Market Analysis – January 23

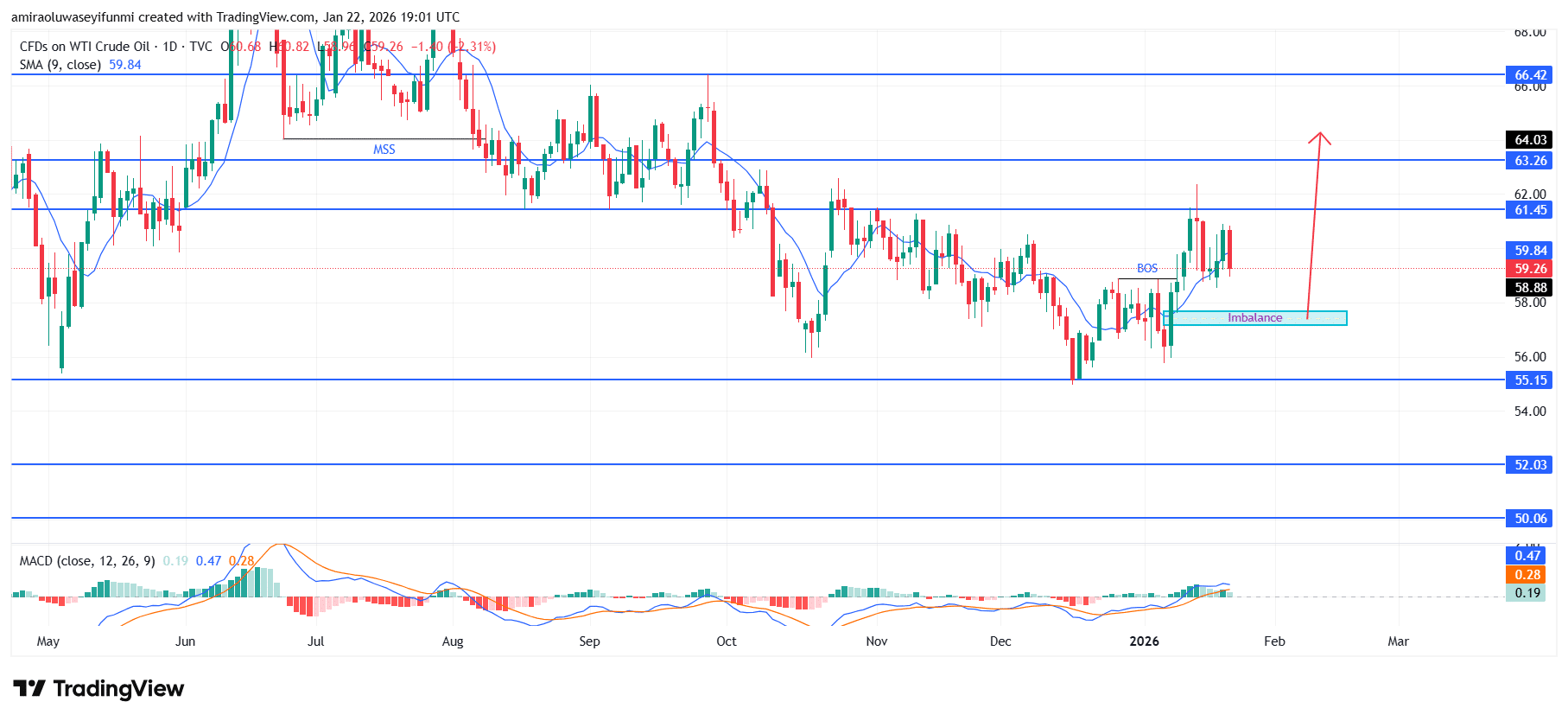

USOil is building upward traction as price reclaims technical control. The market is carving out a measured upside recovery, supported by an improving directional structure and strengthening momentum signals. Price is holding marginally above the 9-day moving average near $59.80, offering early confirmation of short-term trend stabilization. Momentum indicators show the MACD transitioning firmly above the zero line with expanding positive bars, suggesting sustained buying pressure rather than a short-lived rebound. Together, these factors point to a gradual shift in control back to the demand side following an extended range-bound period.

USOil Key Levels

Resistance Levels: $61.450, $66.420, $72.220

Support Levels: $55.150, $52.030, $50.060

USOil Long-Term Trend: Bullish

Price action has remained constructive, consistently defending higher lows originating from the $55.15 base. The recent break above the $58.90 level confirms a clear structural shift, reinforced by a strong reaction from the prior inefficiency zone around $58.80. This response signals active buyer participation and reinforces the zone as a reliable demand base. Price is now rotating toward the psychological $60.00 level, while overhead supply near $63.30 stands as the next significant resistance following earlier rejection.

Looking ahead, sustained price acceptance above $59.80 strengthens the outlook for a controlled advance toward the $63.30 resistance area. A decisive daily close above $63.30 could open the door for further upside toward $64.00, with potential extension into the $66.40 region where historical selling pressure remains evident. As long as price structure holds above $58.80, downside scenarios remain secondary, with any deeper pullback toward $55.15 requiring a clear structural failure. Within this context, traders monitoring forex signals may find alignment in the continued bullish bias rather than signs of trend exhaustion.

USOil Short-Term Trend: Bullish

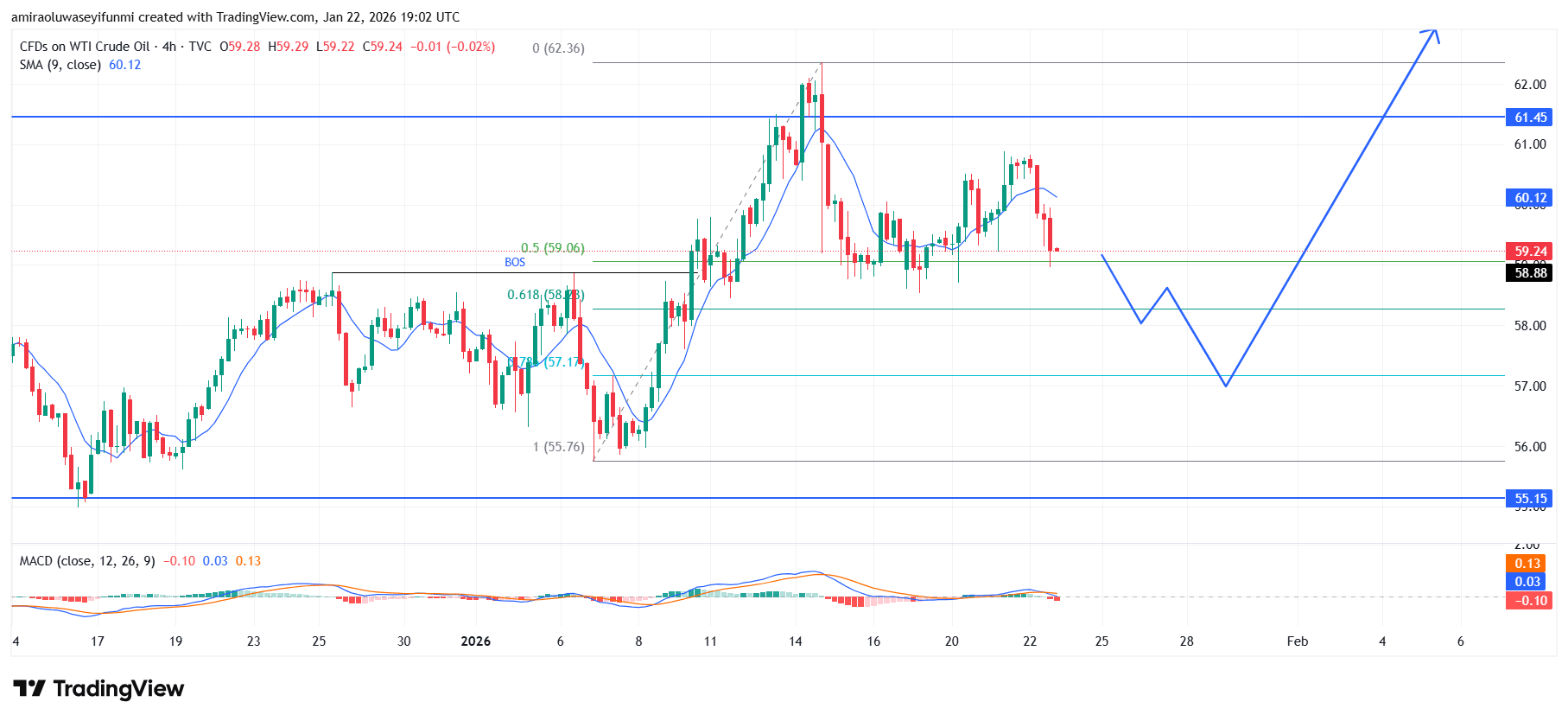

On the four-hour chart, USOil continues to maintain a constructive bullish structure despite the recent pullback. Price is consolidating above the key support band between $58.80 and $59.00, an area reinforced by prior structural levels and Fibonacci confluence, indicating that buyers remain active in defending the trend.

The 9-period moving average is beginning to flatten, signaling that downside momentum is easing rather than accelerating. A sustained hold above this support zone keeps the path open for a renewed bullish move toward $61.45, with potential continuation into the $62.00 region.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.