USDWTI Price Analysis – February 26

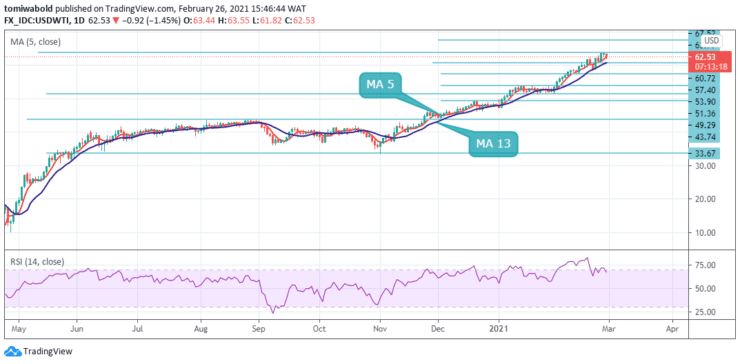

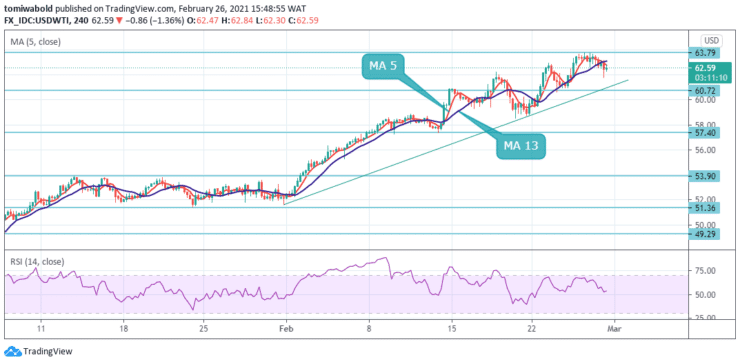

At the time of writing, WTI remains on the back foot trading at $62.53 after sellers’ pressure pushed the USDWTI pair to a $61.82 daily low. The barrel of West Texas Intermediate (WTI) hit its highest level in more than a year at $63.79 during the prior session, however, staged a rebound on Friday.

Key Levels

Resistance Levels: $70.10, $67.52, $63.73

Support Levels: $60.72, $57.40, $53.90

From a technical perspective, USDWTI reflects a clear bullish market on the daily chart. A step above the $63.79 barrier could trigger the next upside breakout. However, the RSI is on a corrective journey before its next leg up. A pullback from the weekly top at $63.79 beneath the MA 5 and 13 threshold may generate additional buying.

The following pullback, however, may not last long as buyers may buy the dip at the $60.72 level. Hence, WTI sellers should keep their eyes on the MA 13 support line, at $60.50 during further declines. However, any further weakness will be probed by the three-week-old horizontal support near the $57.40 level.

WTI price action is currently trading around $63.18 and $61.78 intraday levels beyond the near-term lower end of the channel range at the $60.72 level. With the upward level of resistance shown at $63.79 in the near term, analysts expect prices to trade within that range.

On the upside, a break beyond the $63.79 level would see oil prices challenging the $67.52 psychological level of resistance. Prices are somewhat likely to stay subdued in the short term and risk selling pressure, particularly with economic recovery concerns now lingering.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.