Market Analysis – July 20

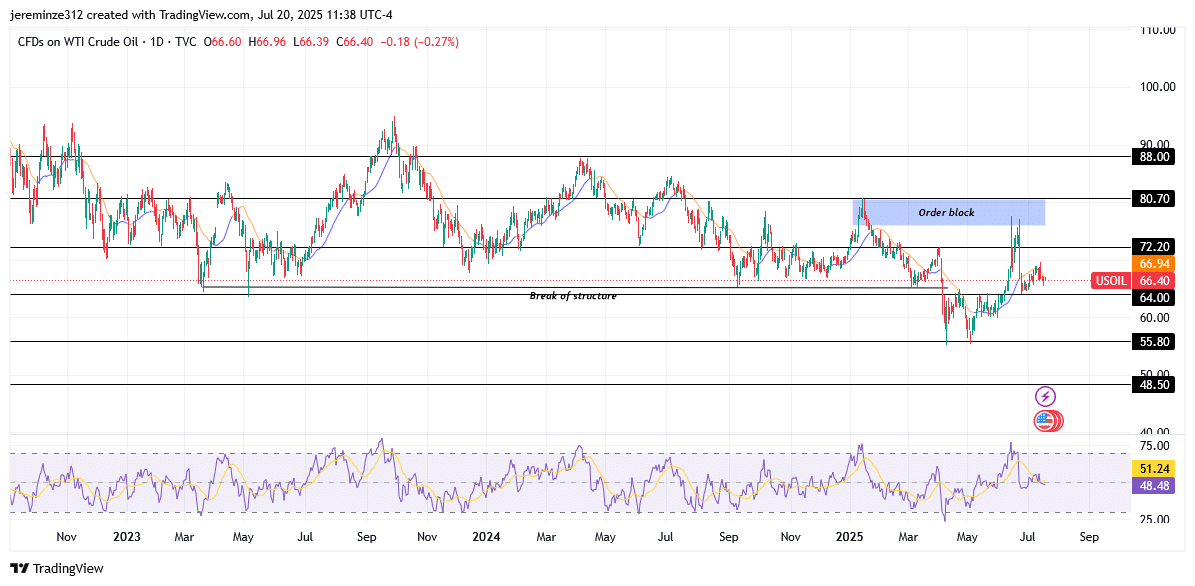

USOil is signaling the potential onset of a new bearish wave after being rejected at a significant daily order block resistance zone. This rejection follows a major structural break, indicating that the previous bullish retracement was merely corrective. With bearish confluences appearing across several timeframes, market sentiment has shifted decisively toward the downside, pointing to a likely continuation of the bearish move.

USOil Key Levels

Demand Levels: 64.00, 55.80, 48.50

Supply Levels: 72.20, 80.70, 88.00

USOil Long-Term Trend: Bearish

The long-term bearish trend was confirmed when price broke below the key low established in September 2024, breaching the $64.00 demand level and descending toward $55.80. This decisive break in structure shifted the broader trend clearly in favor of the bears. After this decline, price began a bullish retracement that extended slightly beyond $72.20, reaching into a clearly defined daily order block.

The reaction from this order block was sharp and immediate, pushing price back downward. Concurrently, the daily Relative Strength Index (RSI) entered overbought territory, indicating exhaustion in the upward correction. With price now trading beneath the daily Moving Average and RSI turning lower again, momentum has realigned with the prevailing bearish trend. These signals suggest that the retracement has likely ended, and the next bearish leg is unfolding—a development closely monitored by traders using forex signals.

USOil Short-Term Trend: Bearish

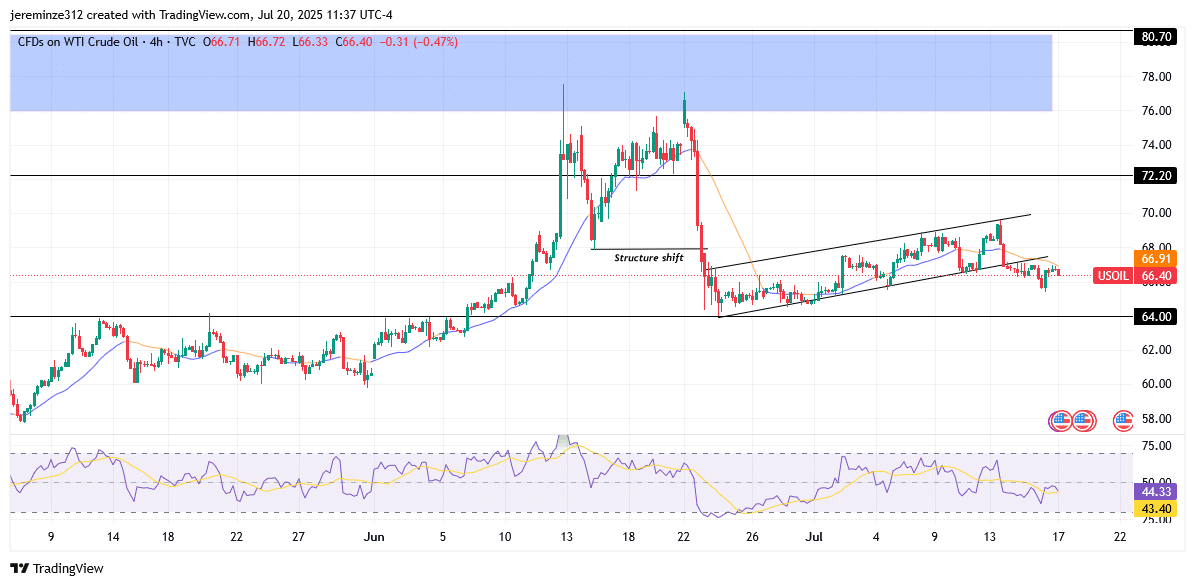

On the 4-hour chart, the market structure reinforces the bearish outlook. After rejecting the daily order block, price staged a brief bullish retracement that evolved into a bearish flag pattern. The subsequent breakout from the flag confirms the return of bearish momentum, further validated by the formation of lower highs and a declining short-term RSI. As long as price remains below the order block and continues setting lower highs, the short-term trend is expected to stay firmly bearish.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.