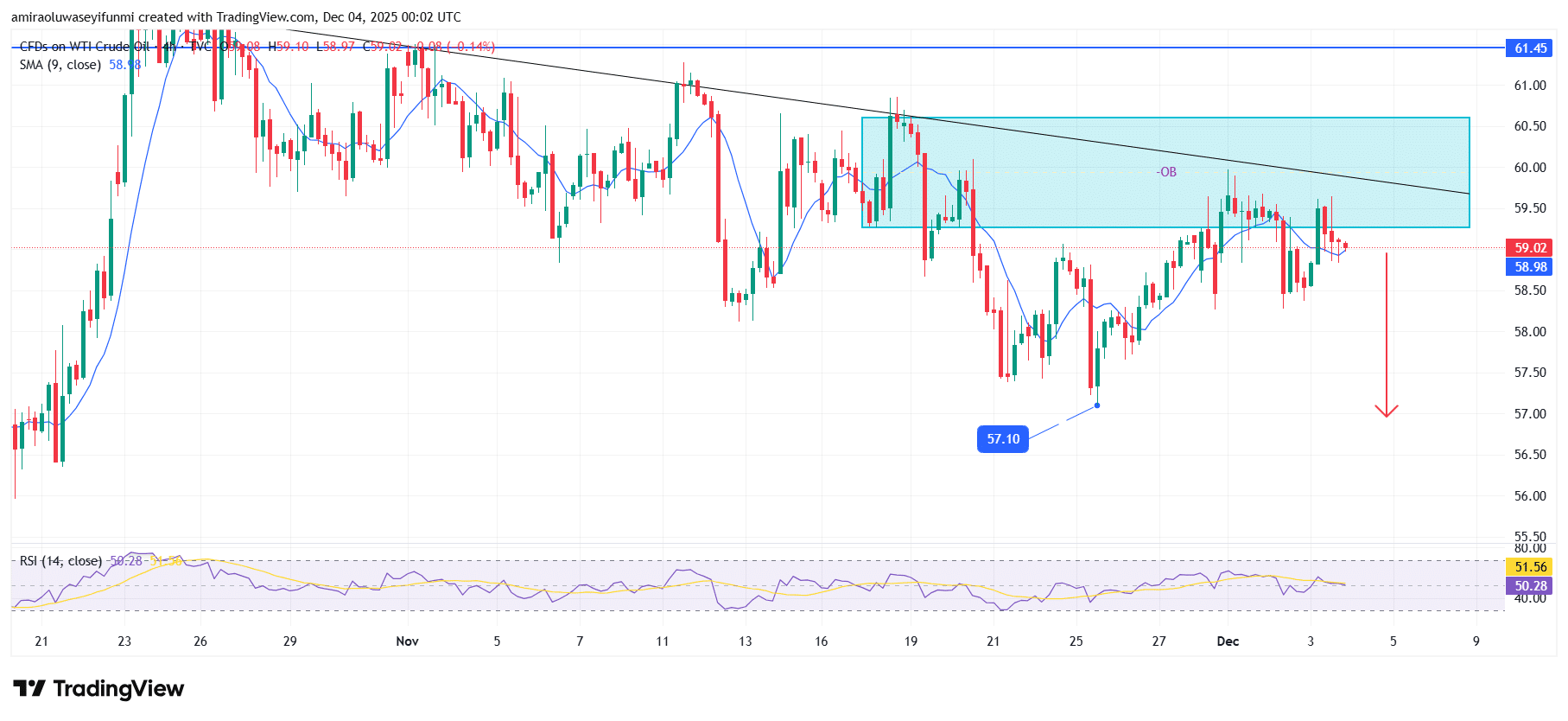

USOil continues to trade below the descending trendline and remains positioned under the 9-period SMA, maintaining its short-term bearish structure. Price has shown repeated rejection within the bearish order-block between $59.500–$60.500, signaling continued selling pressure at higher levels.

The latest lower high formation and inability to break above $61.450 confirm that sellers are still in control of market direction. With momentum indicators weakening further, price appears increasingly likely to retest $57.100 as downside liquidity opens up. This environment may provide traders with clearer directional context, especially for those navigating the market using forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.