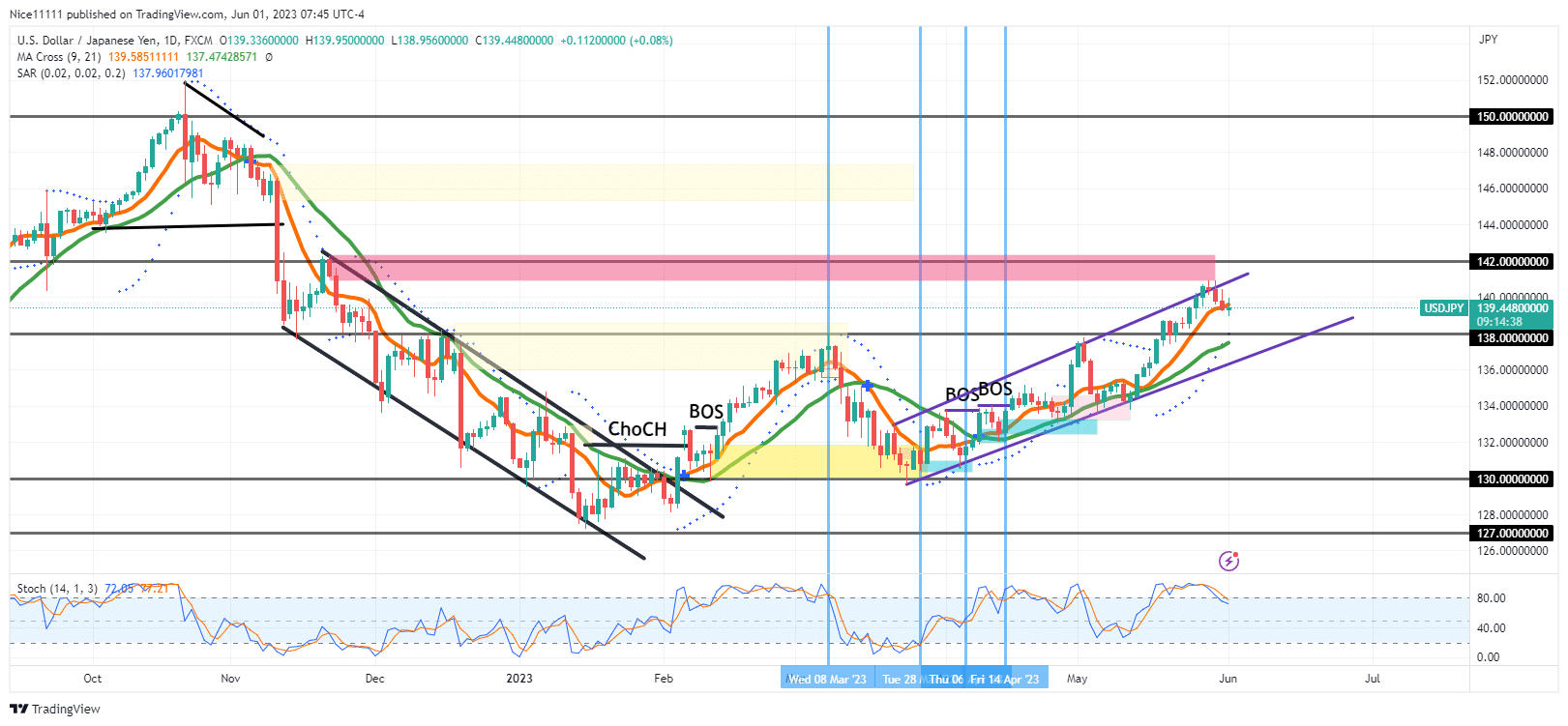

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade is currently experiencing a retracement after reaching an overbought region. Buyers of USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade seem to have exhausted their efforts, resulting in a pause in the upward movement of the price. The price has tested the supply zone at 142.00, triggering a response from sellers in the market. As a result, it is anticipated that the price will decline towards the lower boundary of the parallel channel.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Key levels

Support levels: 138.00, 130.00, 127.00

Resistance levels: 142.00, 150.00, 156.00

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long-term Trend: Bullish

Taking a long-term perspective, the overall trend for USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade remains bullish. On the 24-hour chart, the price is ascending within a bullish parallel channel. The Parabolic SAR (Stop and Reverse) indicator supports this uptrend, signaling a favorable market environment. Furthermore, the Moving Average with a period of 21 also confirms the upward movement in the market.

However, recent developments indicate a shift in the short-term trend towards bearishness. The upper boundary or resistance trendline of the parallel channel was tested just below the supply zone of 142.00. The last two daily candles displayed a bearish pattern, signaling a potential reversal. Additionally, the Stochastic indicator indicates that the market is overbought, suggesting an impending decrease in the price.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-term Trend: Bearish

Zooming in on the 4-hour time frame, the Moving Averages have crossed above the candles, reinforcing the bearish sentiment in the market. The price will likely gravitate towards the next support level at 138.00.

Overall, the USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade pair is currently undergoing a retracement following its overbought condition. Traders should closely monitor the price movements as it approaches the support levels and be aware of the potential for further bearishness in the short term.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.