USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Analysis – October 6

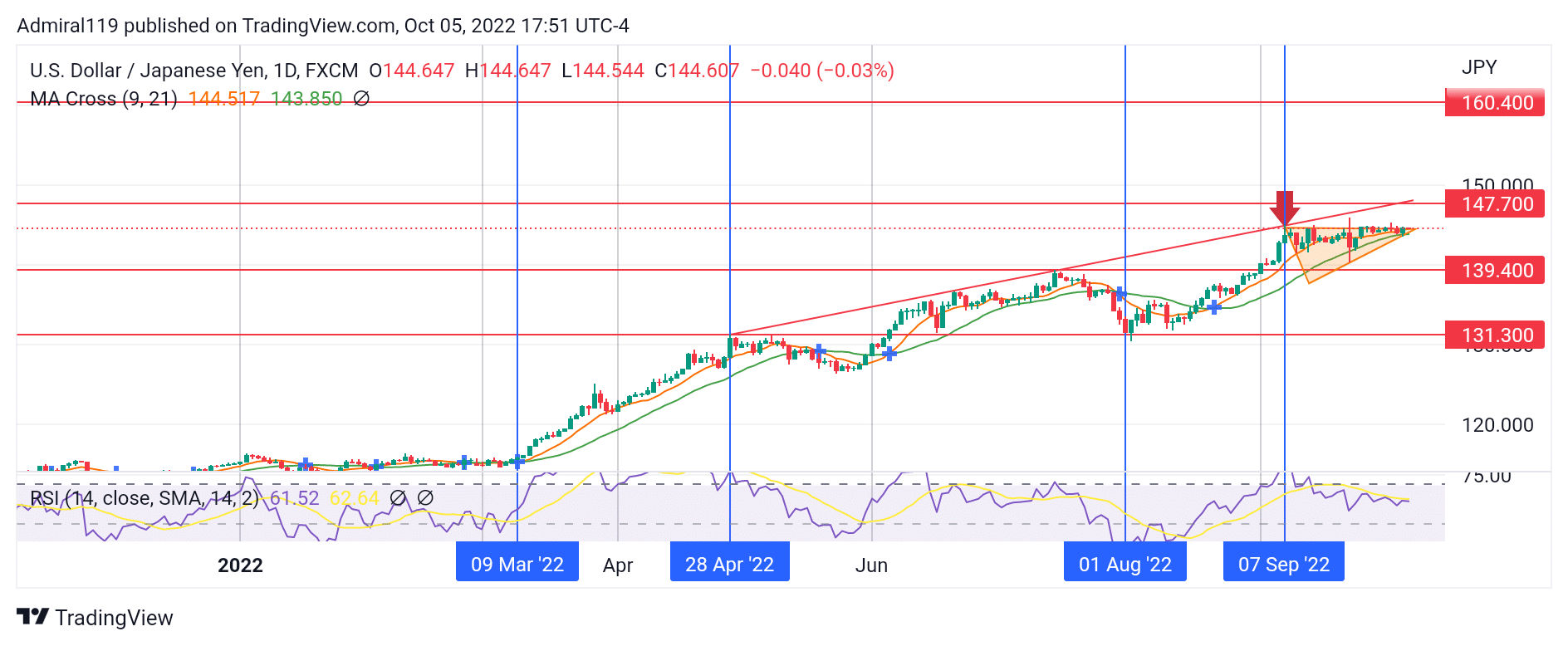

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade consolidates within a continuation pattern in the overbought region after a massive rally to the upside. The MA Cross indicator shows the intent of the bulls in the market on the 9th of March, 2022. This indication came immediately after a breakout from the rectangular pattern formed over the last two to three months. Ever since the successful breakout, the bulls have been riding the wave to the upside.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Significant Zones

Demand Zones: 139.40, 131.30

Supply Zones: 147.70, 160.40

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Long-Term Trend: Bullish

With fear gripping the USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade sellers as the waves rally in fractals, the overall market trend remains bullish. From the breakout in March 2022, the market kept rallying upward until an overbought region was reached. On the 28th of April, 2022, the market began to retrace a few pips downward. The swing high formed during this retracement marked the beginning of a new diagonal resistance. The diagonal resistance served as an upper boundary for the bulls as they rode the wave upward. The market continued its uptrend in June 2022 as it began to respect the diagonal resistance.

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade buyers kept driving prices higher until the previous resistance at 139.40 was reached. At this level, the bears were able to have a moment in the market as prices crashed into an oversold region. A bounce at the 131.30 level made the bulls storm the market on the 1st of August, 2022. On the 7th of September, 2022, prices once again hit the diagonal resistance in an overbought region. The current consolidation phase is caused by the bears’ sell orders at the diagonal resistance and the buying pressure of the bulls in line with the market trend.

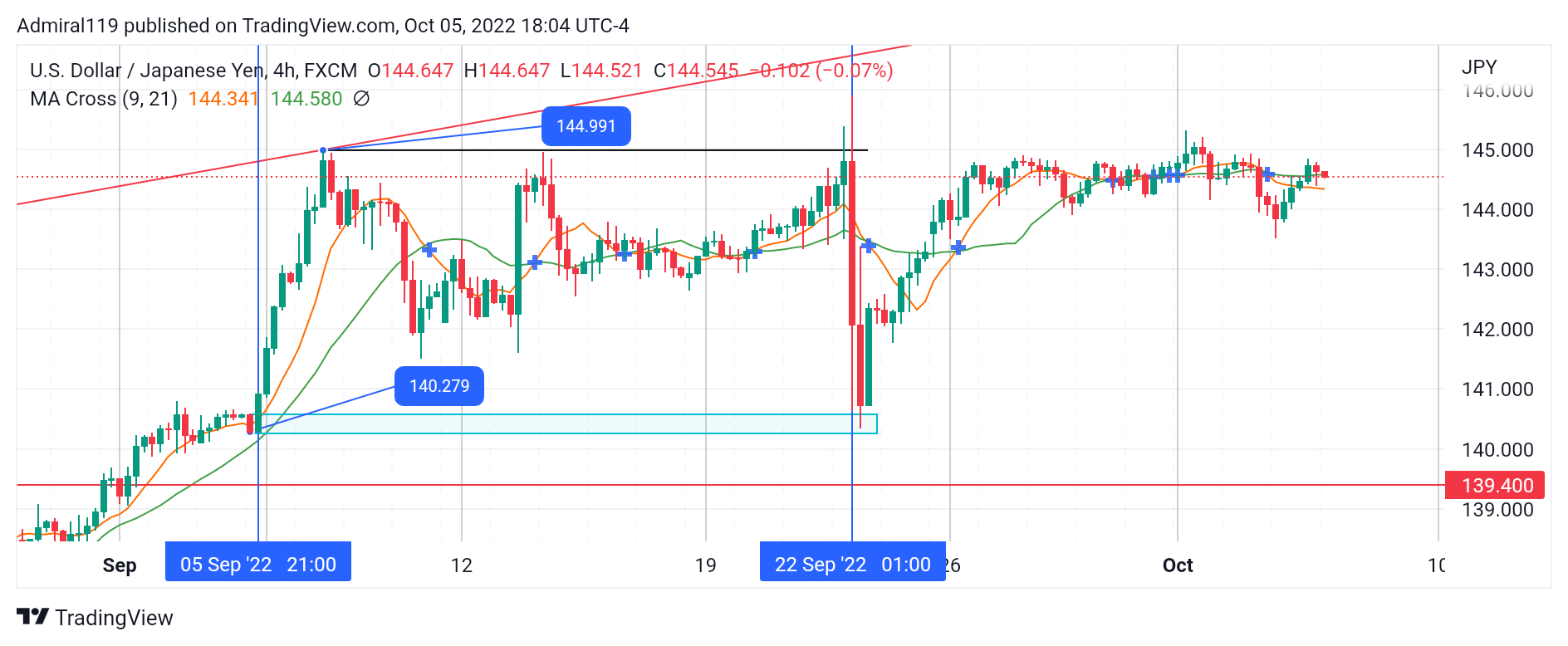

USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade Short-Term Trend: Bullish

The current market range on the four-hour chart is between the 140.279 and 144.991 price levels. On the 22nd of September, 2022, external liquidity was swept off above the range. Then, the bullish order block formed on the 5th of September, 2022, was used to resume the market’s order flow to the upside. Since there’s no market structure shift to the downside, USDJPY – Guide, Tips & Insights | Learn 2 Trade – Guide, Tips & Insights | Learn 2 Trade is expected to keep rallying upward.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.